Region:Middle East

Author(s):Shubham

Product Code:KRAA8844

Pages:95

Published On:November 2025

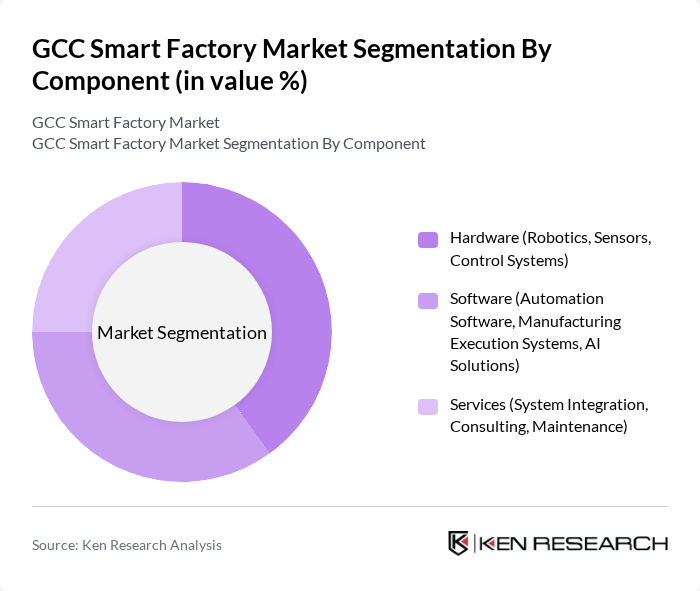

By Component:The market is segmented into three main components:Hardware, Software, and Services. Hardware includes robotics, sensors, and control systems, which are essential for automating production lines and enabling real-time data capture. Software comprises automation platforms, manufacturing execution systems (MES), and AI-driven analytics that drive process optimization and predictive maintenance. Services encompass system integration, consulting, and ongoing maintenance, which are critical for the successful deployment and lifecycle management of smart factory solutions .

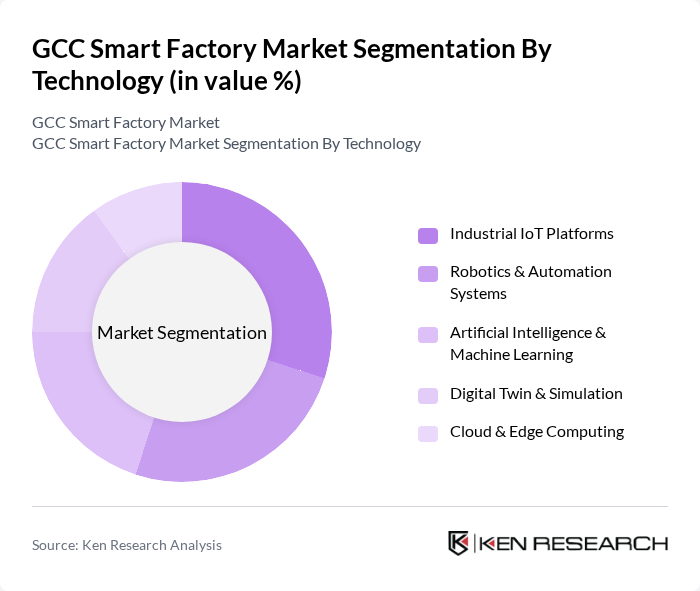

By Technology:The technology segment includesIndustrial IoT Platforms, Robotics & Automation Systems, Artificial Intelligence & Machine Learning, Digital Twin & Simulation, and Cloud & Edge Computing. Industrial IoT platforms are pivotal for connecting factory assets and enabling data-driven decision-making. Robotics and automation systems streamline production and reduce manual intervention. AI and machine learning support predictive analytics and process optimization. Digital twin technology enables real-time simulation and virtual commissioning, while cloud and edge computing provide scalable, secure data management and analytics capabilities .

