Region:Middle East

Author(s):Shubham

Product Code:KRAD5489

Pages:100

Published On:December 2025

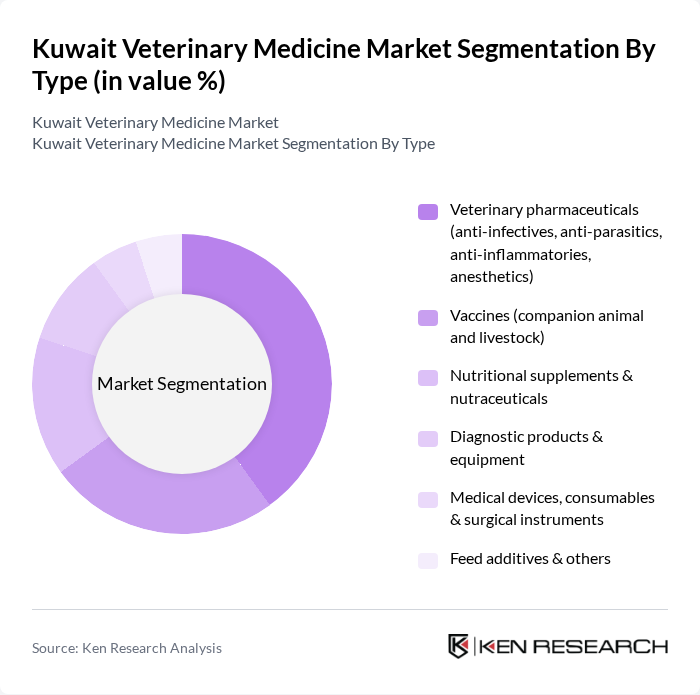

By Type:The market is segmented into various types, including veterinary pharmaceuticals, vaccines, nutritional supplements, diagnostic products, medical devices, and feed additives. Among these, veterinary pharmaceuticals, particularly anti-infectives and anti-parasitics, dominate the market due to their essential role in treating common animal diseases and supporting herd health in livestock. The increasing prevalence of zoonotic diseases, the need for routine vaccination and deworming, and the rising awareness of preventive animal health are driving the demand for these products, alongside a growing uptake of vaccines, diagnostics, and nutraceuticals for companion animals.

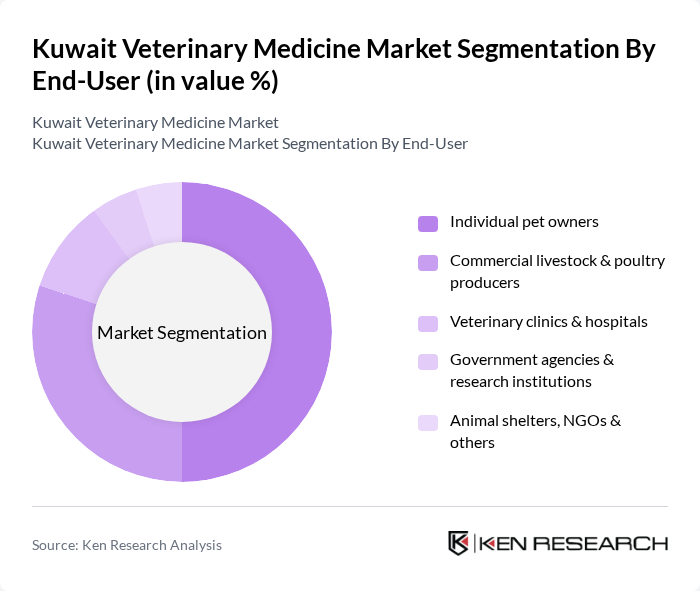

By End-User:The end-user segmentation includes individual pet owners, commercial livestock and poultry producers, veterinary clinics and hospitals, government agencies, and animal shelters. Individual pet owners represent the largest segment, driven by the increasing trend of pet adoption in the Capital and Hawalli governorates and the growing willingness to spend on pet healthcare, wellness, and premium services. This segment's growth is further supported by the rising awareness of preventive care, such as regular check-ups, vaccination, deworming, dental care, and the use of nutritional supplements and alternative therapies among pet owners.

