Region:Asia

Author(s):Rebecca

Product Code:KRAD4914

Pages:94

Published On:December 2025

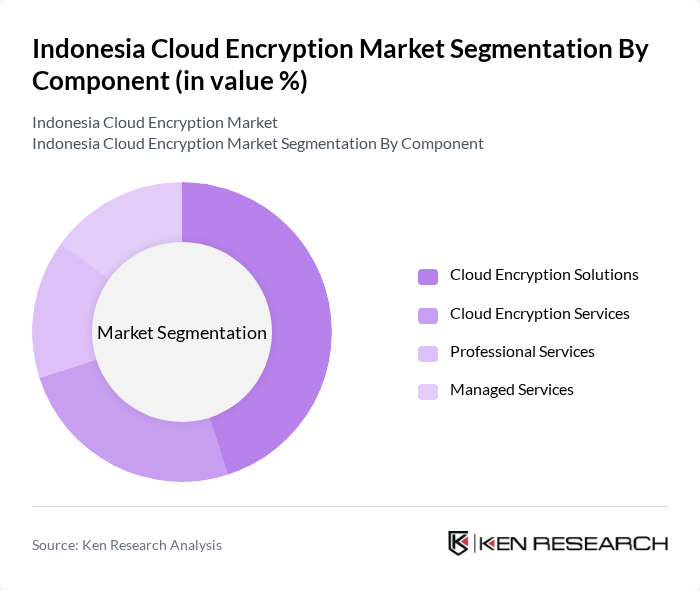

By Component:The market is segmented into Cloud Encryption Solutions, Cloud Encryption Services, Professional Services, and Managed Services. This structure is consistent with global cloud encryption reports, where core software/solution offerings are complemented by associated services. Among these, Cloud Encryption Solutions are leading due to the increasing need for secure data storage and transmission; international market studies show solution/software components accounting for the largest revenue share in cloud encryption globally, which aligns with adoption patterns in Indonesia as enterprises prioritize encryption tools embedded in cloud platforms and applications. Organizations are investing heavily in these solutions to protect sensitive information from cyber threats such as ransomware, data breaches, and insider threats, making them a preferred choice for many businesses undergoing digital and cloud transformations.

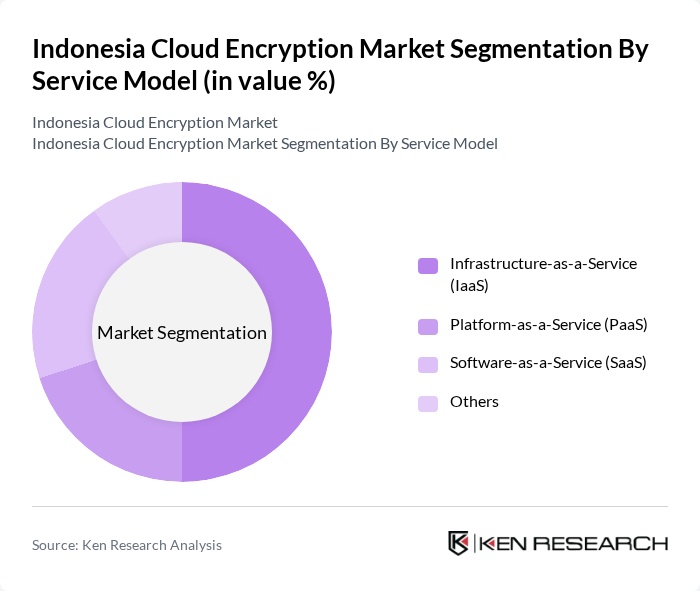

By Service Model:The service model segmentation includes Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), Software-as-a-Service (SaaS), and Others. Global cloud encryption research indicates that encryption is widely adopted across all service models, with strong use in IaaS for storage, backup, and virtual machines, and in SaaS for application-layer protection. IaaS is currently presented as the dominant model in this segmentation as it allows businesses to leverage cloud infrastructure while ensuring data security through encryption and key management integrated at the compute, network, and storage layers; this is consistent with Indonesia’s rapid growth in public and hybrid cloud infrastructure usage among large enterprises and government agencies. The flexibility and scalability offered by IaaS make it a popular choice among enterprises looking to enhance their security posture, implement data residency requirements, and maintain control over encryption policies in multi-cloud or hybrid environments.

The Indonesia Cloud Encryption Market is characterized by a dynamic mix of regional and international players. Leading participants such as Microsoft Corporation, Amazon Web Services (AWS), Google Cloud (Alphabet Inc.), IBM Corporation, Thales Group (Gemalto & Vormetric), Broadcom Inc. (Symantec), Trend Micro Incorporated, Fortinet Inc., Check Point Software Technologies Ltd., Acronis International GmbH, CipherCloud Inc., Huawei Technologies Co., Ltd., Alibaba Cloud (Alibaba Group), Oracle Corporation, Salesforce Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia cloud encryption market appears promising, driven by increasing regulatory pressures and a growing emphasis on data security. As businesses continue to migrate to cloud environments, the demand for advanced encryption solutions will likely escalate. Furthermore, the integration of artificial intelligence in encryption technologies is expected to enhance security measures, making them more efficient and user-friendly. This evolution will create a dynamic landscape for cloud encryption, fostering innovation and investment in the sector.

| Segment | Sub-Segments |

|---|---|

| By Component | Cloud Encryption Solutions Cloud Encryption Services Professional Services Managed Services |

| By Service Model | Infrastructure-as-a-Service (IaaS) Platform-as-a-Service (PaaS) Software-as-a-Service (SaaS) Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Community Cloud |

| By End-User Industry | BFSI (Banking, Financial Services & Insurance) Healthcare Retail & E-commerce Government & Public Sector Telecommunications Manufacturing Education Energy & Utilities Others |

| By Encryption Method | Symmetric Encryption Asymmetric Encryption Hashing Tokenization Others |

| By Data State | Data at Rest Encryption Data in Transit Encryption Data in Use Encryption |

| By Compliance Standards | GDPR HIPAA PCI DSS ISO 27001 Indonesia Data Protection Regulations Others |

| By Region | Java Sumatra Kalimantan Sulawesi Bali & Nusa Tenggara Papua |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Cloud Encryption | 120 | IT Security Managers, Compliance Officers |

| Healthcare Data Protection | 90 | Data Protection Officers, IT Administrators |

| E-commerce Encryption Solutions | 100 | eCommerce Managers, Cybersecurity Analysts |

| Government Sector Encryption Policies | 80 | Policy Makers, IT Security Consultants |

| SME Cloud Adoption and Encryption | 70 | Business Owners, IT Managers |

The Indonesia Cloud Encryption Market is valued at approximately USD 1.0 billion, driven by the rapid growth of cloud computing and cybersecurity sectors, alongside increasing concerns over data security and regulatory compliance.