The GCC Smart Factory Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, ABB Ltd., Honeywell International Inc., Rockwell Automation, Inc., Schneider Electric SE, Mitsubishi Electric Corporation, Bosch Rexroth AG, Emerson Electric Co., General Electric Company, Fanuc Corporation, Yokogawa Electric Corporation, Omron Corporation, PTC Inc., Dassault Systèmes SE, National Instruments Corporation, Schneider Electric Saudi Arabia, Honeywell Middle East, Siemens Middle East, ABB Gulf, Yokogawa Middle East & Africa B.S.C.(c), Emerson Process Management MENA, Rockwell Automation Saudi Arabia, Mitsubishi Electric Saudi Ltd., Schneider Electric UAE, and Honeywell Kuwait contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC smart factory market appears promising, driven by technological advancements and increasing government support. As industries embrace automation and digital transformation, the integration of IoT and AI technologies will become more prevalent. Additionally, the focus on sustainability will push manufacturers to adopt eco-friendly practices, enhancing operational efficiency. The collaboration between public and private sectors will further accelerate innovation, positioning the GCC as a leader in smart manufacturingin future.

| Segment | Sub-Segments |

|---|---|

| By Component | Hardware (Robotics, Sensors, Control Systems) Software (Automation Software, Manufacturing Execution Systems, AI Solutions) Services (System Integration, Consulting, Maintenance) |

| By Technology | Industrial IoT Platforms Robotics & Automation Systems Artificial Intelligence & Machine Learning Digital Twin & Simulation Cloud & Edge Computing |

| By Industry Vertical | Automotive Electronics & Electrical Food & Beverage Pharmaceuticals Oil & Gas Metals & Machinery Others |

| By Application | Predictive Maintenance Quality Control & Inspection Supply Chain & Logistics Optimization Production Planning & Scheduling Energy Management Others |

| By End-User | Discrete Manufacturing Process Manufacturing Commercial & Industrial Facilities Others |

| By Investment Source | Private Investments Government Funding Venture Capital Public-Private Partnerships Others |

| By Policy Support | Tax Incentives Grants for Technology Adoption Regulatory Support for Innovation Training and Development Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Smart Manufacturing | 100 | Production Managers, Technology Officers |

| Electronics Smart Factory Solutions | 80 | Operations Directors, IT Managers |

| Consumer Goods Automation | 70 | Supply Chain Managers, Quality Assurance Heads |

| Pharmaceutical Manufacturing Innovations | 50 | Regulatory Affairs Managers, Production Supervisors |

| Smart Factory Technology Providers | 60 | Sales Managers, Product Development Managers |

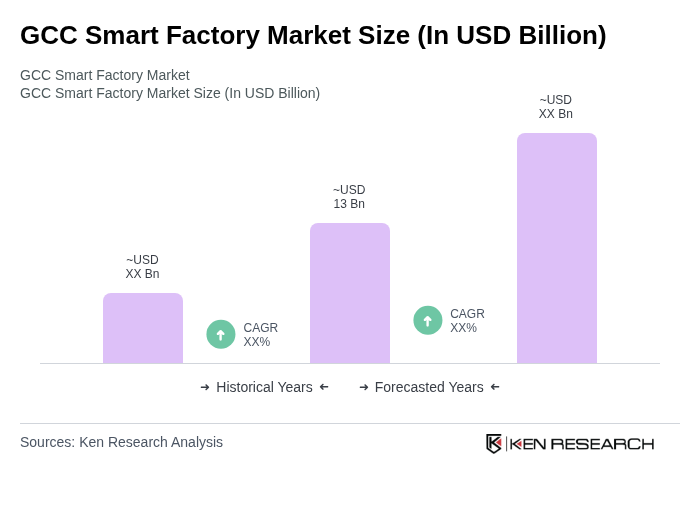

The GCC Smart Factory Market is valued at approximately USD 13 billion, driven by investments in automation technologies, Industry 4.0 adoption, and government-backed digital transformation initiatives across the region.