Region:Middle East

Author(s):Dev

Product Code:KRAD1711

Pages:86

Published On:November 2025

By Type:The market is segmented into various types, including Pharmaceuticals, Biologics (Vaccines, Immunomodulators), Medicated Feed Additives, Diagnostics, Nutraceuticals, Surgical Instruments, and Others. Among these, Pharmaceuticals remain the leading segment, accounting for the largest share due to their critical role in disease prevention and treatment for both companion and production animals. Biologics, particularly vaccines, are rapidly growing, driven by the increasing prevalence of zoonotic diseases and the need for effective vaccination programs .

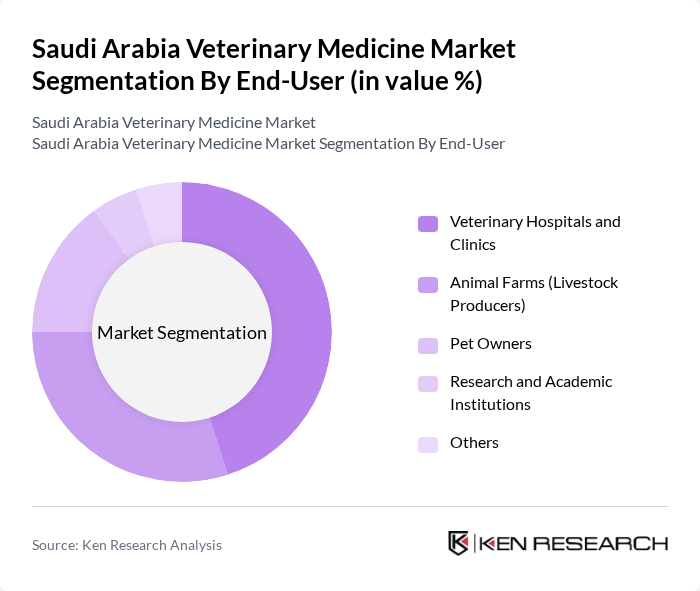

By End-User:The end-user segmentation includes Veterinary Hospitals and Clinics, Animal Farms (Livestock Producers), Pet Owners, Research and Academic Institutions, and Others. Veterinary Hospitals and Clinics are the dominant segment, driven by the increasing number of pet owners and the growing demand for specialized veterinary services. The rise in livestock farming also contributes to the demand from animal farms, as producers seek to maintain the health and productivity of their animals .

The Saudi Arabia Veterinary Medicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Inc., Merck Animal Health, Elanco Animal Health, Boehringer Ingelheim Animal Health, Ceva Santé Animale, Vetoquinol, Virbac, IDEXX Laboratories, Neogen Corporation, Phibro Animal Health Corporation, Alltech, Vetanco, Arasco (Al-Watania Agriculture/Al-Emar International), Al-Takamul Veterinary Company, Almarai Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the veterinary medicine market in Saudi Arabia appears promising, driven by increasing pet ownership and a growing emphasis on animal welfare. The integration of technology in veterinary practices is expected to enhance service delivery, while government initiatives will likely support the sector's growth. As the market evolves, a focus on preventive care and the expansion of telemedicine will play crucial roles in addressing existing challenges and meeting the rising demand for veterinary services.

| Segment | Sub-Segments |

|---|---|

| By Type | Pharmaceuticals Biologics (Vaccines, Immunomodulators) Medicated Feed Additives Diagnostics Nutraceuticals Surgical Instruments Others |

| By End-User | Veterinary Hospitals and Clinics Animal Farms (Livestock Producers) Pet Owners Research and Academic Institutions Others |

| By Animal Type | Companion Animals (Dogs, Cats, Birds, etc.) Production Animals (Cattle, Sheep, Goats, Poultry, Camels, etc.) Others (Exotic, Wildlife) |

| By Distribution Channel | Veterinary Hospitals/Pharmacies Retail Veterinary Pharmacies Online Pharmacies Distributors/Wholesalers Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Service Type | Preventive Care Emergency Care Surgical Services Diagnostic Services Others |

| By Product Formulation | Injectable Oral Topical Auricular, Ophthalmic, and Nasal Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 80 | Veterinarians, Clinic Managers |

| Animal Health Product Distributors | 50 | Sales Managers, Distribution Coordinators |

| Pet Owners | 120 | Pet Owners, Animal Caretakers |

| Livestock Farmers | 60 | Farm Owners, Animal Husbandry Managers |

| Veterinary Pharmaceutical Manufacturers | 40 | Product Development Managers, Regulatory Affairs Specialists |

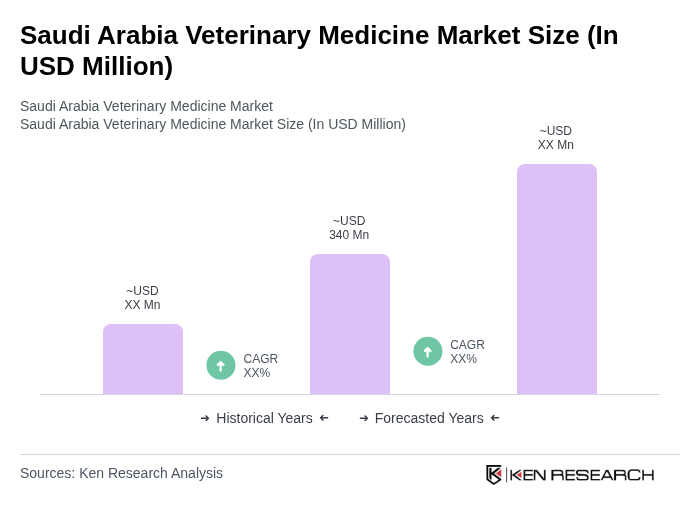

The Saudi Arabia Veterinary Medicine Market is valued at approximately USD 340 million, reflecting significant growth driven by increasing pet ownership, awareness of animal health, and livestock farming expansion.