Region:Asia

Author(s):Geetanshi

Product Code:KRAD1282

Pages:91

Published On:November 2025

By Type:The specialty cheese market in Indonesia is segmented into Mozzarella, Cheddar, Parmesan, Gouda, Blue Cheese, Feta, Cream Cheese, Ricotta, and Others.Mozzarella and Cheddarremain the most popular types, driven by their versatility in cooking and high demand in both households and foodservice establishments. The growing trend of pizza consumption, Western-style dishes, and fusion foods such as martabak and pastries has significantly boosted demand for these cheese types. Product innovation, including blends like mozzarella-cheddar, is also expanding the specialty segment .

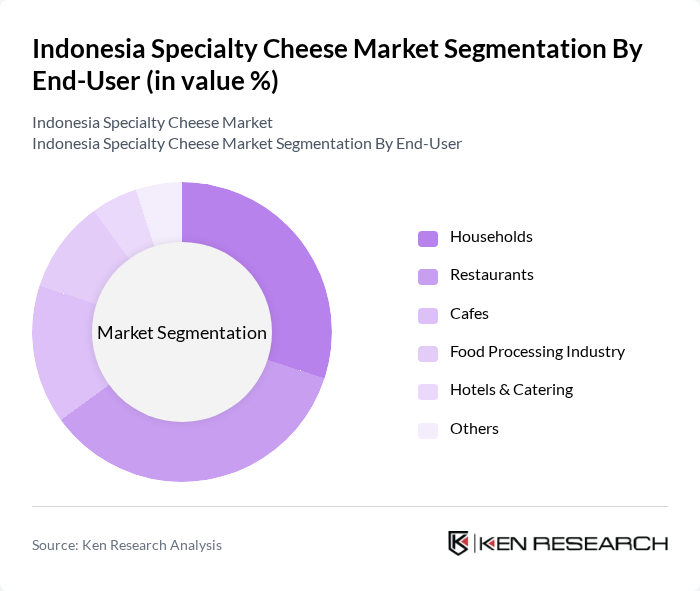

By End-User:The end-user segmentation includes households, restaurants, cafes, food processing industries, hotels & catering, and others.Restaurantsare the leading end-user, reflecting the increasing trend of dining out and the popularity of gourmet food experiences. Households are also significant consumers, with specialty cheeses being incorporated into daily cooking and snacking. The expansion of modern retail and e-commerce has facilitated greater access for both foodservice and household segments .

The Indonesia Specialty Cheese Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Mulia Boga Raya Tbk (Prochiz), PT. Indolakto (Indomilk), PT. Greenfields Dairy Indonesia, PT. Cisarua Mountain Dairy (Cimory), PT. Emina Cheese Indonesia, PT. Sarihusada Generasi Mahardhika (Danone Specialized Nutrition), PT. Frisian Flag Indonesia, PT. Ultra Jaya Milk Industry Tbk, PT. Bina Sumber Rejeki, PT. Tetra Pak Indonesia, PT. Danone Indonesia, PT. Bina Karya Prima, PT. Sumber Alfaria Trijaya Tbk (Alfamart), PT. Cipta Rasa, PT. Bumi Menara Internusa contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesian specialty cheese market appears promising, driven by evolving consumer preferences and a burgeoning food service sector. As health-conscious consumers increasingly seek gourmet products, local producers are likely to innovate with new flavors and varieties. Additionally, the rise of e-commerce platforms will facilitate greater access to specialty cheeses, enhancing market visibility. Collaborations with restaurants and cafes will further solidify the presence of specialty cheese in the culinary landscape, fostering growth and diversification in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Mozzarella Cheddar Parmesan Gouda Blue Cheese Feta Cream Cheese Ricotta Others (e.g., Brie, Camembert, Burrata, etc.) |

| By End-User | Households Restaurants Cafes Food Processing Industry Hotels & Catering Others |

| By Distribution Channel | Supermarkets/Hypermarkets Specialty Stores Online Retail Foodservice Distributors Direct Sales Others |

| By Packaging Type | Vacuum Sealed Plastic Wrap Glass Containers Paper Wrap Others |

| By Price Range | Premium Mid-Range Economy Others |

| By Flavor Profile | Mild Sharp Spicy Smoked Others |

| By Region | Java Sumatra Bali Kalimantan Sulawesi Papua Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Specialty Cheese Outlets | 100 | Store Managers, Product Buyers |

| Artisanal Cheese Producers | 60 | Owners, Production Managers |

| Food Service Industry (Restaurants, Cafes) | 80 | Chefs, Purchasing Managers |

| Consumer Preferences for Specialty Cheese | 120 | General Consumers, Food Enthusiasts |

| Distribution Channels for Specialty Cheese | 50 | Logistics Managers, Supply Chain Coordinators |

The Indonesia Specialty Cheese Market is valued at approximately USD 1.2 billion, reflecting a growing demand for gourmet and artisanal cheese products, driven by changing consumer preferences and the expansion of the foodservice sector.