Region:Africa

Author(s):Geetanshi

Product Code:KRAA4792

Pages:94

Published On:September 2025

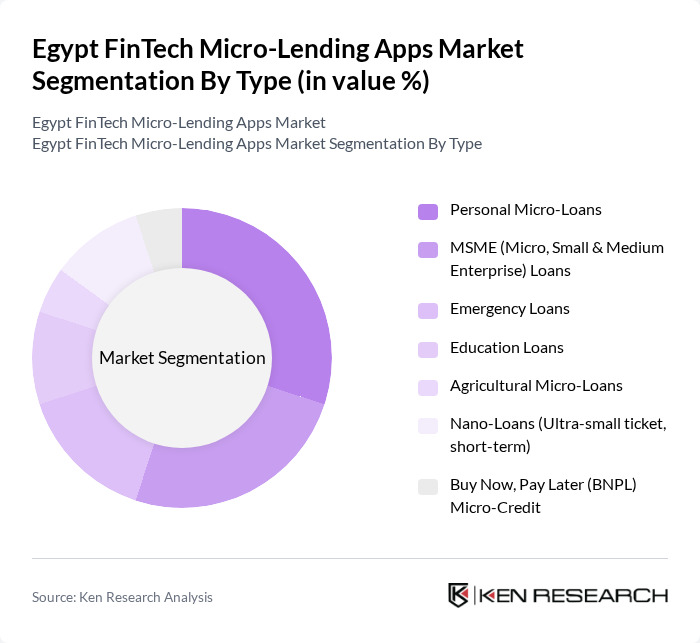

By Type:The market is segmented into various types of micro-lending products, including Personal Micro-Loans, MSME Loans, Emergency Loans, Education Loans, Agricultural Micro-Loans, Nano-Loans, and Buy Now, Pay Later (BNPL) Micro-Credit. Each of these sub-segments addresses distinct consumer needs and financial situations.Personal Micro-LoansandMSME Loansare particularly popular, driven by the need for flexible, rapid financing among individuals and small businesses.Emergency LoansandEducation Loansare gaining traction as digital platforms expand their offerings to underserved segments, whileBNPLandNano-Loansare emerging as innovative solutions for ultra-short-term and small-ticket needs .

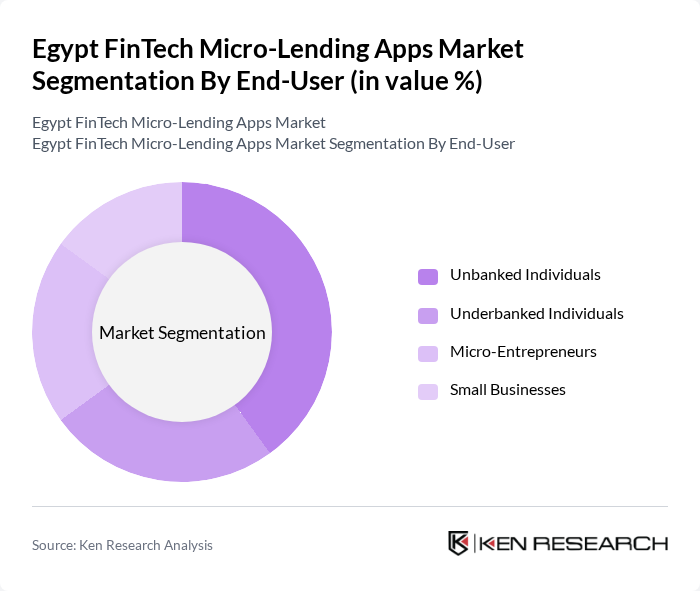

By End-User:The end-user segmentation includes Unbanked Individuals, Underbanked Individuals, Micro-Entrepreneurs, and Small Businesses. Theunbankedandunderbankedsegments are especially significant, representing a substantial portion of Egypt’s population that lacks access to traditional banking services.Micro-EntrepreneursandSmall Businessesare also key drivers of demand, seeking alternative funding sources to support operational growth and resilience in a challenging economic environment .

