Region:Asia

Author(s):Dev

Product Code:KRAD5210

Pages:91

Published On:December 2025

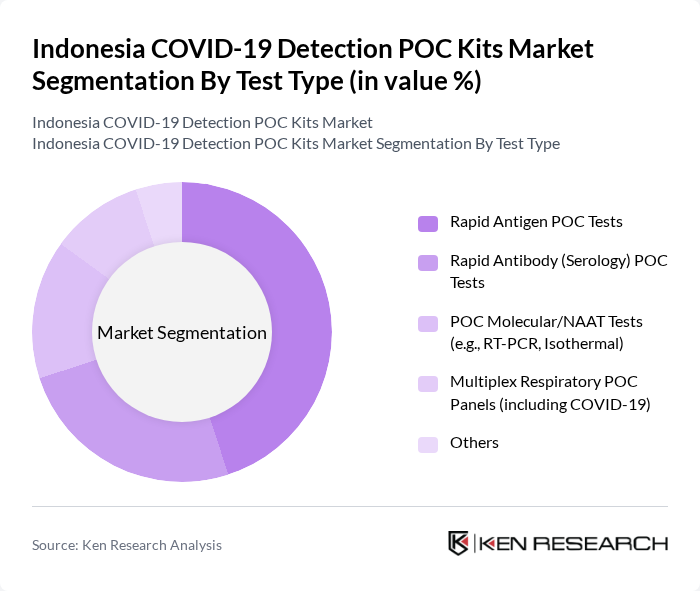

By Test Type:The market is segmented into various test types, including Rapid Antigen POC Tests, Rapid Antibody (Serology) POC Tests, POC Molecular/NAAT Tests (e.g., RT-PCR, Isothermal), Multiplex Respiratory POC Panels (including COVID-19), and Others. Rapid Antigen POC Tests have gained significant traction due to their affordability, minimal instrumentation, and quick turnaround time, making them the preferred choice for large-scale screening, workplace and travel-related testing, and decentralized community programs across Asia Pacific, including Indonesia. The ease of use, suitability for use outside central laboratories, and minimal training required for administration further contribute to their dominance in high-volume testing scenarios, while POC molecular tests are increasingly used where higher sensitivity is required such as hospital emergency departments and high?risk patient groups.

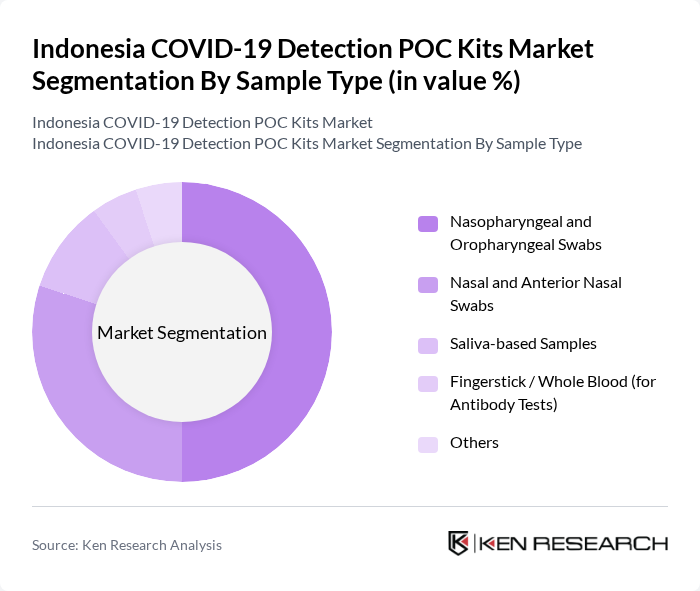

By Sample Type:The sample type segmentation includes Nasopharyngeal and Oropharyngeal Swabs, Nasal and Anterior Nasal Swabs, Saliva-based Samples, Fingerstick / Whole Blood (for Antibody Tests), and Others. Nasopharyngeal and Oropharyngeal Swabs are widely used in clinical and hospital settings because they were initially adopted as the standard sample type in many RT?PCR and antigen testing protocols and have strong evidence for diagnostic accuracy when collected correctly. At the same time, less invasive Nasal and Anterior Nasal Swabs and Saliva-based Samples have gained share, particularly in point-of-care and self-testing applications, due to greater patient comfort and easier collection without trained personnel.

