Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA0318

Pages:89

Published On:August 2025

By Type:The transportation market in Brazil is segmented into road transportation, rail transportation, air transportation, maritime transportation, public transport, freight transportation, and emerging segments such as ride-hailing and micro-mobility. Road transportation remains the backbone of the sector, supporting both passenger and freight movement, while rail and maritime play vital roles in bulk cargo and long-distance logistics. Air transportation is critical for high-value and time-sensitive goods, and public transport is essential for urban mobility. The rise of ride-hailing and micro-mobility reflects changing consumer preferences and urbanization trends .

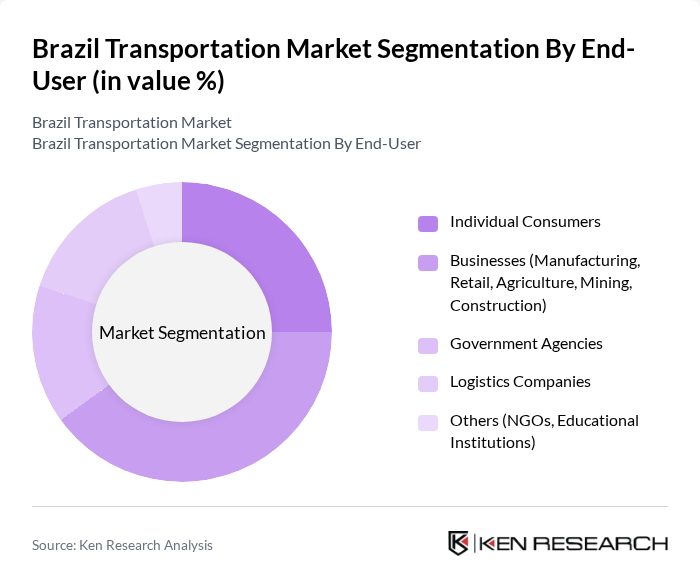

By End-User:The end-user segmentation of the transportation market includes individual consumers, businesses (such as manufacturing, retail, agriculture, mining, and construction), government agencies, logistics companies, and others. Each segment has distinct requirements: individual consumers focus on urban mobility and convenience, businesses demand efficient freight and supply chain services, government agencies prioritize public infrastructure and regulation, and logistics companies drive innovation and network optimization .

The Brazil Transportation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo CCR, Rumo Logística, ViaQuatro, Movida, Localiza, Azul Linhas Aéreas, Gol Linhas Aéreas, JSL S.A., Transpetro, Metrô Rio, Viação Itapemirim, Expresso São Miguel, Buser, Uber Brasil, 99 (Nine Nine), RTE Rodonaves, DHL Group (Brazil), A.P. Moller-Maersk (Brazil), VLI Logística, MRS Logística contribute to innovation, geographic expansion, and service delivery in this space.

The Brazilian transportation market is poised for significant transformation driven by technological advancements and evolving consumer preferences. The integration of smart transportation solutions, such as AI and IoT, is expected to enhance operational efficiency and reduce costs. Additionally, the increasing focus on sustainability will likely lead to greater investments in electric vehicles and green logistics. As urbanization continues, the demand for innovative public transportation systems will rise, creating a dynamic environment for growth and development in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Transportation (Long Haul, Short Haul, FTL, LTL) Rail Transportation (Freight Rail, Passenger Rail) Air Transportation (Domestic, International, Cargo, Passenger) Maritime Transportation (Port-to-Port, Coastal Shipping, Inland Waterways) Public Transport (Urban Buses, Metro/Subway, Commuter Rail) Freight Transportation (Solid Goods, Liquid Goods, Temperature-Controlled, Containerized Freight) Others (Ride-hailing, Micro-mobility, Specialized Logistics) |

| By End-User | Individual Consumers Businesses (Manufacturing, Retail, Agriculture, Mining, Construction) Government Agencies Logistics Companies Others (NGOs, Educational Institutions) |

| By Region | Southeast Brazil South Brazil North Brazil Central-West Brazil |

| By Application | Passenger Transport Cargo Transport Logistics and Supply Chain Public Transport Services Others (Emergency Services, Tourism) |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Others |

| By Policy Support | Subsidies for Public Transport Tax Incentives for Electric Vehicles Grants for Infrastructure Development Others |

| By Technology | Intelligent Transportation Systems (ITS) Autonomous Vehicles Electric and Hybrid Vehicles Mobility as a Service (MaaS) Advanced Fleet Management Solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Transportation Systems | 100 | Transit Authority Officials, Operations Managers |

| Freight and Logistics Services | 120 | Logistics Coordinators, Supply Chain Managers |

| Infrastructure Development Projects | 80 | Project Managers, Civil Engineers |

| Urban Mobility Solutions | 70 | Urban Planners, Transportation Analysts |

| Maritime Transportation Sector | 60 | Port Authorities, Shipping Company Executives |

The Brazil Transportation Market is valued at approximately USD 88 billion, driven by urbanization, infrastructure investments, and the demand for efficient logistics and freight solutions. This valuation reflects a five-year historical analysis of the market's growth.