The Kuwait Veterinary Medicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Veterinary Clinic, Al-Bahar Veterinary Services, PetCare Veterinary Clinic, Animal Care Veterinary Clinic, Kuwait Animal Hospital, Al-Mubarak Veterinary Clinic, Vet4Pets Kuwait, Al-Salam Veterinary Clinic, Pet Health Veterinary Clinic, Kuwait Animal Health Center, Al-Jahra Veterinary Clinic, The Pet Clinic Kuwait, Veterinary Care Center Kuwait, Al-Farabi Veterinary Clinic, Pet Wellness Center Kuwait contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait veterinary medicine market appears promising, driven by increasing pet ownership and a growing emphasis on animal health. As the market evolves, the integration of technology and telemedicine is expected to enhance service delivery, making veterinary care more accessible. Additionally, the rising trend of preventive care will likely lead to increased demand for regular check-ups and vaccinations, fostering a healthier pet population and stimulating market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Veterinary pharmaceuticals (anti-infectives, anti-parasitics, anti-inflammatories, anesthetics) Vaccines (companion animal and livestock) Nutritional supplements & nutraceuticals Diagnostic products & equipment Medical devices, consumables & surgical instruments Feed additives & others |

| By End-User | Individual pet owners Commercial livestock & poultry producers Veterinary clinics & hospitals Government agencies & research institutions Animal shelters, NGOs & others |

| By Animal Type | Companion animals (dogs, cats, small mammals) Livestock (cattle, sheep, goats, poultry) Equine Exotic and other animals |

| By Distribution Channel | Veterinary hospitals & clinics Community and retail pharmacies Online pharmacies & e-commerce Distributors & direct sales Others |

| By Service Type | Preventive care (vaccination, deworming, wellness) Emergency & critical care Surgical services Diagnostic & laboratory services Telemedicine & digital health services Others |

| By Region | Capital Governorate Hawalli Governorate Al Ahmadi Governorate Farwaniya Governorate Mubarak Al-Kabeer Governorate Al Jahra Governorate Others |

| By Policy Support | Subsidies for livestock health & vaccination programs Tax incentives for veterinary facilities & imports of medicines Government tenders & grants for animal health research Regulatory fast-tracking & other incentives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 100 | Veterinarians, Clinic Managers |

| Pet Owners | 120 | Pet Owners, Animal Caretakers |

| Veterinary Pharmaceutical Distributors | 60 | Sales Managers, Product Managers |

| Livestock Health Management | 70 | Farm Owners, Livestock Veterinarians |

| Animal Welfare Organizations | 40 | Program Directors, Outreach Coordinators |

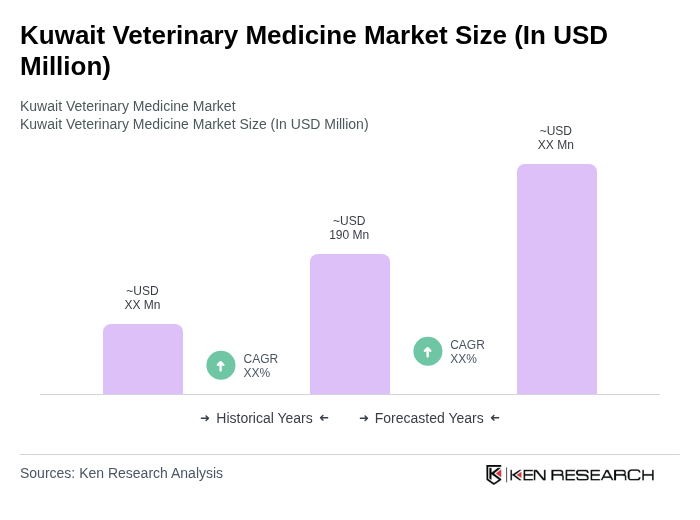

The Kuwait Veterinary Medicine Market is valued at approximately USD 190 million, reflecting a significant growth driven by increasing pet ownership, rising awareness of animal health, and the demand for veterinary services and products.