Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA4536

Pages:92

Published On:September 2025

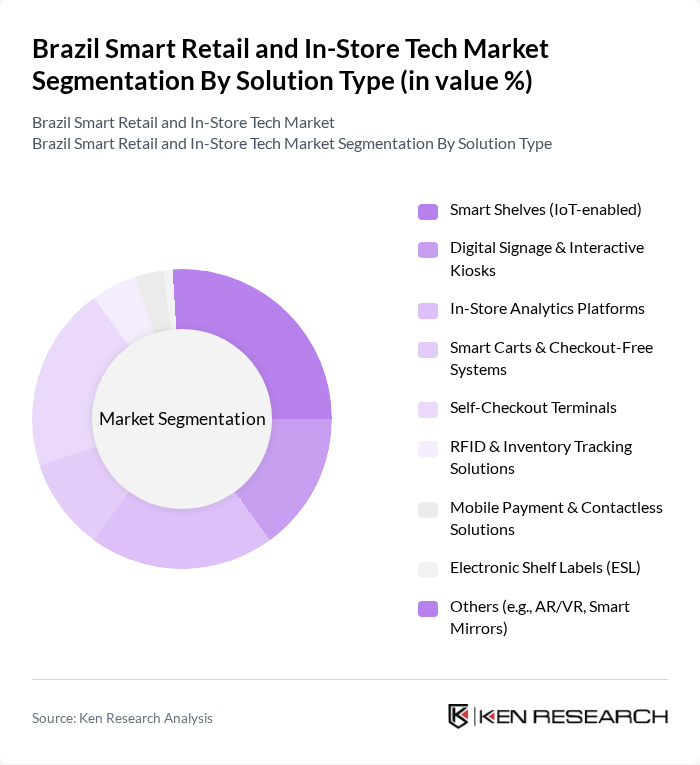

By Solution Type:The solution type segmentation includes a range of technologies that elevate the retail experience. Among these, Smart Shelves (IoT-enabled) and Self-Checkout Terminals are leading the market due to their ability to automate operations and improve customer satisfaction. Smart Shelves provide real-time inventory data and reduce stockouts, while Self-Checkout Terminals minimize wait times, addressing the growing demand for convenience and operational efficiency. Digital signage, interactive kiosks, and mobile payment solutions are also gaining traction as retailers pursue omnichannel strategies and seamless in-store experiences .

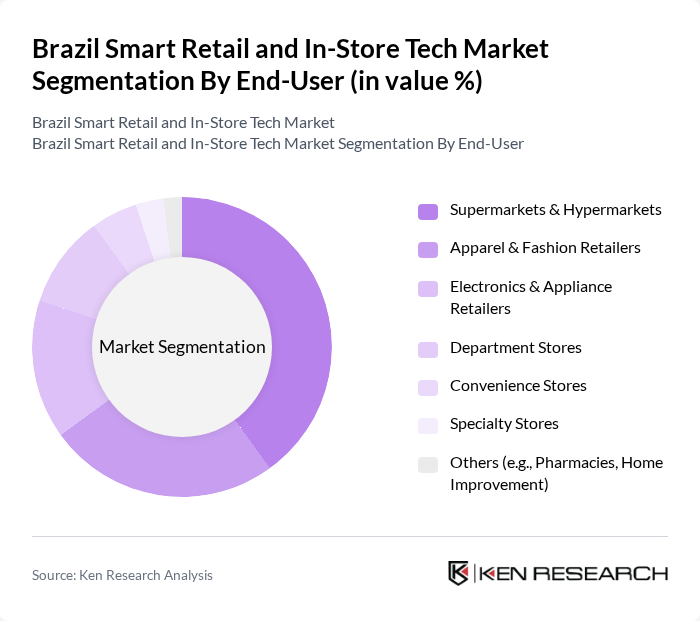

By End-User:The end-user segmentation highlights the diverse retail sectors adopting smart technologies. Supermarkets & Hypermarkets and Apparel & Fashion Retailers are the dominant segments, driven by their requirements for efficient inventory management and enhanced customer engagement. Supermarkets leverage in-store analytics and self-checkout systems to boost operational efficiency, while fashion retailers use digital signage and interactive solutions to attract customers and enrich the shopping experience. Electronics, department, and specialty stores are also increasing adoption of smart tech to remain competitive in a rapidly evolving retail landscape .

The Brazil Smart Retail and In-Store Tech Market is characterized by a dynamic mix of regional and international players. Leading participants such as Magazine Luiza, Via (Via Varejo S.A.), Carrefour Brasil, Grupo Pão de Açúcar (GPA), Lojas Americanas S.A., Americanas S.A. (formerly B2W Digital), Mercado Livre, Amazon Brasil, Cnova Brasil, TOTVS S.A., Linx S.A., Grupo SBF (Centauro), Riachuelo (Guararapes Confecções S.A.), Lojas Renner S.A., C&A Modas S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's smart retail and in-store tech market appears promising, driven by ongoing technological innovations and evolving consumer preferences. As retailers increasingly adopt AI and machine learning, operational efficiencies will improve, leading to enhanced customer experiences. Additionally, the integration of sustainable practices will likely become a focal point, aligning with global trends. The market is expected to witness significant growth as businesses adapt to these changes, positioning themselves competitively in a rapidly evolving retail landscape.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Smart Shelves (IoT-enabled) Digital Signage & Interactive Kiosks In-Store Analytics Platforms Smart Carts & Checkout-Free Systems Self-Checkout Terminals RFID & Inventory Tracking Solutions Mobile Payment & Contactless Solutions Electronic Shelf Labels (ESL) Others (e.g., AR/VR, Smart Mirrors) |

| By End-User | Supermarkets & Hypermarkets Apparel & Fashion Retailers Electronics & Appliance Retailers Department Stores Convenience Stores Specialty Stores Others (e.g., Pharmacies, Home Improvement) |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Omnichannel/Hybrid Models Others |

| By Distribution Mode | Direct Sales Distributors/VARs Retail Partnerships System Integrators Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Application | Inventory & Supply Chain Management Customer Engagement & Personalization Sales Optimization & Conversion Loss Prevention & Security Energy & Resource Management Others |

| By Market Segment | Large Enterprises Small & Medium Enterprises (SMEs) Startups Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Checkout Solutions | 60 | Store Managers, IT Managers |

| In-Store Analytics Tools | 50 | Data Analysts, Marketing Managers |

| Customer Engagement Technologies | 45 | Customer Experience Managers, Retail Executives |

| Inventory Management Systems | 55 | Supply Chain Managers, Operations Managers |

| Mobile Payment Solutions | 40 | Finance Managers, Technology Managers |

The Brazil Smart Retail and In-Store Tech Market is valued at approximately USD 4.8 billion, driven by the adoption of advanced technologies like IoT, AI, and big data analytics, which enhance customer experience and operational efficiency.