Region:Asia

Author(s):Rebecca

Product Code:KRAB5278

Pages:94

Published On:October 2025

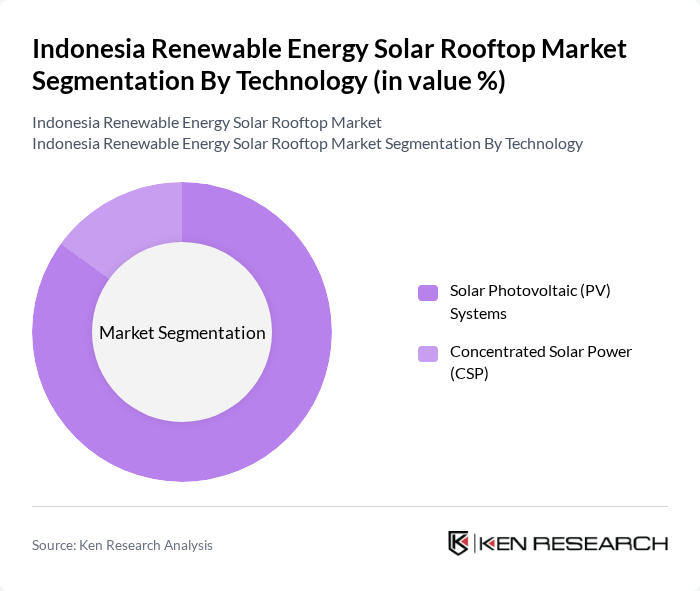

By Technology:The market is segmented into two primary technologies:Solar Photovoltaic (PV) SystemsandConcentrated Solar Power (CSP). Solar PV systems overwhelmingly dominate the market, driven by their versatility, ease of installation, and declining costs. The ongoing shift toward decentralized energy generation has led to increased adoption of PV systems in both residential and commercial sectors. CSP remains a niche segment, primarily considered for utility-scale projects where energy storage and dispatchability are required .

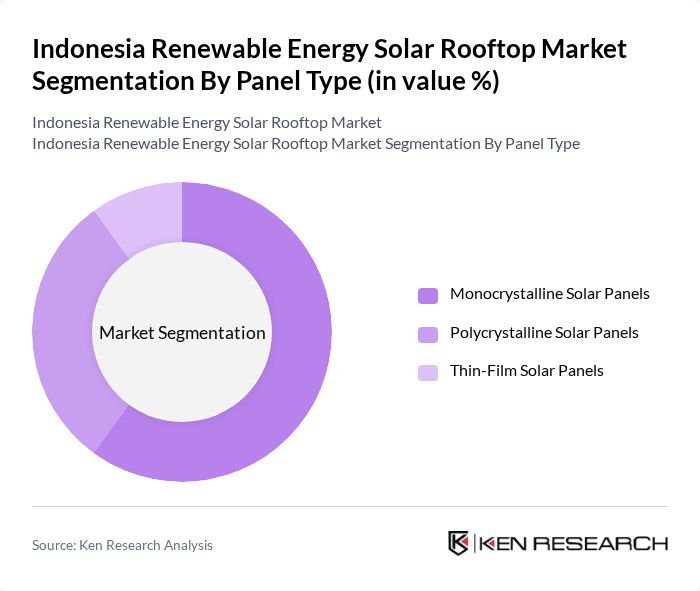

By Panel Type:The market is further segmented by panel type intoMonocrystalline Solar Panels,Polycrystalline Solar Panels, andThin-Film Solar Panels. Monocrystalline panels lead the market due to their higher efficiency and compact form factor, making them ideal for space-constrained urban rooftops. Polycrystalline panels are favored for their cost-effectiveness, while thin-film panels are increasingly adopted in applications requiring flexibility and lightweight materials, such as certain commercial and industrial rooftops .

The Indonesia Renewable Energy Solar Rooftop Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Surya Energi Indotama, PT. ATW Solar, PT. Sky Energy Indonesia Tbk, PT. TML Energy, PT. Selaras Daya Utama (SDU), PT. Xurya Daya Indonesia, PT. TotalEnergies Indonesia, PT. Trina Solar Indonesia, PT. Canadian Solar Indonesia, PT. JinkoSolar Indonesia, PT. SUN Energy, PT. Hanwha Q CELLS Indonesia, PT. LONGi Green Energy Technology Indonesia, PT. JA Solar Technology Indonesia, and PT. First Solar Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the solar rooftop market in Indonesia appears promising, driven by increasing energy demands and supportive government policies. In future, the integration of smart grid technologies is expected to enhance energy efficiency and reliability. Additionally, the rise of community solar projects will facilitate broader access to solar energy, particularly in urban areas. As awareness grows and technology becomes more affordable, the market is likely to witness accelerated adoption, contributing to Indonesia's renewable energy goals.

| Segment | Sub-Segments |

|---|---|

| By Technology | Solar Photovoltaic (PV) Systems Concentrated Solar Power (CSP) |

| By Panel Type | Monocrystalline Solar Panels Polycrystalline Solar Panels Thin-Film Solar Panels |

| By End-User | Residential Commercial Industrial Utility |

| By Application | Grid-Connected Systems Off-Grid Systems Rooftop Installations Utility-Scale Projects |

| By Region | Java Sumatra Bali & Nusa Tenggara Kalimantan Sulawesi |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| By Distribution Mode | Direct Sales Online Sales Distributors and Retailers |

| By Price Range | Budget-Friendly Options Mid-Range Options Premium Options |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Solar Rooftop Installations | 120 | Homeowners, Property Managers |

| Commercial Solar Rooftop Projects | 80 | Facility Managers, Business Owners |

| Industrial Solar Energy Solutions | 60 | Operations Directors, Energy Managers |

| Government and Regulatory Insights | 40 | Policy Makers, Energy Regulators |

| Solar Technology Providers | 50 | Product Managers, Sales Executives |

The Indonesia Renewable Energy Solar Rooftop Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by increasing energy demand, supportive government policies, and rising consumer awareness of environmental sustainability.