Region:Middle East

Author(s):Dev

Product Code:KRAA9659

Pages:92

Published On:November 2025

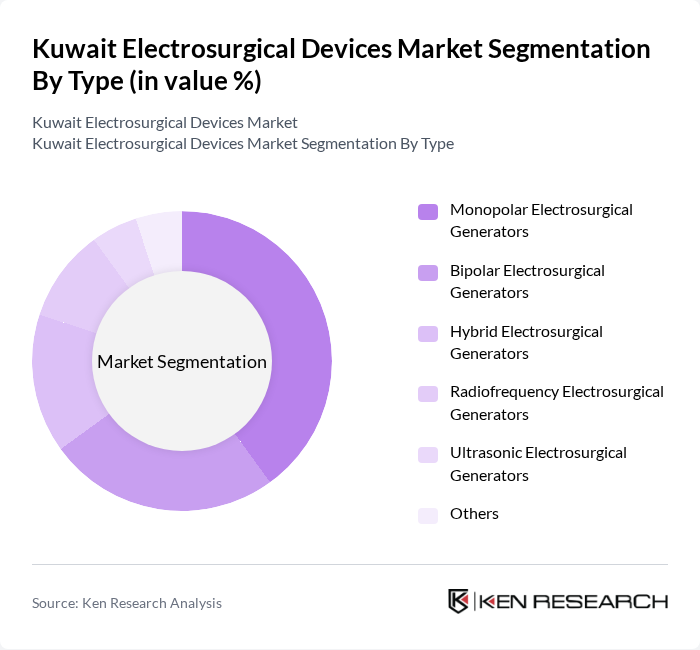

By Type:The market is segmented into various types of electrosurgical devices, including Monopolar Electrosurgical Generators, Bipolar Electrosurgical Generators, Hybrid Electrosurgical Generators, Radiofrequency Electrosurgical Generators, Ultrasonic Electrosurgical Generators, and Others. Among these, Monopolar Electrosurgical Generators are the most widely used due to their versatility and effectiveness in a range of surgical procedures. The increasing preference for minimally invasive surgeries has further propelled the demand for these devices, making them a dominant force in the market .

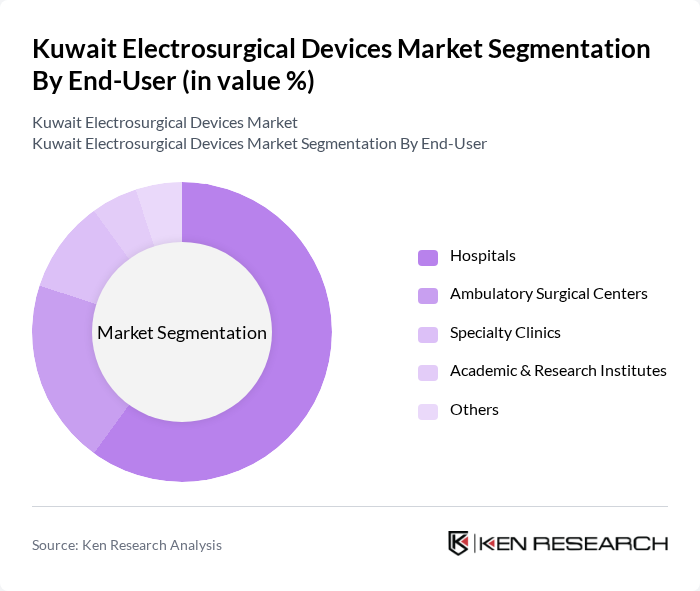

By End-User:The end-user segmentation includes Hospitals, Ambulatory Surgical Centers, Specialty Clinics, Academic & Research Institutes, and Others. Hospitals are the leading end-user segment, accounting for a significant portion of the market share. This dominance is attributed to the high volume of surgical procedures performed in hospitals, coupled with the availability of advanced surgical technologies and skilled healthcare professionals .

The Kuwait Electrosurgical Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Johnson & Johnson (Ethicon), Stryker Corporation, B. Braun Melsungen AG, Olympus Corporation, CONMED Corporation, Karl Storz SE & Co. KG, Erbe Elektromedizin GmbH, Boston Scientific Corporation, Smith & Nephew plc, Hologic, Inc., Zimmer Biomet Holdings, Inc., Apyx Medical Corporation (formerly Bovie Medical Corporation), BOWA-electronic GmbH & Co. KG, Cook Medical, Terumo Corporation, Medline Industries, LP contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electrosurgical devices market in Kuwait appears promising, driven by ongoing technological innovations and a growing emphasis on patient-centered care. As healthcare facilities continue to invest in advanced surgical technologies, the integration of artificial intelligence and robotic assistance is expected to enhance surgical precision. Additionally, the increasing focus on training programs for healthcare professionals will likely improve device utilization, ultimately leading to better patient outcomes and market expansion.

| Segment | Sub-Segments |

|---|---|

| By Type | Monopolar Electrosurgical Generators Bipolar Electrosurgical Generators Hybrid Electrosurgical Generators Radiofrequency Electrosurgical Generators Ultrasonic Electrosurgical Generators Others |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty Clinics Academic & Research Institutes Others |

| By Application | General Surgery Gynecological Surgery Urological Surgery Orthopedic Surgery Cardiovascular Surgery ENT Surgery Others |

| By Product | Electrosurgical Generators Electrosurgical Instruments Accessories Others |

| By Technology | Standard Electrosurgical Technology Advanced Electrosurgical Technology (e.g., Smart Generators, Feedback Systems) Laser Technology Ultrasonic Technology Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Tender/Procurement Others |

| By Region | Capital Governorate (Kuwait City) Hawalli Governorate Farwaniya Governorate Ahmadi Governorate Jahra Governorate Mubarak Al-Kabeer Governorate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 100 | Procurement Managers, Supply Chain Coordinators |

| Surgeons and Medical Practitioners | 80 | General Surgeons, Specialists in Electrosurgery |

| Medical Device Distributors | 60 | Sales Managers, Product Line Managers |

| Healthcare Policy Makers | 50 | Health Administrators, Regulatory Affairs Specialists |

| Clinical Research Organizations | 40 | Clinical Researchers, Data Analysts |

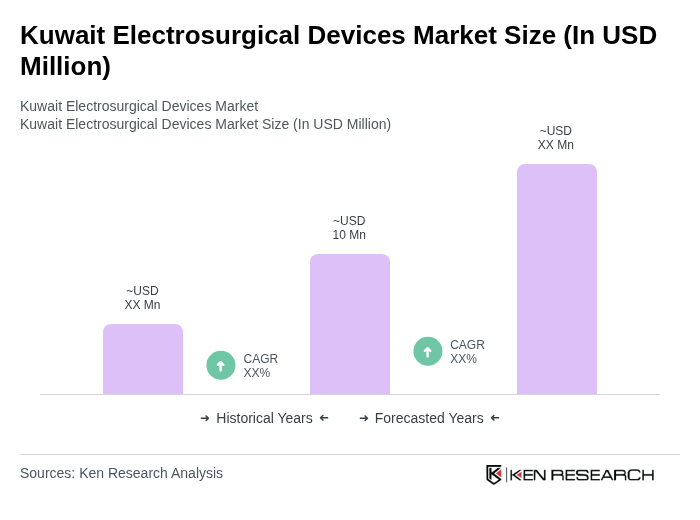

The Kuwait Electrosurgical Devices Market is valued at approximately USD 10 million, reflecting a five-year historical analysis. This growth is attributed to the rising prevalence of surgical procedures and advancements in medical technology.