Region:Asia

Author(s):Dev

Product Code:KRAC2725

Pages:83

Published On:October 2025

Market.png)

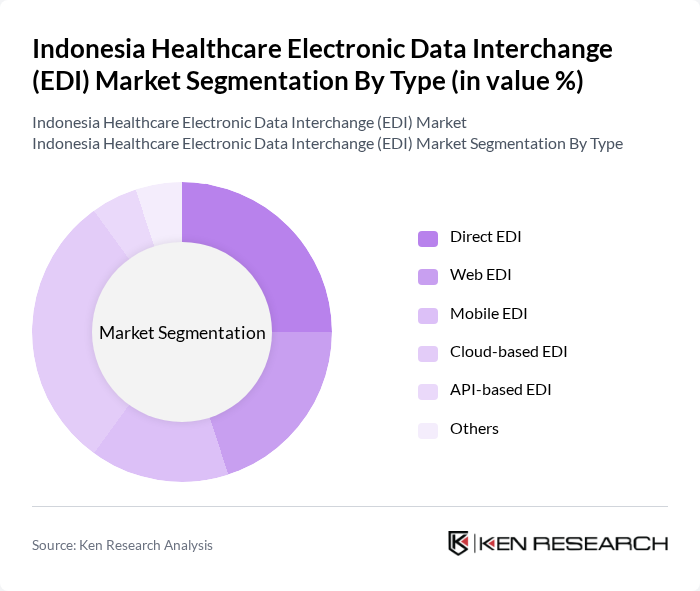

By Type:The market is segmented into various types of EDI solutions, including Direct EDI, Web EDI, Mobile EDI, Cloud-based EDI, API-based EDI, and Others. Each type serves different operational needs and preferences among healthcare providers. There is a notable trend towards cloud-based solutions due to their scalability, security, and cost-effectiveness, while direct EDI is gaining traction among organizations seeking secure, direct connections with trading partners.

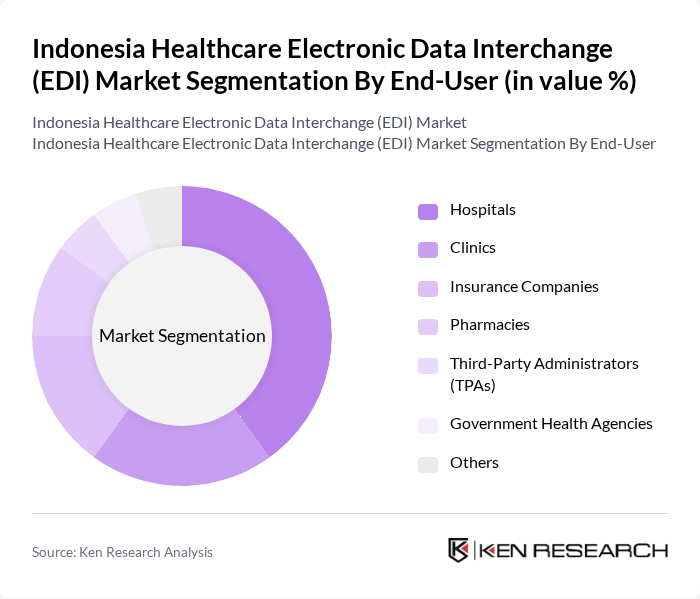

By End-User:The end-user segmentation includes Hospitals, Clinics, Insurance Companies, Pharmacies, Third-Party Administrators (TPAs), Government Health Agencies, and Others. Hospitals are the leading end-users due to their extensive data management needs and the necessity for efficient claims processing. Clinics and insurance companies are also significant contributors, as they increasingly adopt EDI solutions to enhance operational efficiency and improve patient care.

The Indonesia Healthcare Electronic Data Interchange (EDI) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Telkom Indonesia, Halodoc, Alodokter, Good Doctor Technology Indonesia, SehatQ, EMC Healthcare, InterSystems, IBM Indonesia, Oracle Indonesia, Microsoft Indonesia, Siemens Healthineers, Cerner Corporation, Philips Healthcare, GE Healthcare, Medtronic, eClinicalWorks, NextGen Healthcare, Infor Healthcare, McKesson Corporation, Optum contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia Healthcare EDI market appears promising, driven by ongoing digital transformation efforts and increasing healthcare investments. As the government continues to prioritize digital health initiatives, the integration of advanced technologies such as AI and blockchain will enhance data security and interoperability. Furthermore, the growing emphasis on patient-centered care models will necessitate more efficient data exchange, positioning EDI as a critical component in the evolution of Indonesia's healthcare landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Direct EDI Web EDI Mobile EDI Cloud-based EDI API-based EDI Others |

| By End-User | Hospitals Clinics Insurance Companies Pharmacies Third-Party Administrators (TPAs) Government Health Agencies Others |

| By Application | Claims Processing Patient Registration Billing and Payment Processing Referral Management Eligibility Verification e-Prescribing Others |

| By Component | Software Services Hardware Others |

| By Sales Channel | Direct Sales Distributors Online Sales System Integrators Others |

| By Distribution Mode | Online Distribution Offline Distribution Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-based Pricing Subscription-based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital EDI Implementation | 100 | IT Managers, Chief Information Officers |

| Insurance Provider EDI Usage | 80 | Operations Managers, Claims Processing Heads |

| Clinic EDI Adoption | 60 | Practice Managers, Healthcare Administrators |

| Healthcare Technology Vendors | 50 | Sales Directors, Product Managers |

| Government Health Officials | 40 | Policy Makers, Regulatory Affairs Specialists |

The Indonesia Healthcare Electronic Data Interchange (EDI) Market is valued at approximately USD 110 million, reflecting a significant growth trend driven by the increasing digitization of healthcare services and the demand for efficient data management.