Region:Middle East

Author(s):Shubham

Product Code:KRAD5499

Pages:81

Published On:December 2025

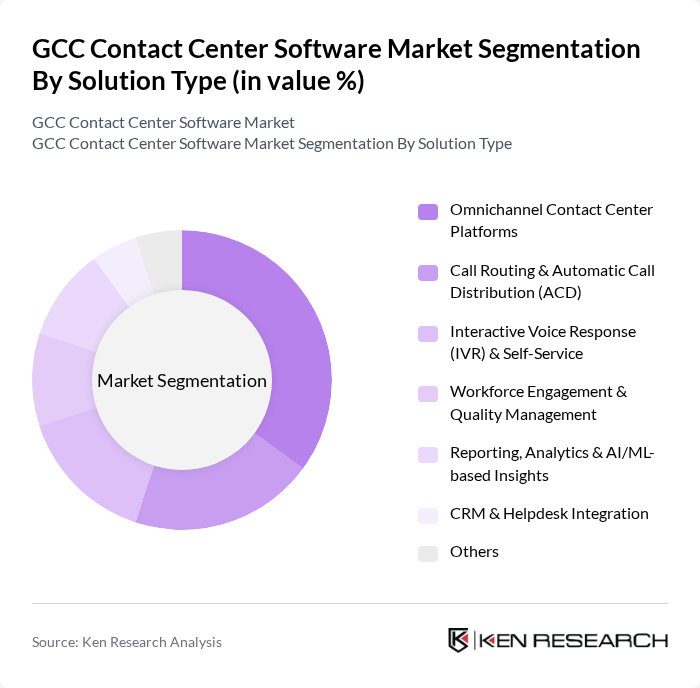

By Solution Type:The solution type segmentation includes various subsegments such as Omnichannel Contact Center Platforms, Call Routing & Automatic Call Distribution (ACD), Interactive Voice Response (IVR) & Self-Service, Workforce Engagement & Quality Management, Reporting, Analytics & AI/ML-based Insights, CRM & Helpdesk Integration, and Others. Omnichannel Contact Center Platforms are leading the market due to the increasing need for businesses to provide seamless customer experiences across voice, email, chat, social media, and messaging channels from a unified interface. The demand for integrated cloud-based solutions that allow for real-time communication, centralized customer data, and embedded AI capabilities (such as sentiment analysis and intelligent routing) is driving growth in this subsegment across GCC enterprises and government entities.

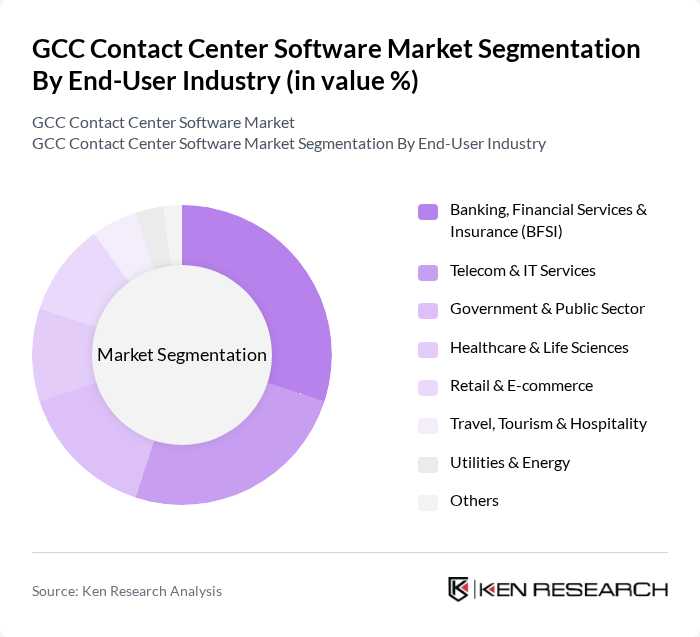

By End-User Industry:The end-user industry segmentation encompasses Banking, Financial Services & Insurance (BFSI), Telecom & IT Services, Government & Public Sector, Healthcare & Life Sciences, Retail & E-commerce, Travel, Tourism & Hospitality, Utilities & Energy, and Others. The BFSI sector is the dominant segment, driven by the need for secure and compliant customer service solutions, including advanced authentication, call recording, and audit trails. The increasing complexity of financial products, the expansion of digital and mobile banking, and the demand for personalized, omnichannel customer interactions are propelling the adoption of contact center software in this industry, alongside strong uptake in telecom and government as they modernize citizen and subscriber support.

The GCC Contact Center Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Avaya Holdings Corp., Cisco Systems, Inc., Genesys Telecommunications Laboratories, Inc., NICE CXone (NICE Ltd.), Five9, Inc., Talkdesk, Inc., RingCentral, Inc., 8x8, Inc., Zendesk, Inc., Freshworks Inc. (Freshdesk), Mitel Networks Corporation, Alcatel-Lucent Enterprise, Enghouse Interactive, SAP SE, Oracle Corporation, Etisalat by e& (UAE), stc Solutions (Saudi Telecom Company), du (Emirates Integrated Telecommunications Company) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC contact center software market appears promising, driven by technological advancements and evolving customer expectations. As businesses increasingly adopt AI and machine learning, the demand for intelligent automation solutions is expected to rise. Additionally, the shift towards omnichannel communication will enhance customer interactions, making it essential for companies to invest in integrated platforms. The focus on real-time analytics will further empower organizations to make data-driven decisions, ensuring they remain competitive in a rapidly changing landscape.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Omnichannel Contact Center Platforms Call Routing & Automatic Call Distribution (ACD) Interactive Voice Response (IVR) & Self-Service Workforce Engagement & Quality Management Reporting, Analytics & AI/ML-based Insights CRM & Helpdesk Integration Others |

| By End-User Industry | Banking, Financial Services & Insurance (BFSI) Telecom & IT Services Government & Public Sector Healthcare & Life Sciences Retail & E-commerce Travel, Tourism & Hospitality Utilities & Energy Others |

| By Deployment Model | On-Premise Public Cloud (SaaS) Private Cloud Hybrid Cloud |

| By Functionality / Channel | Voice (Inbound & Outbound) Email & Ticketing Web Chat & In-App Messaging Social Media & Digital Messaging (WhatsApp, SMS, etc.) Chatbots & Virtual Assistants Video & Co-browsing Others |

| By Organization Size | Small Enterprises (1–49 Seats) Medium Enterprises (50–249 Seats) Large Enterprises (250+ Seats) |

| By Service Type | Implementation & Integration Services Managed Contact Center Services Training, Support & Maintenance Consulting & Optimization Services |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Contact Center Solutions | 120 | IT Managers, Customer Experience Directors |

| SME Contact Center Software | 90 | Business Owners, Operations Managers |

| Cloud-based Contact Center Adoption | 80 | IT Directors, Cloud Solutions Architects |

| Omni-channel Customer Support | 60 | Customer Service Managers, Marketing Directors |

| AI-driven Contact Center Technologies | 70 | Product Managers, Technology Strategists |

The GCC Contact Center Software Market is valued at approximately USD 1.4 billion, reflecting significant growth driven by increased demand for customer service solutions and digital transformation initiatives across the region.