Region:Asia

Author(s):Dev

Product Code:KRAA5377

Pages:94

Published On:September 2025

By Type:The luxury fashion and footwear market is segmented into various types, including apparel, footwear, accessories, handbags, jewelry, watches, and others. Among these, apparel is the leading sub-segment, driven by the increasing demand for high-end clothing among consumers who prioritize quality and brand reputation. Footwear also holds a significant share, with luxury sneakers and designer shoes gaining popularity. Accessories, including handbags and jewelry, are essential for completing luxury outfits, further driving their demand.

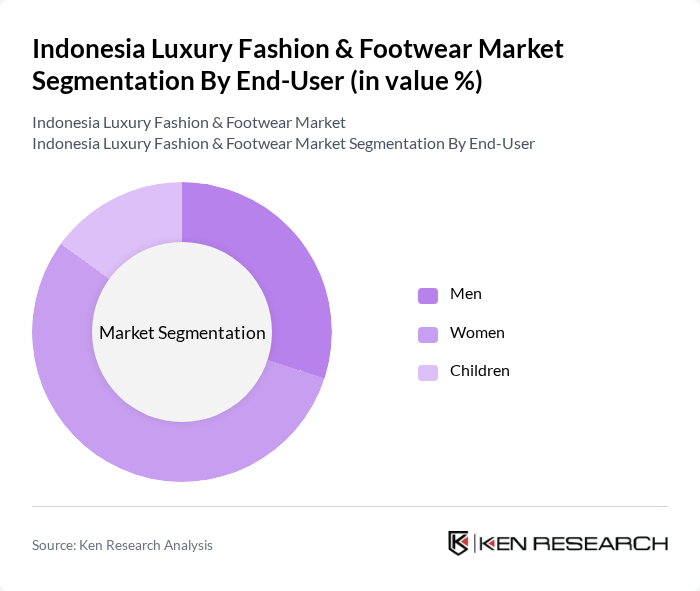

By End-User:The market is segmented by end-user into men, women, and children. Women represent the largest consumer group in the luxury fashion and footwear market, driven by their higher spending on fashion and accessories. Men are increasingly becoming significant consumers as well, with a growing interest in luxury brands and tailored clothing. The children's segment, while smaller, is also gaining traction as parents are willing to invest in high-quality, branded clothing and footwear for their children.

The Indonesia Luxury Fashion & Footwear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Louis Vuitton, Gucci, Prada, Chanel, Hermès, Salvatore Ferragamo, Christian Dior, Burberry, Fendi, Versace, Balenciaga, Valentino, Bottega Veneta, Dolce & Gabbana, Givenchy contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia luxury fashion and footwear market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands that adopt eco-friendly practices are likely to gain a competitive edge. Additionally, the integration of augmented reality in online shopping experiences is expected to enhance consumer engagement, making luxury shopping more interactive. The market is poised for growth as brands adapt to these trends and leverage digital platforms to reach a broader audience.

| Segment | Sub-Segments |

|---|---|

| By Type | Apparel Footwear Accessories Handbags Jewelry Watches Others |

| By End-User | Men Women Children |

| By Distribution Channel | Online Retail Department Stores Specialty Stores Direct Sales |

| By Price Range | Premium High-End Luxury |

| By Brand Positioning | Established Brands Emerging Brands Local Artisans |

| By Material | Leather Synthetic Natural Fabrics |

| By Occasion | Casual Wear Formal Wear Sportswear Seasonal Wear |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Apparel Purchasers | 150 | High-income Consumers, Fashion Enthusiasts |

| Footwear Market Insights | 100 | Retail Managers, Brand Representatives |

| Accessory Trends Analysis | 80 | Stylists, Fashion Bloggers |

| Online Luxury Shopping Behavior | 120 | eCommerce Managers, Digital Marketing Experts |

| Consumer Sentiment on Sustainability | 90 | Eco-conscious Consumers, Industry Analysts |

The Indonesia Luxury Fashion & Footwear Market is valued at approximately USD 5 billion, driven by rising disposable incomes and increasing consumer awareness of global fashion trends, particularly in urban areas.