Region:Africa

Author(s):Geetanshi

Product Code:KRAB5234

Pages:90

Published On:October 2025

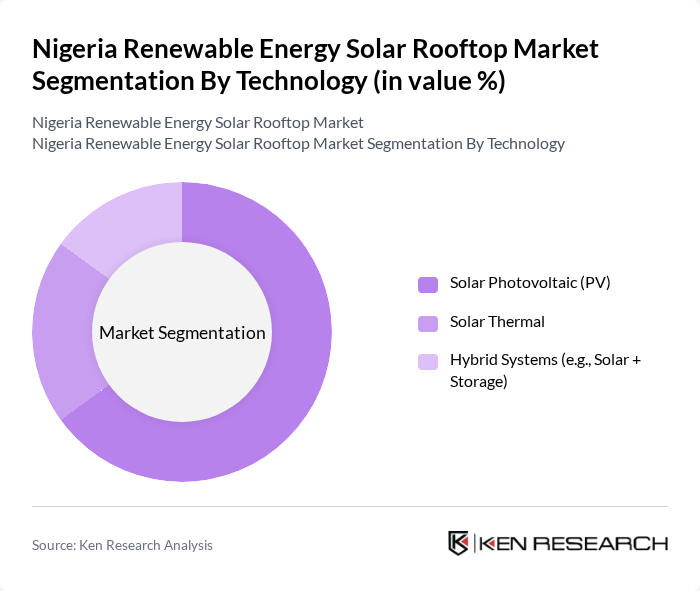

By Technology:The technology segment encompasses Solar Photovoltaic (PV), Solar Thermal, and Hybrid Systems (e.g., Solar + Storage). Solar PV remains the most widely adopted technology due to its cost-effectiveness, scalability, and suitability for both grid-tied and off-grid applications. Solar Thermal is gaining traction in industrial processes and large-scale heating, while Hybrid Systems are increasingly preferred for their ability to provide uninterrupted power in regions with unstable grid supply .

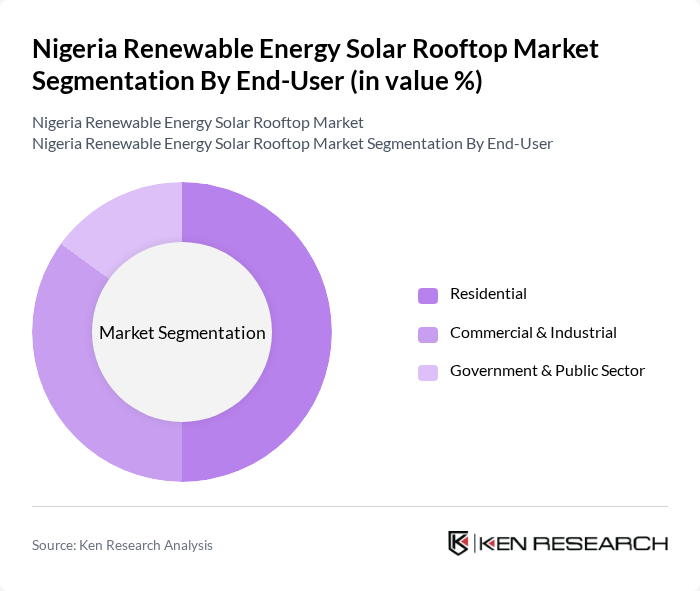

By End-User:The end-user segment includes Residential, Commercial & Industrial, and Government & Public Sector. The residential sector leads adoption, driven by the need for energy independence and rising electricity costs. Commercial and industrial users are investing in solar to reduce operational expenses and ensure business continuity. The government and public sector actively promote solar through electrification initiatives and public procurement programs, further boosting market growth .

The Nigeria Renewable Energy Solar Rooftop Market is characterized by a dynamic mix of regional and international players. Leading participants such as SolarAfrica, Daystar Power, Lumos Nigeria, Greenlight Planet, GVE Projects, Arnergy, Solynta Energy, Solar Depot Nigeria, PowerGen Renewable Energy, d.light, Rubitec Solar, Renewable Energy Association of Nigeria (REAN), Nigerian Solar Industry Association (NSIA), Solar Sister, TotalEnergies contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's solar rooftop market appears promising, driven by increasing energy demands and supportive government policies. As urbanization accelerates, more households and businesses are likely to adopt solar solutions. Technological advancements in solar efficiency and energy storage will further enhance the attractiveness of solar rooftops. Additionally, the growing emphasis on sustainability and environmental responsibility will encourage investments in renewable energy, positioning Nigeria as a leader in solar energy adoption in Africa.

| Segment | Sub-Segments |

|---|---|

| By Technology | Solar Photovoltaic (PV) Solar Thermal Hybrid Systems (e.g., Solar + Storage) |

| By End-User | Residential Commercial & Industrial Government & Public Sector |

| By Application | Rooftop Installations Off-Grid (Mini-Grids, Solar Home Systems) Grid-Connected Rural Electrification |

| By Investment Source | Domestic Private Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes & Grants |

| By Policy Support | Subsidies Tax Exemptions & Incentives Renewable Energy Certificates (RECs) |

| By Distribution Mode | Direct Sales Online Sales Retail & Distribution Partnerships |

| By Region | North South East West |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Solar Rooftop Installations | 100 | Homeowners, Property Managers |

| Commercial Solar Rooftop Projects | 80 | Facility Managers, Business Owners |

| Industrial Solar Energy Solutions | 60 | Operations Directors, Energy Managers |

| Government Policy Impact on Solar Adoption | 50 | Policy Makers, Regulatory Officials |

| Solar Technology Providers | 40 | Product Managers, Technical Sales Representatives |

The Nigeria Renewable Energy Solar Rooftop Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the demand for reliable power solutions, government incentives, and the increasing adoption of solar energy storage systems.