Region:Asia

Author(s):Dev

Product Code:KRAB3069

Pages:91

Published On:October 2025

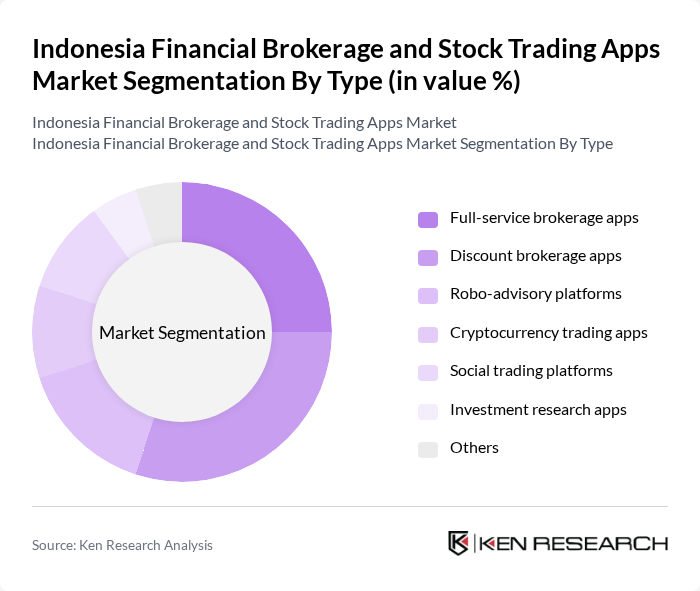

By Type:The market is segmented into various types of brokerage apps, each catering to different investor needs and preferences. Full-service brokerage apps offer comprehensive services, while discount brokerage apps focus on cost-effective trading solutions. Robo-advisory platforms are gaining traction due to their automated investment strategies, and cryptocurrency trading apps are becoming increasingly popular among younger investors. Social trading platforms allow users to follow and copy the trades of experienced investors, while investment research apps provide valuable insights and analytics. Other types include niche platforms catering to specific investment needs.

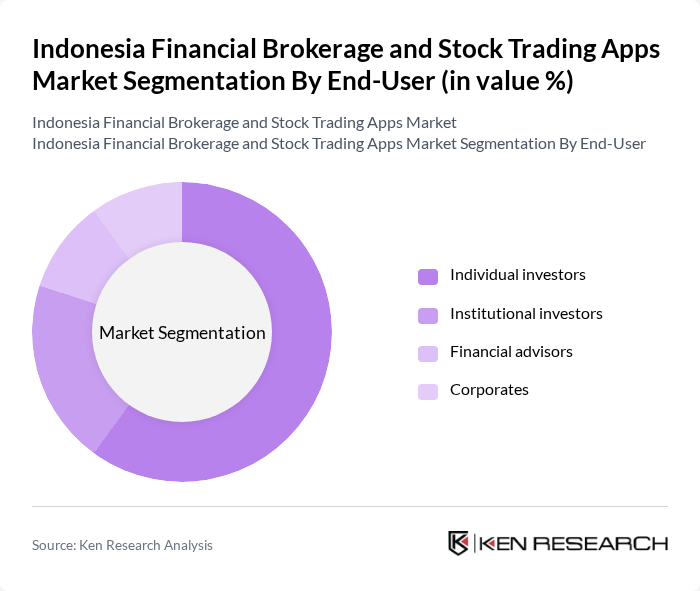

By End-User:The end-user segmentation includes individual investors, institutional investors, financial advisors, and corporates. Individual investors dominate the market, driven by the increasing number of retail investors entering the stock market. Institutional investors, while fewer in number, contribute significantly to trading volumes. Financial advisors leverage these apps to manage client portfolios, while corporates utilize them for treasury management and investment purposes.

The Indonesia Financial Brokerage and Stock Trading Apps Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mandiri Sekuritas, BNI Sekuritas, Mirae Asset Sekuritas, Danareksa Sekuritas, RHB Sekuritas Indonesia, Trimegah Sekuritas, Panin Sekuritas, Sinarmas Sekuritas, CIMB Niaga Sekuritas, Indo Premier Sekuritas, Kresna Sekuritas, Samuel Sekuritas, First Asia Capital, MNC Sekuritas, Asjaya Indosurya Securities contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesian financial brokerage and stock trading apps market appears promising, driven by technological advancements and evolving consumer preferences. As mobile-first solutions gain traction, firms are likely to invest in enhancing user experience and integrating advanced features. Additionally, the growing interest in sustainable investing will encourage brokerage firms to develop products that align with environmental, social, and governance (ESG) criteria, appealing to a broader range of investors and fostering market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-service brokerage apps Discount brokerage apps Robo-advisory platforms Cryptocurrency trading apps Social trading platforms Investment research apps Others |

| By End-User | Individual investors Institutional investors Financial advisors Corporates |

| By Investment Type | Stocks Bonds Mutual funds ETFs Derivatives Others |

| By User Demographics | Age group (18-24, 25-34, 35-44, 45+) Income level (Low, Middle, High) Education level (High school, Bachelor's, Master's) |

| By Sales Channel | Direct downloads from app stores Partnerships with financial institutions Affiliate marketing |

| By Geographic Distribution | Urban areas Rural areas Tier 1 cities Tier 2 cities |

| By Customer Loyalty Programs | Reward points systems Referral bonuses Subscription models |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Investor Insights | 150 | Individual Investors, Retail Traders |

| Brokerage Firm Operations | 100 | Operations Managers, Compliance Officers |

| App Development Feedback | 80 | Software Developers, UX/UI Designers |

| Market Analyst Perspectives | 60 | Financial Analysts, Market Researchers |

| Regulatory Compliance Insights | 50 | Legal Advisors, Regulatory Affairs Specialists |

The Indonesia Financial Brokerage and Stock Trading Apps Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased digital financial service adoption and smartphone usage among retail investors.