Region:Middle East

Author(s):Dev

Product Code:KRAD5237

Pages:92

Published On:December 2025

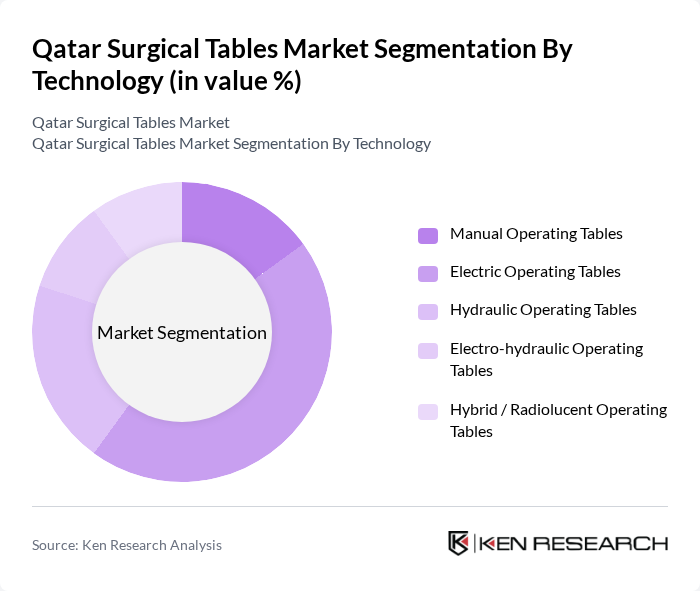

By Technology:The technology segment includes various types of surgical tables that cater to different surgical needs. The subsegments are Manual Operating Tables, Electric Operating Tables, Hydraulic Operating Tables, Electro-hydraulic Operating Tables, and Hybrid / Radiolucent Operating Tables. The Electric Operating Tables are currently dominating the market due to their ease of use, precision, and ability to enhance surgical efficiency. The trend towards minimally invasive surgeries has also increased the demand for advanced electric tables that offer better positioning and support for patients.

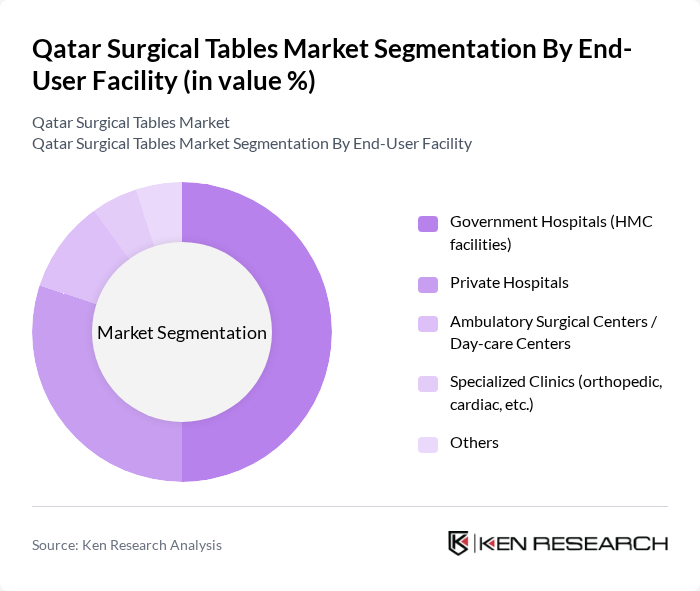

By End-User Facility:This segment includes Government Hospitals (HMC facilities), Private Hospitals, Ambulatory Surgical Centers / Day-care Centers, Specialized Clinics (orthopedic, cardiac, etc.), and Others. Government Hospitals are the leading end-user facilities due to their large patient volumes and the government's investment in healthcare infrastructure. The increasing number of private hospitals and specialized clinics is also contributing to the growth of this segment, as they seek to provide advanced surgical solutions to meet patient demands.

The Qatar Surgical Tables Market is characterized by a dynamic mix of regional and international players. Leading participants such as Getinge AB (Maquet brand), Stryker Corporation, Hillrom (Baxter International Inc.), Siemens Healthineers AG, GE HealthCare Technologies Inc., Drägerwerk AG & Co. KGaA, Trumpf Medizin Systeme GmbH + Co. KG (TRUMPF Medical), Skytron LLC, Mizuho Corporation (Mizuho OSI), Steris plc, B. Braun Melsungen AG (Aesculap), Alvo Medical Sp. z o.o., AMTAI Medical Equipment, Inc., Mindray Medical International Limited, Elekta AB contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar surgical tables market appears promising, driven by ongoing advancements in technology and increasing healthcare investments. As the demand for minimally invasive surgeries rises, the need for innovative surgical tables will grow. Additionally, the expansion of healthcare infrastructure, including new hospitals and surgical centers, will further enhance market opportunities. Manufacturers are likely to focus on developing ergonomic and customizable solutions to meet evolving healthcare needs, ensuring patient safety and comfort remain a priority.

| Segment | Sub-Segments |

|---|---|

| By Technology | Manual Operating Tables Electric Operating Tables Hydraulic Operating Tables Electro-hydraulic Operating Tables Hybrid / Radiolucent Operating Tables |

| By End-User Facility | Government Hospitals (HMC facilities) Private Hospitals Ambulatory Surgical Centers / Day-care Centers Specialized Clinics (orthopedic, cardiac, etc.) Others |

| By Surgical Specialty | General & Digestive Surgery Orthopedic & Trauma Surgery Neurosurgery & Spine Surgery Cardiothoracic & Vascular Surgery Obstetrics & Gynecology / Urology Others |

| By Table Top Material | Stainless Steel Carbon Fiber / Radiolucent Composites Aluminum & Other Alloys Others |

| By Installation Area | General Operating Rooms Hybrid Operating Rooms Imaging Suites (Cath Labs, Interventional Radiology) Others |

| By Price Band (CIF Qatar) | Economy Operating Tables (< USD 15,000) Mid-Range Operating Tables (USD 15,000–40,000) Premium / High-End Operating Tables (> USD 40,000) Customized Solutions |

| By Procurement Channel | Direct Tenders (MoPH / HMC) Private Hospital Tenders Local Distributors / Importers Group Purchasing / Regional Procurement |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Hospital Surgical Departments | 100 | Surgeons, Department Heads, Procurement Officers |

| Private Healthcare Facilities | 80 | Medical Directors, Operating Room Managers |

| Medical Equipment Distributors | 60 | Sales Managers, Product Specialists |

| Healthcare Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Surgeon Focus Groups | 40 | Orthopedic Surgeons, General Surgeons, Anesthesiologists |

The Qatar Surgical Tables Market is valued at approximately USD 42 million, driven by the increasing demand for advanced surgical procedures and the expansion of healthcare facilities in the region.