Region:Asia

Author(s):Dev

Product Code:KRAD3449

Pages:100

Published On:November 2025

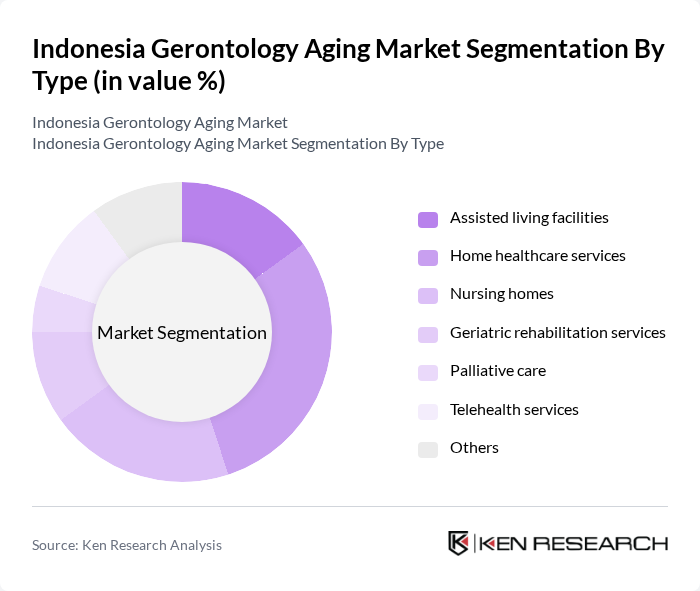

By Type:The market is segmented into various types, including assisted living facilities, home healthcare services, nursing homes, geriatric rehabilitation services, palliative care, telehealth services, and others. Among these, home healthcare services are gaining significant traction due to the preference for aging in place and personalized care solutions.

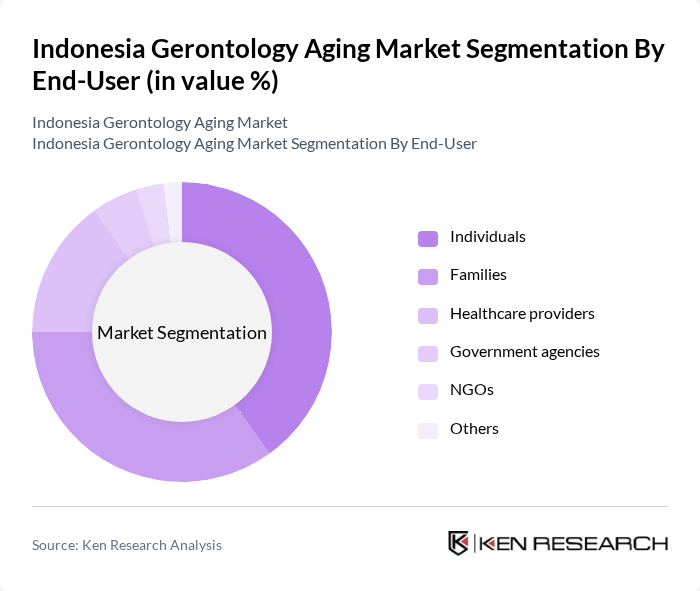

By End-User:The end-user segmentation includes individuals, families, healthcare providers, government agencies, NGOs, and others. Individuals and families are the primary users of geriatric services, driven by the need for personalized care and support for elderly family members.

The Indonesia Gerontology Aging Market is characterized by a dynamic mix of regional and international players. Leading participants such as RSU Budi Kemuliaan, Siloam Hospitals, Medistra Hospital, RSUP Persahabatan, RSU Citra Medika, RSU Mitra Keluarga, RSU Harapan Kita, RSU Sumber Waras, RSU Puri Cinere, RSU Bunda Margonda, RSU Siloam contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia gerontology aging market appears promising, driven by demographic shifts and increasing healthcare investments. As the elderly population continues to grow, there will be a heightened focus on developing comprehensive elder care services and innovative healthcare solutions. Additionally, the integration of technology in geriatric care is expected to enhance service delivery, making it more efficient and accessible. Stakeholders must adapt to these changes to meet the evolving needs of seniors effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Assisted living facilities Home healthcare services Nursing homes Geriatric rehabilitation services Palliative care Telehealth services Others |

| By End-User | Individuals Families Healthcare providers Government agencies NGOs Others |

| By Region | Java Sumatra Bali Kalimantan Sulawesi Others |

| By Service Type | In-home care Community-based services Institutional care Mobile health services Others |

| By Age Group | 69 years 79 years years and above Others |

| By Health Condition | Chronic illnesses Mobility impairments Cognitive impairments Others |

| By Payment Model | Out-of-pocket Insurance-based Government-funded Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Elderly Healthcare Services | 150 | Healthcare Providers, Geriatric Specialists |

| Assistive Technology for Seniors | 100 | Product Managers, Technology Developers |

| Senior Living Facilities | 80 | Facility Managers, Social Workers |

| Caregiver Support Programs | 70 | Caregivers, NGO Representatives |

| Government Aging Policies | 60 | Policy Makers, Public Health Officials |

The Indonesia Gerontology Aging Market is valued at approximately USD 15 billion, reflecting significant growth driven by an increasing aging population and rising healthcare expenditures. This market is expected to expand further as demand for specialized geriatric services continues to rise.