Region:Asia

Author(s):Rebecca

Product Code:KRAD1357

Pages:99

Published On:November 2025

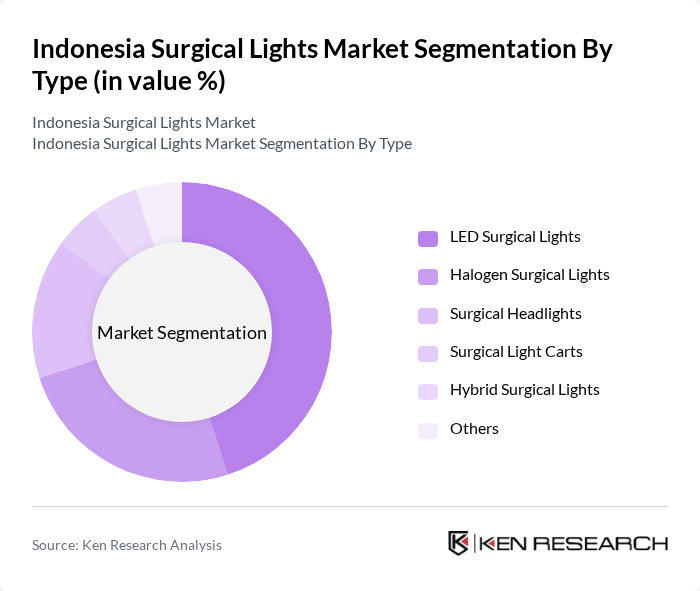

By Type:The market is segmented into various types of surgical lights, including LED Surgical Lights, Halogen Surgical Lights, Surgical Headlights, Surgical Light Carts, Hybrid Surgical Lights, and Others. Among these, LED Surgical Lights are gaining significant traction due to their energy efficiency, longer lifespan, and superior illumination quality. Halogen Surgical Lights, while still in use, are gradually being replaced by LED options. The demand for Surgical Headlights is also increasing, particularly in minimally invasive surgeries where portability and flexibility are essential .

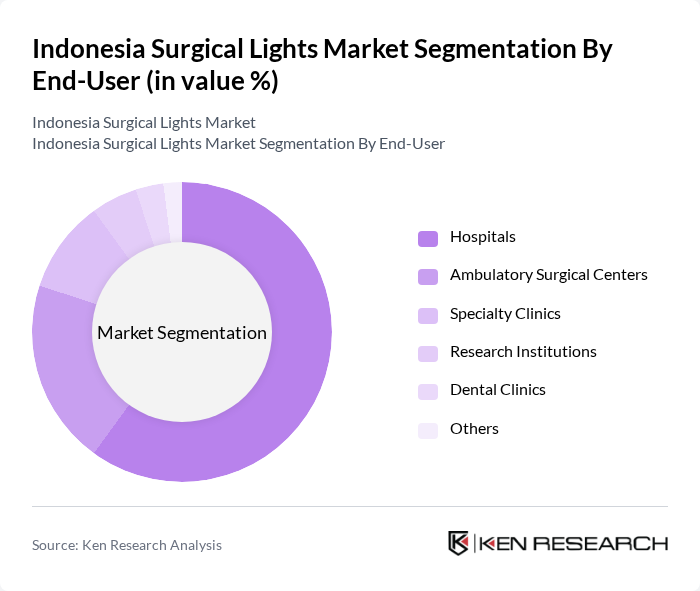

By End-User:The end-user segmentation includes Hospitals, Ambulatory Surgical Centers, Specialty Clinics, Research Institutions, Dental Clinics, and Others. Hospitals are the primary end-users, accounting for a significant portion of the market due to the high volume of surgical procedures performed. Ambulatory Surgical Centers are also witnessing growth as they offer cost-effective surgical options. Specialty Clinics and Dental Clinics are increasingly adopting advanced surgical lighting solutions to enhance their operational capabilities .

The Indonesia Surgical Lights Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Stryker Corporation, GE Healthcare, Hillrom (now part of Baxter International Inc.), Getinge Group, Drägerwerk AG & Co. KGaA, Maquet (Getinge Group), Steris Corporation, Amico Corporation, A-dec Inc., Bovie Medical Corporation, KLS Martin Group, NDS Surgical Imaging, Trumpf Medical (part of Hillrom/Baxter), Mindray Medical International Limited, PT. Mega Medica Pharmaceuticals (Indonesia), PT. Sinar Abadi Medika (Indonesia) contribute to innovation, geographic expansion, and service delivery in this space.

The Indonesia surgical lights market is poised for significant growth as healthcare infrastructure continues to expand and technological innovations reshape surgical environments. The integration of smart technologies and energy-efficient lighting solutions is becoming increasingly prevalent, enhancing surgical precision and patient safety. Additionally, the government's commitment to improving healthcare access will likely drive further investments in surgical facilities, ensuring that even rural areas benefit from advanced surgical lighting systems, ultimately improving overall healthcare outcomes.

| Segment | Sub-Segments |

|---|---|

| By Type | LED Surgical Lights Halogen Surgical Lights Surgical Headlights Surgical Light Carts Hybrid Surgical Lights Others |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty Clinics Research Institutions Dental Clinics Others |

| By Application | General Surgery Orthopedic Surgery Neurosurgery Gynecological Surgery Cardiac Surgery ENT Surgery Others |

| By Installation Type | Ceiling Mounted Wall Mounted Mobile Surgical Lights Others |

| By Region | Java Sumatra Bali Kalimantan Sulawesi Others |

| By Technology | Conventional Lighting LED Technology Fiber Optic Technology Hybrid Technology Others |

| By Pricing Tier | Premium Mid-range Economy Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Hospital Surgical Departments | 100 | Surgeons, Department Heads, Procurement Officers |

| Private Clinic Operating Rooms | 60 | Clinic Owners, Surgeons, Equipment Managers |

| Medical Equipment Distributors | 40 | Sales Managers, Product Specialists, Market Analysts |

| Healthcare Regulatory Bodies | 40 | Policy Makers, Compliance Officers, Industry Experts |

| Surgeon Focus Groups | 50 | Experienced Surgeons, Surgical Residents, Operating Room Nurses |

The Indonesia Surgical Lights Market is valued at approximately USD 140 million, reflecting a significant growth trend driven by increased surgical procedures and advancements in lighting technology, particularly the transition from halogen to LED systems.