The Indonesia COVID-19 Detection POC Kits Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Bio Farma (Persero), PT Indofarma Tbk, PT Kimia Farma Tbk, PT Phapros Tbk, PT Enseval Putera Megatrading Tbk, Abbott Laboratories, F. Hoffmann-La Roche Ltd (Roche Diagnostics), Becton, Dickinson and Company (BD), Cepheid, Siemens Healthineers, SD Biosensor, Inc., QuidelOrtho Corporation, Thermo Fisher Scientific Inc., Hologic, Inc., Mylab Discovery Solutions Pvt. Ltd. contribute to innovation, geographic expansion, and service delivery in this space, through manufacturing partnerships, local distribution networks, and the deployment of rapid antigen and molecular platforms across hospitals, clinics, and community testing sites.

The future of the Indonesia COVID-19 detection POC kits market appears promising, driven by ongoing technological advancements and increased government support. As the healthcare sector continues to evolve, the integration of digital health technologies and telehealth services is expected to enhance testing accessibility. Furthermore, the focus on personalized healthcare solutions will likely lead to the development of more tailored testing options, ensuring that the market remains responsive to public health needs and challenges.

| Segment | Sub-Segments |

|---|---|

| By Test Type | Rapid Antigen POC Tests Rapid Antibody (Serology) POC Tests POC Molecular/NAAT Tests (e.g., RT-PCR, Isothermal) Multiplex Respiratory POC Panels (including COVID-19) Others |

| By Sample Type | Nasopharyngeal and Oropharyngeal Swabs Nasal and Anterior Nasal Swabs Saliva-based Samples Fingerstick / Whole Blood (for Antibody Tests) Others |

| By End-User | Public Hospitals and Referral Hospitals (RSUD/RSUP) Private Hospitals Primary Healthcare Centers (Puskesmas) Private Diagnostic Laboratories and Clinics At-home / Self-testing Users Others |

| By Distribution Channel | Government Tenders and Centralized Procurement Direct Sales to Hospitals and Laboratories Retail Pharmacies and Drug Stores (Apotek) E-commerce and Online Pharmacies Distributors and Importers Others |

| By Province / Region | Java (including DKI Jakarta, West, Central, East Java, Banten, Yogyakarta) Sumatra Kalimantan Sulawesi Bali & Nusa Tenggara Papua & Maluku |

| By Testing Environment | Hospital and Emergency Department POC Puskesmas and Community / Mobile Clinics Workplace, School and Airport Screening Sites Home and Self-testing Others |

| By Regulatory Approval Status (Indonesia) | MoH / Kemenkes and BPOM Approved Kits Kits with Emergency Use Authorization Kits Under Evaluation / Registration Non-approved / Grey-market Kits Others |

| By Price Band (per Test) | Low Price (Mass-market Antigen & Self-tests) Mid Price (Premium Rapid Tests) High Price (POC Molecular & Multiplex Panels) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Facilities | 120 | Hospital Administrators, Lab Directors |

| Distributors of POC Kits | 90 | Sales Managers, Supply Chain Coordinators |

| End-Users of Testing Kits | 70 | Clinicians, Public Health Officials |

| Government Health Agencies | 50 | Policy Makers, Health Program Managers |

| Research Institutions | 40 | Epidemiologists, Public Health Researchers |

The Indonesia COVID-19 Detection POC Kits Market is valued at approximately USD 1.1 billion, reflecting the urgent demand for rapid testing solutions during the pandemic and the growth of healthcare spending in the country.