Region:Middle East

Author(s):Dev

Product Code:KRAD3268

Pages:88

Published On:November 2025

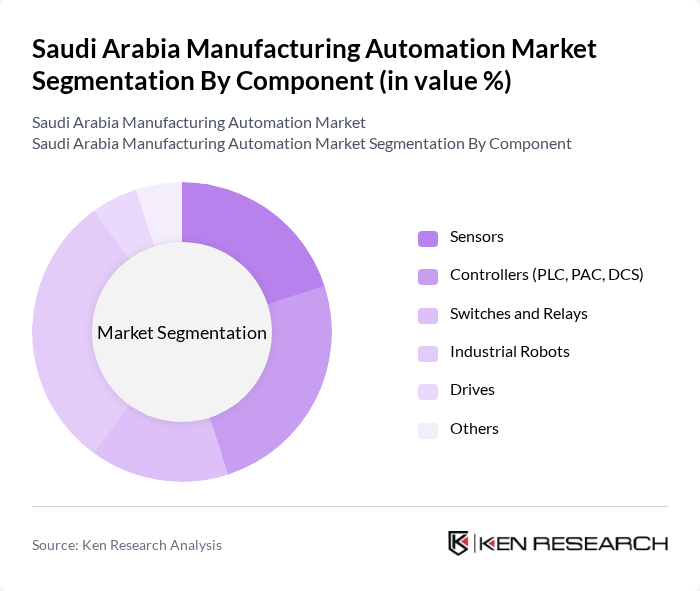

By Component:The components of the manufacturing automation market include various technologies that enhance operational efficiency. The leading subsegment is Industrial Robots, which are increasingly utilized for their ability to perform repetitive tasks with precision and speed. Sensors and Controllers also play significant roles, as they are essential for monitoring and controlling manufacturing processes. The demand for these components is driven by the need for improved productivity, reduced operational costs, and the integration of Industry 4.0 solutions such as AI-powered predictive maintenance and real-time data analytics .

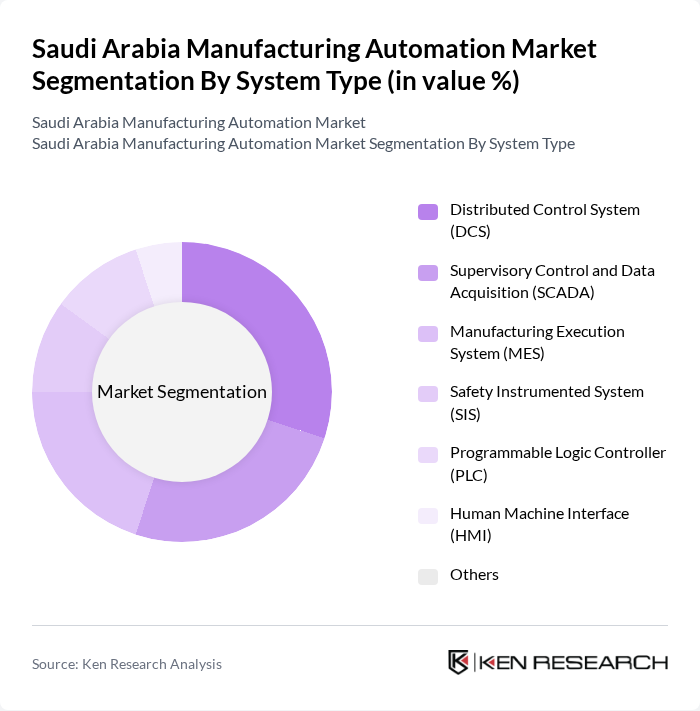

By System Type:The system types in the manufacturing automation market encompass various control and management systems. The Distributed Control System (DCS) is the leading subsegment, favored for its ability to manage complex processes across multiple locations. Supervisory Control and Data Acquisition (SCADA) systems are also critical, providing real-time data monitoring and control. The increasing complexity of manufacturing processes, along with the adoption of digital transformation strategies, drives the demand for these advanced systems .

The Saudi Arabia Manufacturing Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Rockwell Automation, Inc., ABB Ltd., Schneider Electric SE, Honeywell International Inc., Mitsubishi Electric Corporation, Emerson Electric Co., Yokogawa Electric Corporation, FANUC Corporation, KUKA AG, Omron Corporation, Bosch Rexroth AG, National Instruments Corporation, Beckhoff Automation GmbH & Co. KG, Festo AG & Co. KG, Saudi Automation Company, Advanced Electronics Company (AEC), Alfanar Company, Yokogawa Saudi Arabia Ltd., Schneider Electric Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia manufacturing automation market appears promising, driven by ongoing technological advancements and government support. As industries increasingly adopt AI and IoT solutions, the focus on smart factories will intensify. Additionally, the push for sustainable manufacturing practices will likely lead to innovations that enhance efficiency while minimizing environmental impact. These trends indicate a robust growth trajectory for automation technologies, positioning Saudi Arabia as a key player in the regional manufacturing landscape.

| Segment | Sub-Segments |

|---|---|

| By Component | Sensors Controllers (PLC, PAC, DCS) Switches and Relays Industrial Robots Drives Others |

| By System Type | Distributed Control System (DCS) Supervisory Control and Data Acquisition (SCADA) Manufacturing Execution System (MES) Safety Instrumented System (SIS) Programmable Logic Controller (PLC) Human Machine Interface (HMI) Others |

| By Industry Vertical | Automotive Manufacturing Food and Beverage Oil and Gas Processing Electronics Mining and Metals Chemicals Pharmaceuticals Textiles Others |

| By Automation Level | Fully Automated Semi-Automated Manual Others |

| By Technology | Industrial IoT Cloud Computing Big Data Analytics Artificial Intelligence (AI) Machine Vision Others |

| By Geographic Region | Central Region Eastern Region Western Region Southern Region |

| By Policy Support | Government Subsidies Tax Incentives Grants for R&D Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Petrochemical Manufacturing Automation | 100 | Plant Managers, Automation Engineers |

| Food Processing Automation | 60 | Operations Managers, Quality Control Supervisors |

| Electronics Manufacturing Automation | 50 | Production Supervisors, R&D Managers |

| Textile Industry Automation | 40 | Supply Chain Managers, Production Planners |

| General Manufacturing Automation Trends | 70 | Industry Analysts, Technology Consultants |

The Saudi Arabia Manufacturing Automation Market is valued at approximately USD 2.2 billion, reflecting a significant growth trend driven by advanced manufacturing technologies and government initiatives aimed at economic diversification under Vision 2030.