Region:Asia

Author(s):Rebecca

Product Code:KRAD6275

Pages:85

Published On:December 2025

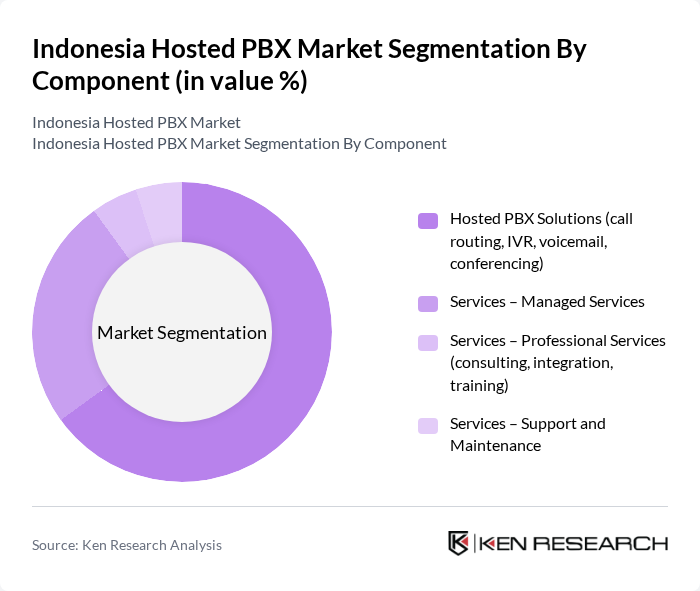

By Component:The components of the hosted PBX market include various solutions and services that cater to the communication needs of businesses. The primary subsegments are Hosted PBX Solutions, Managed Services, Professional Services, and Support and Maintenance. Among these, Hosted PBX Solutions, which encompass call routing, IVR, voicemail, and conferencing, are leading the market due to their comprehensive features that enhance business communication efficiency.

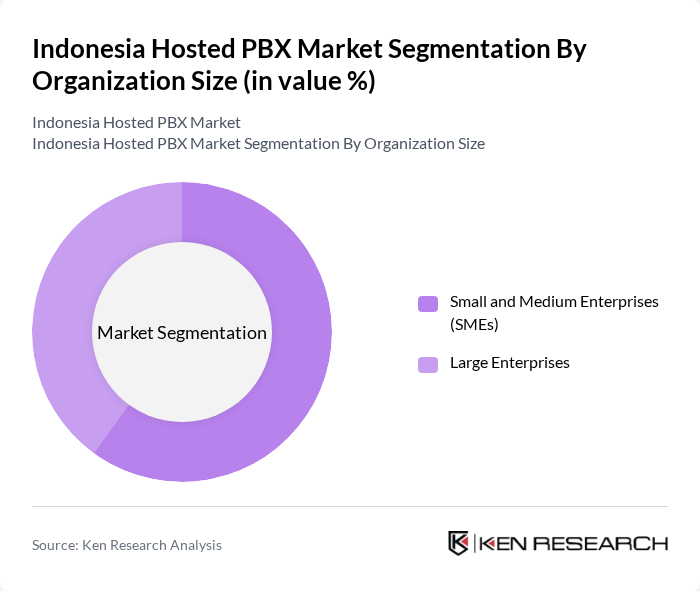

By Organization Size:The hosted PBX market is segmented by organization size, primarily focusing on Small and Medium Enterprises (SMEs) and Large Enterprises. SMEs are the dominant segment, driven by their increasing need for cost-effective communication solutions that can scale with their growth, limited funding for traditional PBX systems, and lack of IT infrastructure. The flexibility and affordability of hosted PBX systems make them particularly attractive to SMEs, which often have limited budgets for traditional telephony systems.

The Indonesia Hosted PBX Market is characterized by a dynamic mix of regional and international players. Leading participants such as Telkom Indonesia (PT Telekomunikasi Indonesia Tbk – IndiHome/Enterprise Voice), Indosat Ooredoo Hutchison (IOH Business), XL Axiata (XL Business Solutions), Smartfren Telecom (Smartfren Business), Biznet Networks (Biznet Gio & Biznet Data Center), CBN (PT Cyberindo Aditama), Lintasarta (PT Aplikanusa Lintasarta), MyRepublic Indonesia (Business Services), PT NEC Indonesia (enterprise communications & PBX solutions), Cisco Systems Indonesia, Avaya Indonesia, 8x8 Inc. (regional cloud PBX/UCaaS provider serving Indonesia), RingCentral Inc. (regional UCaaS provider serving Indonesia), Mitel Networks (regional PBX/hosted voice vendor), VADS Indonesia (managed services & contact center solutions) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hosted PBX market in Indonesia appears promising, driven by ongoing technological advancements and evolving business needs. As companies increasingly adopt hybrid communication solutions, the integration of AI and IoT technologies is expected to enhance service offerings. Additionally, the government's focus on digital infrastructure development will likely facilitate greater access to hosted PBX services, particularly in underserved regions. This evolving landscape presents significant opportunities for service providers to innovate and cater to diverse customer needs, ensuring sustained growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Component | Hosted PBX Solutions (call routing, IVR, voicemail, conferencing) Services – Managed Services Services – Professional Services (consulting, integration, training) Services – Support and Maintenance |

| By Organization Size | Small and Medium Enterprises (SMEs) Large Enterprises |

| By Industry Vertical | IT and Telecommunications BFSI (Banking, Financial Services and Insurance) Healthcare Retail & E?commerce Education Government and Public Sector Others (logistics, manufacturing, professional services) |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Service Type | Unified Communications as a Service (UCaaS) Bundles Standalone Hosted PBX SIP Trunking & Connectivity Services Integration & API Services (CRM, contact center, collaboration) |

| By Access Method | Fixed broadband-based access (fiber, xDSL) Mobile / Wireless access SD?WAN and VPN-enabled access |

| By Geographic Distribution (Indonesia) | Java (Jakarta, West Java, Central Java, East Java, Banten, Yogyakarta) Sumatra Kalimantan Sulawesi Bali & Nusa Tenggara Papua & Maluku |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate PBX Users | 120 | IT Managers, Operations Directors |

| Telecommunications Service Providers | 80 | Sales Executives, Product Managers |

| SME PBX Implementations | 60 | Business Owners, IT Consultants |

| Healthcare Sector PBX Solutions | 50 | Healthcare Administrators, IT Directors |

| Education Sector Communication Systems | 40 | School Administrators, IT Coordinators |

The Indonesia Hosted PBX Market is valued at approximately USD 150 million, reflecting a significant growth trend driven by the adoption of cloud-based communication solutions and the increasing demand for flexible communication systems among businesses.