Region:Asia

Author(s):Dev

Product Code:KRAA8409

Pages:89

Published On:November 2025

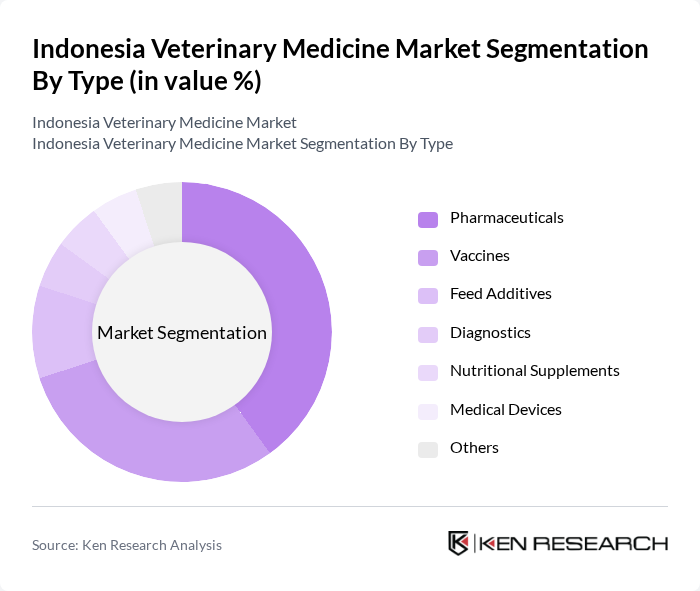

By Type:The veterinary medicine market is segmented into various types, including Pharmaceuticals, Vaccines, Feed Additives, Diagnostics, Nutritional Supplements, Medical Devices, and Others. Among these, Pharmaceuticals and Vaccines are the leading segments due to their critical role in disease prevention and treatment in both companion and production animals. The increasing prevalence of zoonotic diseases, the need for effective vaccination programs, and the growing demand for organic and antibiotic-free veterinary medicines are driving the demand for these products .

By End-User:The end-user segmentation includes Pet Owners, Livestock Farmers, Veterinary Hospitals and Clinics, Animal Farms, Research Institutions, and Others. Pet Owners and Livestock Farmers are the primary consumers of veterinary products, driven by the increasing trend of pet adoption, the need for livestock health management, and the expansion of animal health services. The growing awareness of animal welfare and health among these groups is significantly influencing market dynamics .

The Indonesia Veterinary Medicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Vaksindo Satwa Nusantara, PT. Medion Farma Jaya, PT. Indofarma Tbk, PT. Kimia Farma Tbk, PT. Sido Muncul Tbk, PT. Cargill Indonesia, PT. Japfa Comfeed Indonesia Tbk, PT. Charoen Pokphand Indonesia Tbk, PT. Sanbe Farma, PT. Elanco Animal Health Indonesia, PT. Zoetis Animal Health Indonesia, PT. Sierad Produce Tbk, PT. Phapros Tbk, PT. Sierad Labora, PT. Sumber Alam Satwa contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Indonesian veterinary medicine market appears promising, driven by increasing awareness of animal health and welfare. The integration of technology in veterinary practices is expected to enhance service delivery, while government initiatives will likely support the sector's growth. Additionally, the rising trend of preventive healthcare will encourage pet and livestock owners to invest in regular veterinary services, fostering a more robust market environment. Overall, these factors will contribute to a more sustainable veterinary landscape in Indonesia.

| Segment | Sub-Segments |

|---|---|

| By Type | Pharmaceuticals Vaccines Feed Additives Diagnostics Nutritional Supplements Medical Devices Others |

| By End-User | Pet Owners Livestock Farmers Veterinary Hospitals and Clinics Animal Farms Research Institutions Others |

| By Animal Type | Companion Animals Production Animals Aquatic Animals Others |

| By Distribution Channel | Retail Sales (including pharmacies and veterinary clinics) Online Retail Direct Tender Distributors Others |

| By Region | Java Sumatra Kalimantan Sulawesi Others |

| By Product Formulation | Injectable Oral Topical Others |

| By Application | Bacterial Diseases Foot and Mouth Disease Animal Cancer Bluetongue Autoimmune Diseases Helminthic Infection Canine Atopic Dermatitis Others |

| By Policy Support | Subsidies for veterinary services Tax incentives for veterinary product manufacturers Grants for veterinary research Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 100 | Veterinarians, Clinic Managers |

| Pharmaceutical Distributors | 60 | Sales Managers, Distribution Heads |

| Livestock Farmers | 90 | Farm Owners, Livestock Managers |

| Animal Health Product Manufacturers | 40 | Product Development Managers, Marketing Directors |

| Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Specialists |

The Indonesia Veterinary Medicine Market is valued at approximately USD 330 million, reflecting significant growth driven by increasing pet ownership, livestock production, and heightened awareness of animal health among consumers.