Region:Asia

Author(s):Dev

Product Code:KRAA5900

Pages:97

Published On:September 2025

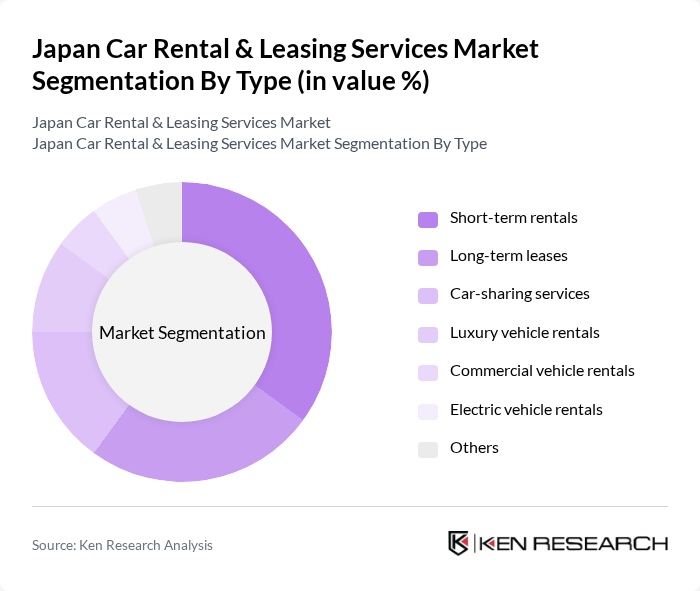

By Type:The market is segmented into various types, including short-term rentals, long-term leases, car-sharing services, luxury vehicle rentals, commercial vehicle rentals, electric vehicle rentals, and others. Each segment caters to different consumer needs, with short-term rentals being particularly popular among tourists and business travelers seeking flexibility.

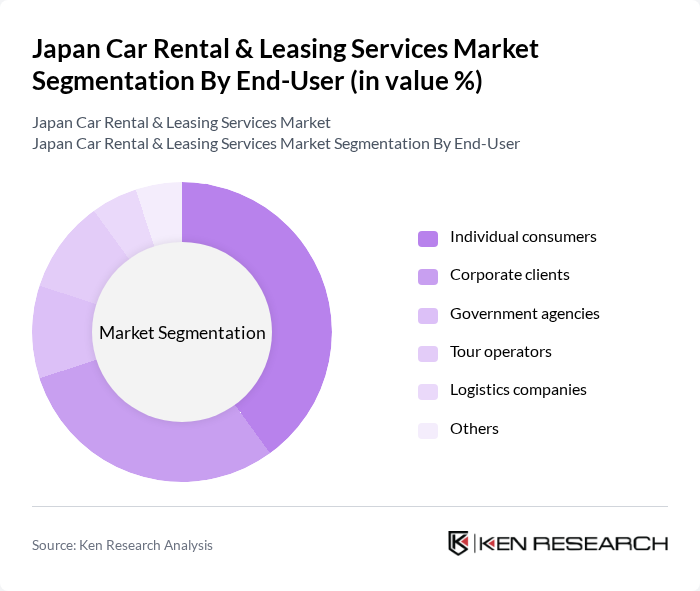

By End-User:The end-user segmentation includes individual consumers, corporate clients, government agencies, tour operators, logistics companies, and others. Individual consumers and corporate clients represent the largest segments, driven by the need for personal and business travel solutions.

The Japan Car Rental & Leasing Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Rent a Car, Nippon Rent-A-Car, Times Car Rental, Orix Rent-A-Car, JR Rent-A-Car, Budget Rent a Car Japan, Europcar Japan, Nissan Rent a Car, Honda Rent a Car, Aucar, Daisuke Rent a Car, Car Rental Japan, Sapporo Rent a Car, Rakuten Car Rental, Aichi Rent a Car contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan car rental and leasing services market appears promising, driven by evolving consumer preferences and technological advancements. As urbanization continues to rise, the demand for flexible mobility solutions will likely increase, encouraging rental companies to innovate. Additionally, the integration of electric vehicles into rental fleets will align with sustainability trends, appealing to environmentally conscious consumers. Overall, the market is poised for growth, with a focus on enhancing customer experience and operational efficiency through technology.

| Segment | Sub-Segments |

|---|---|

| By Type | Short-term rentals Long-term leases Car-sharing services Luxury vehicle rentals Commercial vehicle rentals Electric vehicle rentals Others |

| By End-User | Individual consumers Corporate clients Government agencies Tour operators Logistics companies Others |

| By Vehicle Type | Sedans SUVs Vans Trucks Buses Others |

| By Rental Duration | Daily rentals Weekly rentals Monthly rentals Annual leases Others |

| By Distribution Channel | Online platforms Travel agencies Direct bookings Corporate contracts Others |

| By Pricing Model | Fixed pricing Dynamic pricing Subscription-based pricing Pay-per-use pricing Others |

| By Fleet Size | Small fleet Medium fleet Large fleet Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Car Leasing | 150 | Fleet Managers, Procurement Officers |

| Leisure Car Rentals | 120 | Travel Agency Managers, Tour Operators |

| Long-term Vehicle Leasing | 100 | HR Managers, Business Executives |

| Short-term Car Rentals | 80 | Frequent Travelers, Business Consultants |

| Electric Vehicle Rentals | 70 | Environmental Officers, Sustainability Managers |

The Japan Car Rental & Leasing Services Market is valued at approximately USD 10 billion, reflecting a significant growth driven by increasing demand for flexible transportation solutions, urbanization, and a rise in tourism.