Region:Global

Author(s):Dev

Product Code:KRAA2553

Pages:82

Published On:August 2025

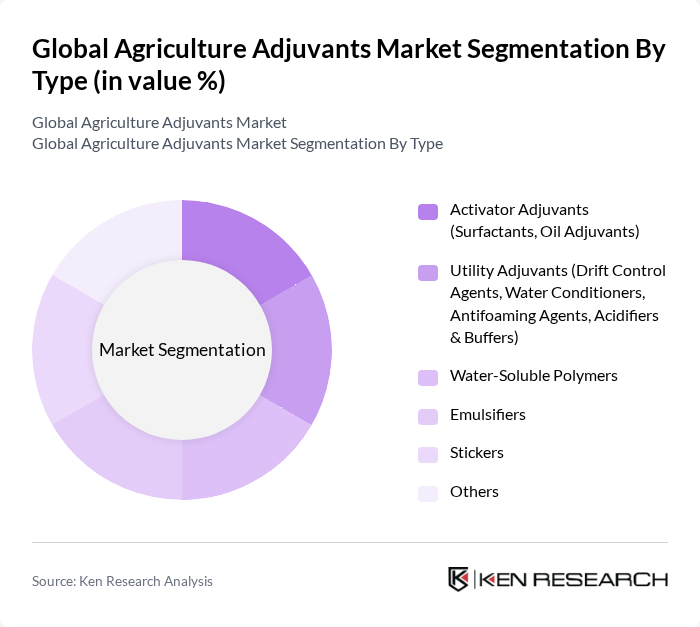

By Type:The market is segmented into various types of adjuvants, including Activator Adjuvants, Utility Adjuvants, Water-Soluble Polymers, Emulsifiers, Stickers, and Others. Among these,Activator Adjuvants—which include surfactants and oil adjuvants—lead the market due to their effectiveness in enhancing the performance of pesticides and fertilizers. The increasing demand for high-efficiency agricultural inputs and the need to reduce chemical usage are key growth drivers for this segment .

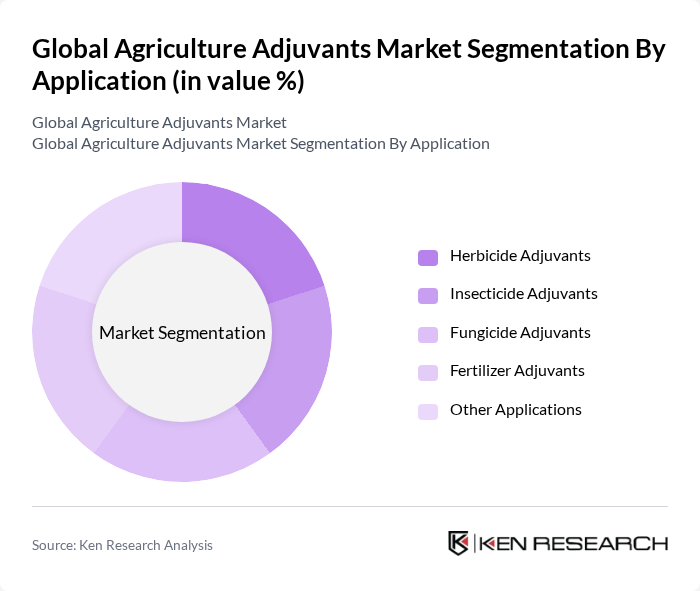

By Application:The applications of adjuvants are categorized into Herbicide Adjuvants, Insecticide Adjuvants, Fungicide Adjuvants, Fertilizer Adjuvants, and Other Applications.Herbicide Adjuvantsdominate the market due to the increasing need for effective weed management and the rise of herbicide-resistant weed species. The demand for specialized herbicide adjuvants that enhance efficacy is a major driver in this segment .

The Global Agriculture Adjuvants Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Corteva Agriscience, Syngenta AG, FMC Corporation, Adjuvants Plus Inc., Nufarm Limited, Croda International Plc, Helena Agri-Enterprises, LLC, Wilbur-Ellis Company LLC, Solvay S.A., Precision Laboratories, LLC, Bayer AG, UPL Limited, KALO, Inc., Evonik Industries AG contribute to innovation, geographic expansion, and service delivery in this space.

The agriculture adjuvants market is poised for significant transformation as it adapts to evolving agricultural practices and consumer preferences. The integration of digital technologies, such as AI and machine learning, is expected to enhance product development and application efficiency. Additionally, the increasing focus on sustainability will drive innovation in biodegradable adjuvants, aligning with global trends towards organic farming. As these trends continue to evolve, the market will likely see a shift towards more customized solutions tailored to specific crop needs, enhancing overall agricultural productivity.

| Segment | Sub-Segments |

|---|---|

| By Type | Activator Adjuvants (Surfactants, Oil Adjuvants) Utility Adjuvants (Drift Control Agents, Water Conditioners, Antifoaming Agents, Acidifiers & Buffers) Water-Soluble Polymers Emulsifiers Stickers Others |

| By Application | Herbicide Adjuvants Insecticide Adjuvants Fungicide Adjuvants Fertilizer Adjuvants Other Applications |

| By Crop Type | Cereals & Grains Oilseeds & Pulses Fruits & Vegetables Others |

| By End-User | Commercial Farmers Agricultural Cooperatives Government Agencies Research Institutions Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Agricultural Supply Stores Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, France, U.K., Italy, Russia, Rest of Europe) Asia-Pacific (China, India, Japan, Australia, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (South Africa, Nigeria, Saudi Arabia, UAE, Rest of MEA) |

| By Product Formulation | Liquid Formulations Granular Formulations Powder Formulations Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Crop Protection Adjuvants | 100 | Agronomists, Product Development Managers |

| Fertilizer Adjuvants | 80 | Farm Managers, Agricultural Scientists |

| Herbicide Adjuvants | 60 | Procurement Managers, Crop Consultants |

| Insecticide Adjuvants | 50 | Field Technicians, Research Analysts |

| Regional Adjuvant Usage Trends | 70 | Farmers, Agricultural Extension Officers |

The Global Agriculture Adjuvants Market is valued at approximately USD 4.0 billion, driven by the increasing need for crop protection, the adoption of precision agriculture, and a shift towards sustainable farming practices.