Region:Middle East

Author(s):Dev

Product Code:KRAC1236

Pages:84

Published On:October 2025

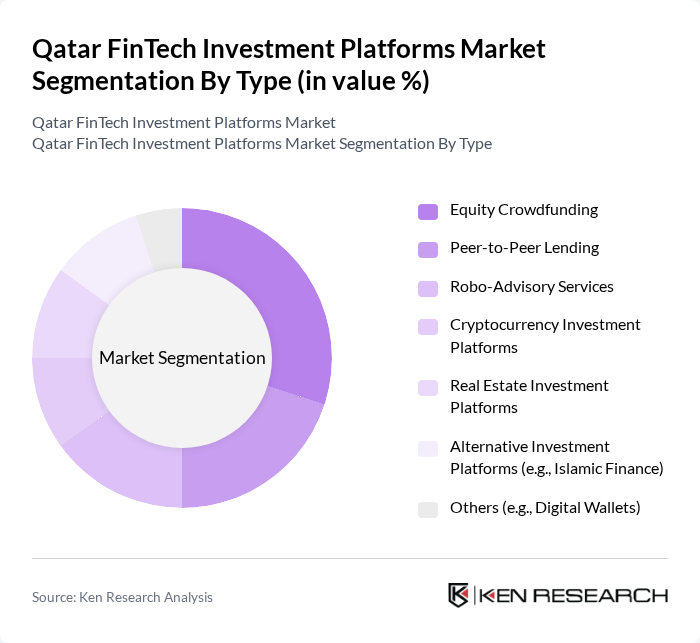

By Type:The market is segmented into Equity Crowdfunding, Peer-to-Peer Lending, Robo-Advisory Services, Cryptocurrency Investment Platforms, Real Estate Investment Platforms, Alternative Investment Platforms (such as Islamic Finance), and Others (including Digital Wallets). Equity Crowdfunding has emerged as a leading segment, driven by its ability to democratize investment opportunities and attract a diverse investor base. The increasing number of startups seeking alternative funding sources and the rise of digital platforms have accelerated growth in this segment. Peer-to-Peer Lending and Robo-Advisory Services are also gaining traction, supported by growing consumer demand for accessible and automated investment solutions.

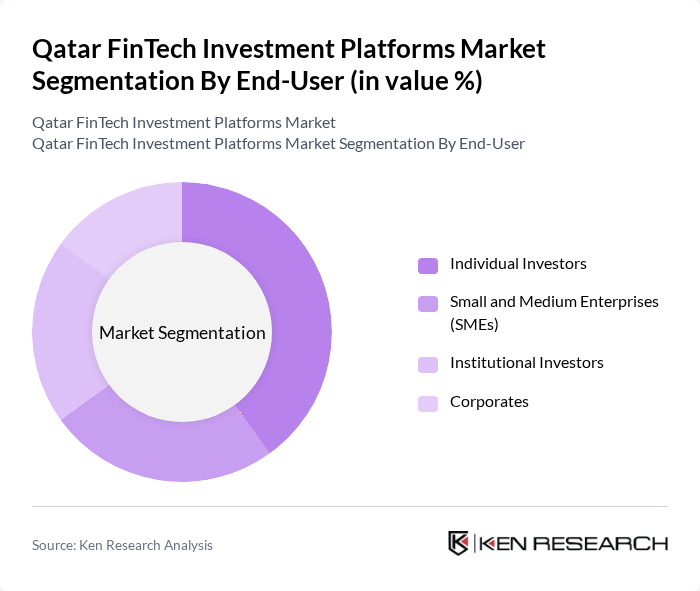

By End-User:End-user segmentation includes Individual Investors, Small and Medium Enterprises (SMEs), Institutional Investors, and Corporates. Individual Investors are the dominant segment, driven by the increasing accessibility of investment platforms and a heightened interest in personal finance management. The proliferation of mobile applications and user-friendly digital interfaces has made investment activities more convenient for individuals, supporting segment growth. SMEs and Institutional Investors are also expanding their use of fintech platforms for portfolio diversification and efficient capital management.

The Qatar FinTech Investment Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as QInvest, Qatar Islamic Bank, Doha Bank, Qatar National Bank, Al Rayan Investment, Dlala Brokerage, QNB Capital, Investment House, Qatar Financial Centre, FinTech Qatar, MenaPay, Beehive, Rain, Sarwa, Ethis, SkipCash, CWallet, and Karty contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar FinTech investment platforms market appears promising, driven by ongoing digital transformation and government initiatives. As consumer preferences shift towards digital solutions, platforms that prioritize user experience and security will likely thrive. Additionally, the integration of advanced technologies such as artificial intelligence and blockchain is expected to enhance service offerings, making them more attractive to investors. The collaboration between FinTech firms and traditional banks will further solidify the market's growth trajectory, fostering innovation and expanding service accessibility.

| Segment | Sub-Segments |

|---|---|

| By Type | Equity Crowdfunding Peer-to-Peer Lending Robo-Advisory Services Cryptocurrency Investment Platforms Real Estate Investment Platforms Alternative Investment Platforms (e.g., Islamic Finance) Others (e.g., Digital Wallets) |

| By End-User | Individual Investors Small and Medium Enterprises (SMEs) Institutional Investors Corporates |

| By Investment Source | Domestic Investors Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Application | Wealth Management Retirement Planning Tax Optimization Portfolio Diversification |

| By User Demographics | Age Group (18-24, 25-34, 35-44, 45+) Income Level (Low, Middle, High) Investment Experience (Novice, Intermediate, Expert) |

| By Regulatory Compliance Level | Fully Compliant Platforms Partially Compliant Platforms Non-Compliant Platforms |

| By Technology Utilization | Blockchain-Based Platforms AI-Driven Platforms Traditional Platforms Others (e.g., Cloud Computing) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Investment Platforms Overview | 100 | Platform Founders, CEOs, CTOs |

| Venture Capital Insights | 70 | Venture Capitalists, Investment Analysts |

| Regulatory Impact Assessment | 50 | Regulatory Officials, Compliance Officers |

| Consumer Behavior in FinTech | 90 | End-users, Financial Advisors |

| Market Trends and Innovations | 60 | Industry Analysts, Market Researchers |

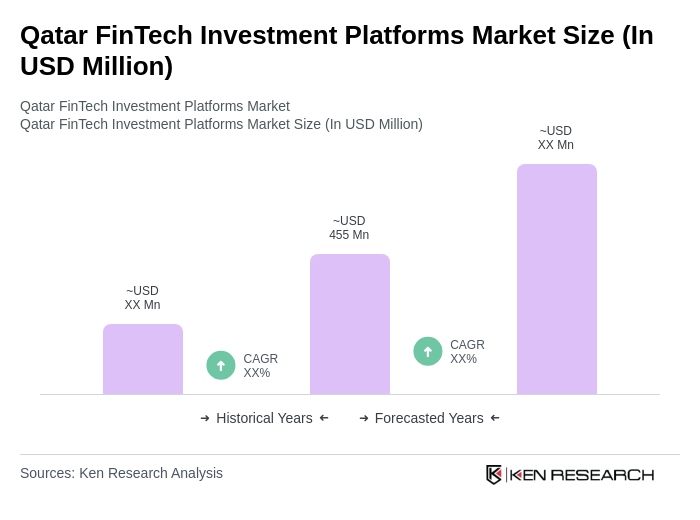

The Qatar FinTech Investment Platforms Market is valued at approximately USD 455 million, reflecting significant growth driven by the adoption of digital financial services, mobile banking, and alternative investment options among consumers.