Region:North America

Author(s):Shubham

Product Code:KRAB0807

Pages:99

Published On:August 2025

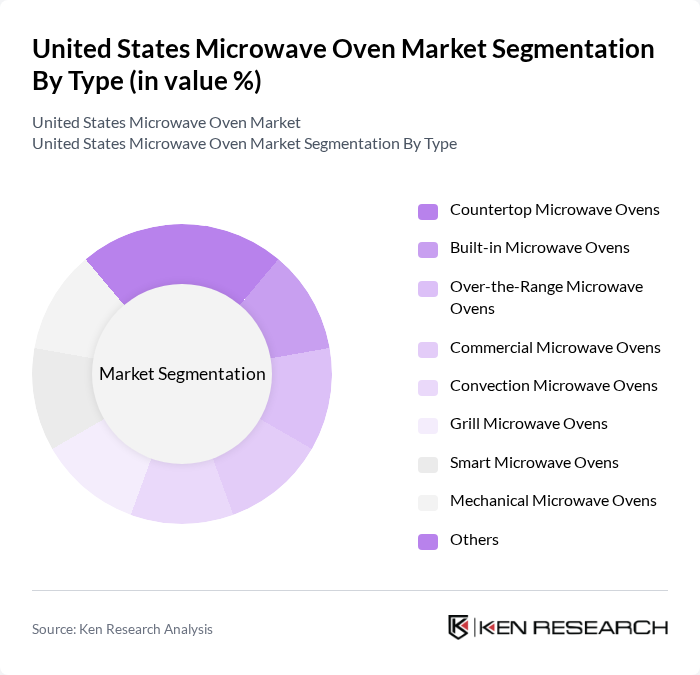

By Type:The market is segmented into various types of microwave ovens, each catering to different consumer needs and preferences. The primary subsegments include Countertop Microwave Ovens, Built-in Microwave Ovens, Over-the-Range Microwave Ovens, Commercial Microwave Ovens, Convection Microwave Ovens, Grill Microwave Ovens, Smart Microwave Ovens, Mechanical Microwave Ovens, and Others. Among these, Countertop Microwave Ovens are the most popular due to their compact design, affordability, ease of use, and versatility, making them a staple in both residential and commercial settings. Convection microwave ovens are also gaining traction, especially among consumers seeking multifunctional appliances that combine microwave and traditional oven capabilities.

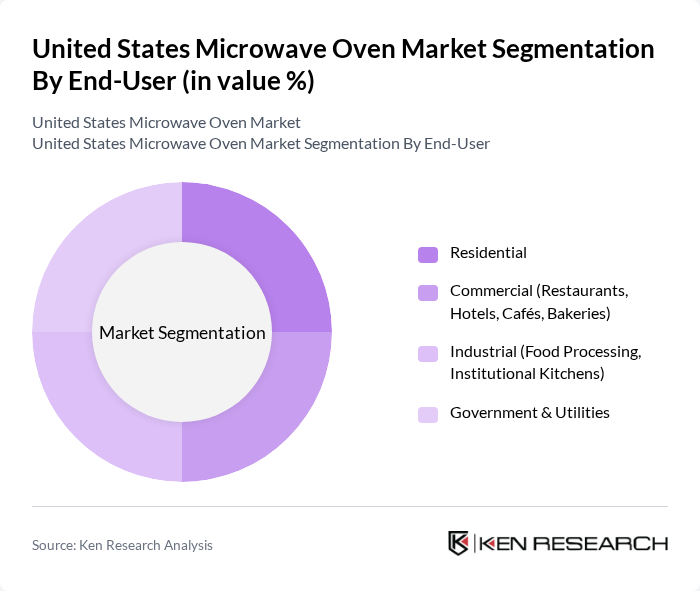

By End-User:The end-user segmentation includes Residential, Commercial (Restaurants, Hotels, Cafés, Bakeries), Industrial (Food Processing, Institutional Kitchens), and Government & Utilities. The Residential segment dominates the market, driven by the increasing number of households and the growing trend of home cooking, especially during the pandemic. Consumers are increasingly seeking convenient cooking solutions that fit their busy lifestyles. In the commercial segment, restaurants and hotels are significant adopters, leveraging advanced microwave ovens for speed and efficiency in food preparation.

The United States Microwave Oven Market is characterized by a dynamic mix of regional and international players. Leading participants such as Whirlpool Corporation, Samsung Electronics America, Inc., LG Electronics USA, Inc., Panasonic Corporation of North America, Breville USA, Inc., GE Appliances, a Haier Company, Sharp Electronics Corporation, Frigidaire (Electrolux North America), Bosch Home Appliances, Miele, Inc., Emerson Radio Corporation, Amana (Whirlpool Corporation), Insignia (Best Buy), Smeg USA, Inc., Cuisinart (Conair Corporation), Galanz Americas, Midea America Corp., Toshiba America Consumer Products, LLC, Mainstays (Walmart), AmazonBasics (Amazon) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. microwave oven market appears promising, driven by ongoing technological innovations and changing consumer preferences. As smart kitchen appliances gain traction, manufacturers are likely to invest in developing multifunctional microwave ovens that integrate IoT capabilities. Additionally, the increasing focus on energy efficiency will push brands to create models that meet stringent energy standards, appealing to environmentally conscious consumers. These trends indicate a dynamic market landscape that will continue to evolve in response to consumer demands and technological advancements.

| Segment | Sub-Segments |

|---|---|

| By Type | Countertop Microwave Ovens Built-in Microwave Ovens Over-the-Range Microwave Ovens Commercial Microwave Ovens Convection Microwave Ovens Grill Microwave Ovens Smart Microwave Ovens Mechanical Microwave Ovens Others |

| By End-User | Residential Commercial (Restaurants, Hotels, Cafés, Bakeries) Industrial (Food Processing, Institutional Kitchens) Government & Utilities |

| By Distribution Channel | Online Retail (E-commerce Platforms) Offline Retail (Appliance Stores, Big-box Retailers) Direct Sales Wholesale |

| By Price Range | Budget Mid-Range Premium |

| By Features | Smart Features (Wi-Fi, Voice Control, App Integration) Energy Efficiency (Inverter Technology, Low Power Consumption) Size and Capacity (Compact, Standard, Large) Cooking Functions (Defrost, Grill, Convection, Sensor Cooking) |

| By Brand | Major National Brands (Whirlpool, GE, LG, Samsung, Panasonic, Sharp, Frigidaire) Private Labels (Insignia, Mainstays, AmazonBasics) Emerging Brands (Galanz, Midea, Toshiba) |

| By Application | Home Cooking Food Service (Restaurants, Cafés, Catering) Institutional (Schools, Hospitals, Corporate Cafeterias) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Appliance Sales | 100 | Store Managers, Sales Associates |

| Consumer Usage Patterns | 120 | Homeowners, Renters |

| Product Development Insights | 80 | R&D Managers, Product Designers |

| Market Trends Analysis | 60 | Market Analysts, Industry Experts |

| Consumer Satisfaction Surveys | 90 | Microwave Oven Users, Appliance Reviewers |

The United States Microwave Oven Market is valued at approximately USD 3.3 billion, reflecting a significant growth trend driven by consumer demand for convenient cooking solutions and the rise of smart kitchen appliances.