The Egypt FinTech Micro-Lending Apps Market is characterized by a dynamic mix of regional and international players. Leading participants such as MNT-Halan, Fawry Microfinance, Tamweely Microfinance, Aman for Financial Services, Kashat, ValU, Bee Smart Payment Solutions, MoneyFellows, Lucky Egypt, Yomken.com, EFG Hermes Corp-Solutions, Banque Misr, National Bank of Egypt (NBE) Microfinance, Qard Hassan Foundation, Al Baraka Bank Egypt contribute to innovation, geographic expansion, and service delivery in this space.

The future of Egypt's micro-lending apps market appears promising, driven by technological advancements and increasing consumer demand for accessible financial services. As smartphone penetration continues to rise, more users will likely turn to digital platforms for their lending needs. Additionally, the integration of artificial intelligence in credit scoring and risk assessment will enhance lending efficiency. These trends, combined with supportive government initiatives, are expected to foster a more robust micro-lending ecosystem, ultimately benefiting both lenders and borrowers.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Micro-Loans MSME (Micro, Small & Medium Enterprise) Loans Emergency Loans Education Loans Agricultural Micro-Loans Nano-Loans (Ultra-small ticket, short-term) Buy Now, Pay Later (BNPL) Micro-Credit |

| By End-User | Unbanked Individuals Underbanked Individuals Micro-Entrepreneurs Small Businesses |

| By Application | Working Capital Financing Consumer Purchases Emergency Medical Funding Education & Tuition Financing |

| By Distribution Channel | Mobile Apps Web Portals Agent Networks |

| By Customer Segment | Low-Income Individuals Women Entrepreneurs Youth/Young Adults Rural Households |

| By Loan Amount | Nano-Loans (up to EGP 1,000) Micro-Loans (EGP 1,001 - EGP 10,000) Small Loans (EGP 10,001 - EGP 50,000) |

| By Repayment Period | Ultra Short-Term (up to 1 month) Short-Term (1-6 months) Medium-Term (6-12 months) Long-Term (over 1 year) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Micro-lending App Users | 100 | Current Users, Recent Borrowers |

| FinTech Industry Experts | 40 | FinTech Analysts, Regulatory Officials |

| Potential Borrowers | 100 | Individuals Aged 18-45, Low to Middle Income |

| Micro-lending App Developers | 40 | Product Managers, Software Engineers |

| Financial Institutions | 40 | Banking Executives, Credit Analysts |

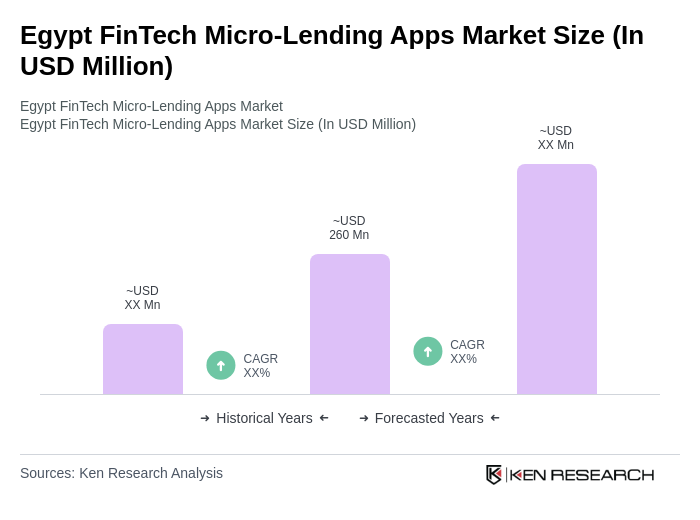

The Egypt FinTech Micro-Lending Apps Market is valued at approximately USD 260 million, reflecting a significant growth driven by the increasing demand for accessible credit solutions among unbanked and underbanked populations, as well as the rapid adoption of mobile technology.