Region:Asia

Author(s):Dev

Product Code:KRAA8303

Pages:96

Published On:November 2025

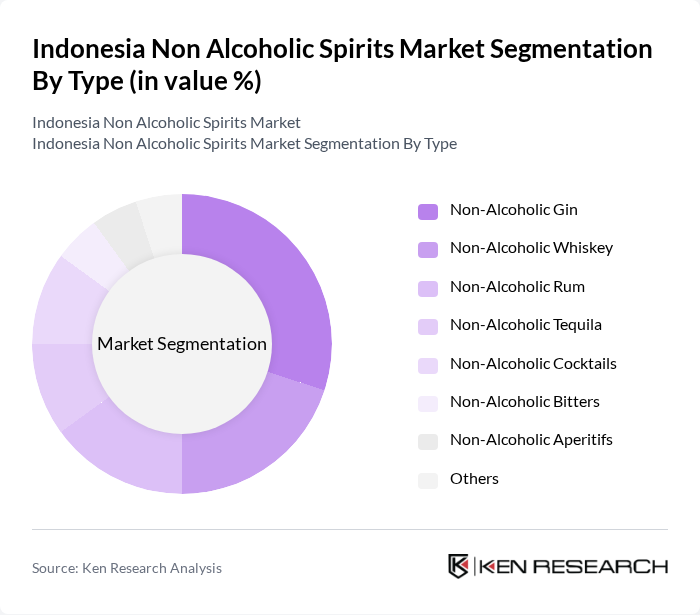

By Type:The market is segmented into various types of non-alcoholic spirits, including Non-Alcoholic Gin, Non-Alcoholic Whiskey, Non-Alcoholic Rum, Non-Alcoholic Tequila, Non-Alcoholic Cocktails, Non-Alcoholic Bitters, Non-Alcoholic Aperitifs, and Others. Among these, Non-Alcoholic Gin has emerged as a leading sub-segment, driven by its versatility in cocktails and the growing trend of gin-based drinks. Consumers are increasingly seeking sophisticated flavors and experiences, which non-alcoholic gin provides, making it a popular choice in bars and restaurants.

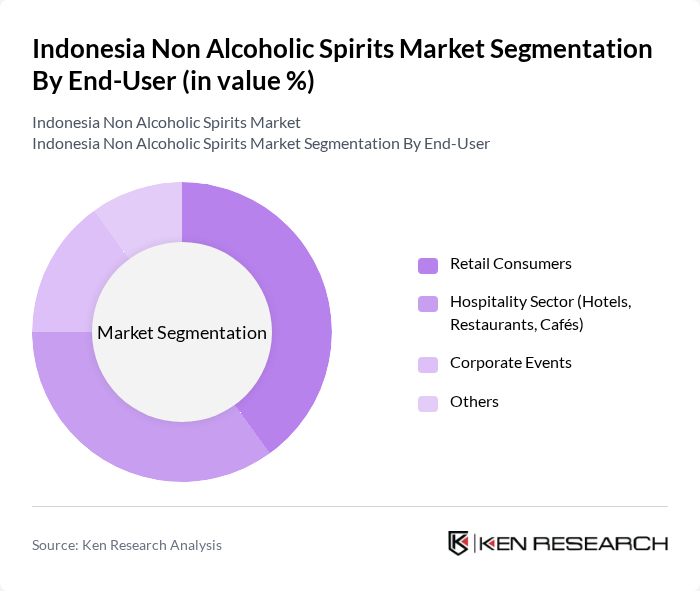

By End-User:The end-user segmentation includes Retail Consumers, the Hospitality Sector (Hotels, Restaurants, Cafés), Corporate Events, and Others. The Hospitality Sector is currently the dominant segment, as establishments increasingly offer non-alcoholic options to cater to health-conscious consumers and those seeking alternatives to traditional alcoholic beverages. This trend is further supported by the rise of social gatherings and events where non-alcoholic spirits are becoming a staple.

The Indonesia Non Alcoholic Spirits Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lyre's Non-Alcoholic Spirits, Seedlip, Ritual Zero Proof, Monday Zero Alcohol Gin, CleanCo, Three Spirit, Kin Euphorics, Curious Elixirs, Ceder's, H2O Spirits, Free Spirits, Sucofindo Beverage (Indonesia), PT. Multi Bintang Indonesia Tbk (Heineken Indonesia, Non-Alcoholic Division), PT. Orang Tua Group (Non-Alcoholic Spirits), The Mocktail Club contribute to innovation, geographic expansion, and service delivery in this space.

The future of the non-alcoholic spirits market in Indonesia appears promising, driven by evolving consumer preferences and innovative product development. As health consciousness continues to rise, brands are likely to focus on creating unique, flavorful options that cater to diverse tastes. Additionally, the integration of technology in marketing strategies, particularly through social media and e-commerce, will enhance brand visibility and consumer engagement, fostering a more robust market presence in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Non-Alcoholic Gin Non-Alcoholic Whiskey Non-Alcoholic Rum Non-Alcoholic Tequila Non-Alcoholic Cocktails Non-Alcoholic Bitters Non-Alcoholic Aperitifs Others |

| By End-User | Retail Consumers Hospitality Sector (Hotels, Restaurants, Cafés) Corporate Events Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail/E-commerce Specialty Stores Bars and Restaurants Convenience Stores Others |

| By Packaging Type | Glass Bottles Cans Tetra Packs PET Bottles Others |

| By Flavor Profile | Herbal Fruity Spicy Citrus Others |

| By Price Range | Premium Mid-Range Economy Others |

| By Consumer Demographics | Age Group Gender Income Level Urban vs Rural Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Non-Alcoholic Spirits | 120 | Health-conscious Consumers, Young Adults |

| Retail Distribution Insights | 60 | Retail Managers, Beverage Buyers |

| Market Trends and Innovations | 50 | Product Development Managers, Marketing Executives |

| Impact of Health Trends on Purchasing | 40 | Nutritionists, Fitness Trainers |

| Consumer Awareness and Brand Perception | 70 | Brand Managers, Market Researchers |

The Indonesia Non Alcoholic Spirits Market is valued at approximately USD 150 million, reflecting a significant growth trend driven by increasing health consciousness and the rise of sober-curious lifestyles among consumers.