Region:North America

Author(s):Rebecca

Product Code:KRAC8459

Pages:94

Published On:November 2025

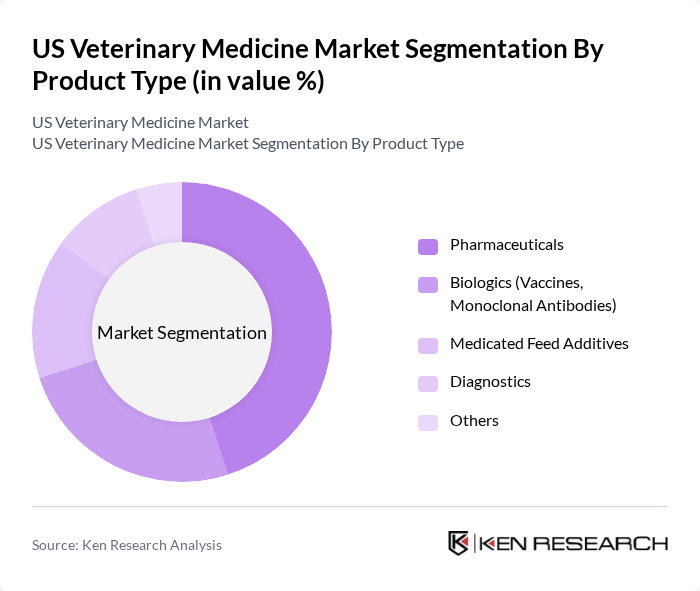

By Product Type:The product type segmentation includes Pharmaceuticals, Biologics (Vaccines, Monoclonal Antibodies), Medicated Feed Additives, Diagnostics, and Others. Pharmaceuticals remain the leading subsegment, driven by the increasing prevalence of chronic diseases in pets and livestock, alongside a growing demand for preventive care solutions. Biologics, particularly vaccines, are gaining traction due to heightened awareness of zoonotic diseases and the importance of vaccination in animal health. The diagnostics segment is expanding, supported by advancements in digital diagnostic tools and rapid disease detection technologies .

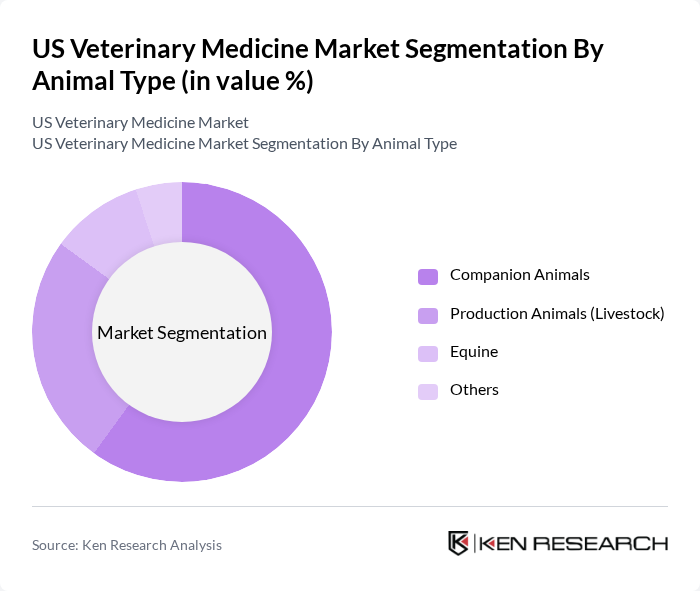

By Animal Type:The animal type segmentation includes Companion Animals, Production Animals (Livestock), Equine, and Others. Companion animals dominate the market, driven by the increasing trend of pet humanization and the willingness of pet owners to spend on high-quality veterinary care. The production animals segment is also significant, as livestock health is crucial for food security and agricultural productivity. The equine segment, while smaller, is growing due to the rising interest in equestrian sports and horse ownership. The continued rise in pet adoption and the expansion of pet insurance coverage are further supporting the companion animal segment .

The US Veterinary Medicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Inc., Merck Animal Health, Elanco Animal Health, Bayer Animal Health, Boehringer Ingelheim Animal Health, Ceva Santé Animale, IDEXX Laboratories, Vetoquinol, Neogen Corporation, Virbac Corporation, PetIQ, Covetrus, Animal Health International, Kemin Industries, Phibro Animal Health contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. veterinary medicine market appears promising, driven by ongoing trends in pet ownership and technological advancements. As pet humanization continues to rise, owners are increasingly willing to invest in high-quality veterinary care. Additionally, the integration of telemedicine and digital health solutions is expected to enhance service delivery. These trends will likely foster a more proactive approach to animal health, ensuring that veterinary services remain essential in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Pharmaceuticals Biologics (Vaccines, Monoclonal Antibodies) Medicated Feed Additives Diagnostics Others |

| By Animal Type | Companion Animals Production Animals (Livestock) Equine Others |

| By Route of Administration | Oral Parenteral (Injectable) Topical Others |

| By Distribution Channel | Veterinary Hospitals & Clinics Online Pharmacies Retail Pharmacies Direct Sales Others |

| By Geography | Northeast Midwest South West |

| By Service Type | Preventive Care Surgical Services Emergency Care Specialty Services Others |

| By Product Category | Prescription Products Over-the-Counter Products Specialty Products Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 100 | Veterinarians, Clinic Managers |

| Pet Owners | 150 | Dog and Cat Owners, Pet Care Enthusiasts |

| Pet Insurance Providers | 70 | Insurance Underwriters, Claims Adjusters |

| Veterinary Technicians | 60 | Veterinary Technicians, Support Staff |

| Pet Supply Retailers | 40 | Store Managers, Product Buyers |

The US Veterinary Medicine Market is valued at approximately USD 8 billion, reflecting a significant growth driven by increasing pet ownership, heightened awareness of animal health, and advancements in veterinary technology.