Region:Asia

Author(s):Shubham

Product Code:KRAB3227

Pages:89

Published On:October 2025

By Type:The market is segmented into various types of plant-based products, including Plant-Based Meat Alternatives, Plant-Based Dairy Alternatives, Plant-Based Snacks, Plant-Based Beverages, Plant-Based Protein Supplements, Plant-Based Frozen Foods, and Others. Among these, Plant-Based Meat Alternatives have emerged as the leading sub-segment, driven by the increasing popularity of meat substitutes among flexitarians and vegetarians. The growing trend of health-conscious eating and the desire for sustainable food options have further propelled the demand for these products.

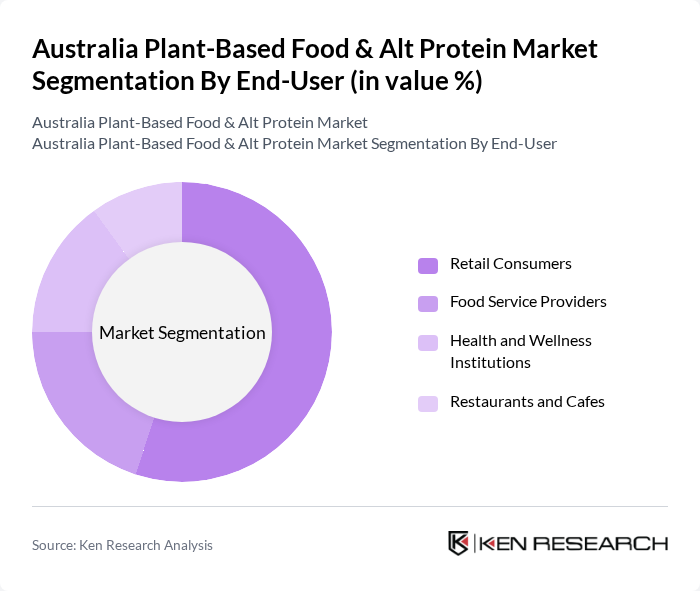

By End-User:The market is segmented by end-users into Retail Consumers, Food Service Providers, Health and Wellness Institutions, and Restaurants and Cafes. Retail Consumers represent the largest segment, driven by the increasing availability of plant-based products in supermarkets and online platforms. The growing trend of health and wellness among consumers has led to a significant shift towards plant-based diets, making this segment a key driver of market growth.

The Australia Plant-Based Food & Alt Protein Market is characterized by a dynamic mix of regional and international players. Leading participants such as Beyond Meat, Impossible Foods, Tofurky, V2food, Sunfed Foods, Plant-Based Foods Australia, The Good Crisp Company, Nourish Foods, Happy Planet Foods, Alpro, Oatly, So Delicious Dairy Free, Earth Balance, Daiya Foods, Ripple Foods contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australian plant-based food and alternative protein market appears promising, driven by evolving consumer preferences and increasing health consciousness. As more Australians adopt flexitarian diets, the demand for innovative plant-based products is expected to rise. Additionally, the expansion of e-commerce platforms will facilitate greater accessibility, allowing consumers to explore diverse options. Companies that prioritize sustainability and transparency in their offerings will likely gain a competitive edge in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Plant-Based Meat Alternatives Plant-Based Dairy Alternatives Plant-Based Snacks Plant-Based Beverages Plant-Based Protein Supplements Plant-Based Frozen Foods Others |

| By End-User | Retail Consumers Food Service Providers Health and Wellness Institutions Restaurants and Cafes |

| By Distribution Channel | Supermarkets and Hypermarkets Online Retail Specialty Stores Direct-to-Consumer Sales |

| By Price Range | Premium Products Mid-Range Products Budget Products |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging |

| By Nutritional Profile | High-Protein Products Low-Carb Products Gluten-Free Products |

| By Product Form | Ready-to-Eat Products Frozen Products Dry Products |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Plant-Based Products | 150 | Health-conscious Consumers, Flexitarians |

| Retailer Insights on Plant-Based Product Sales | 100 | Store Managers, Category Buyers |

| Food Service Industry Adoption of Alt Proteins | 80 | Restaurant Owners, Menu Developers |

| Nutritionist Perspectives on Plant-Based Diets | 60 | Registered Dietitians, Nutrition Consultants |

| Market Trends in Plant-Based Snacks | 70 | Product Managers, Marketing Executives |

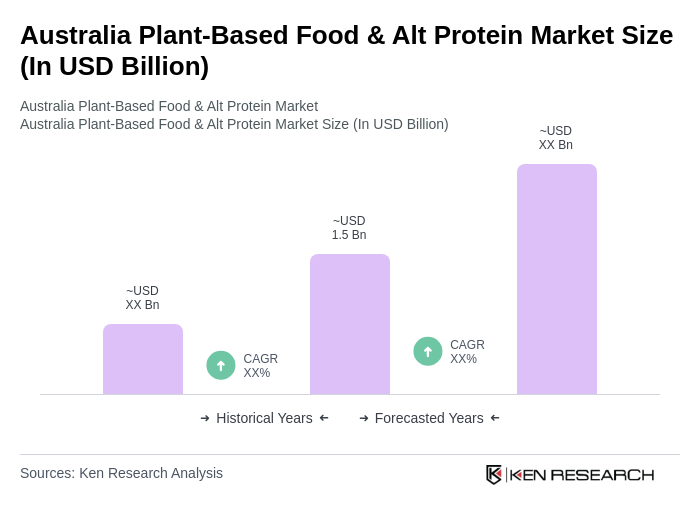

The Australia Plant-Based Food & Alt Protein Market is valued at approximately USD 1.5 billion, reflecting a significant growth trend driven by consumer demand for healthier and sustainable food options, as well as increased awareness of the environmental impacts of animal agriculture.