Region:Global

Author(s):Dev

Product Code:KRAA2569

Pages:87

Published On:August 2025

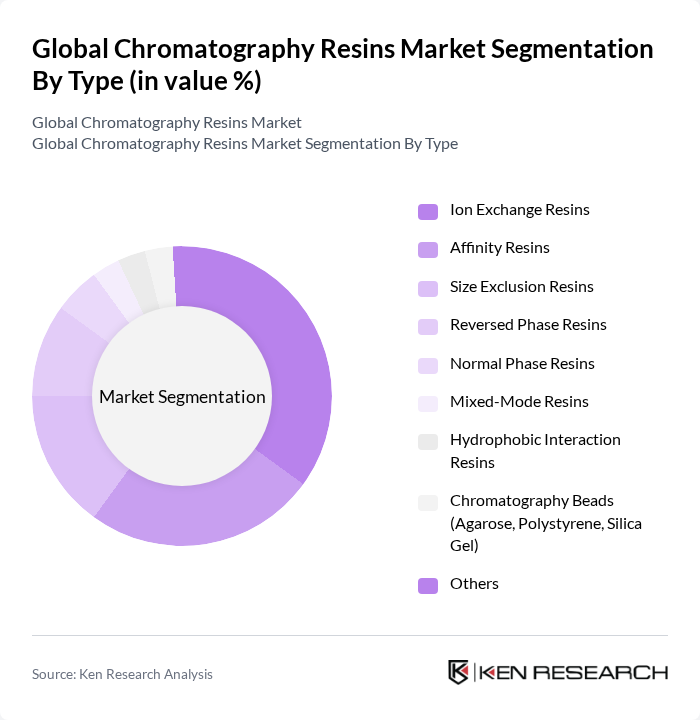

By Type:The chromatography resins market is segmented into various types, including Ion Exchange Resins, Affinity Resins, Size Exclusion Resins, Reversed Phase Resins, Normal Phase Resins, Mixed-Mode Resins, Hydrophobic Interaction Resins, Chromatography Beads (Agarose, Polystyrene, Silica Gel), and Others. Among these, Ion Exchange Resins are the most widely used due to their effectiveness in separating charged molecules, making them essential in pharmaceutical and biotechnology applications. The demand for Affinity Resins is also significant, driven by their specificity in capturing target biomolecules, which is crucial for drug development and diagnostics .

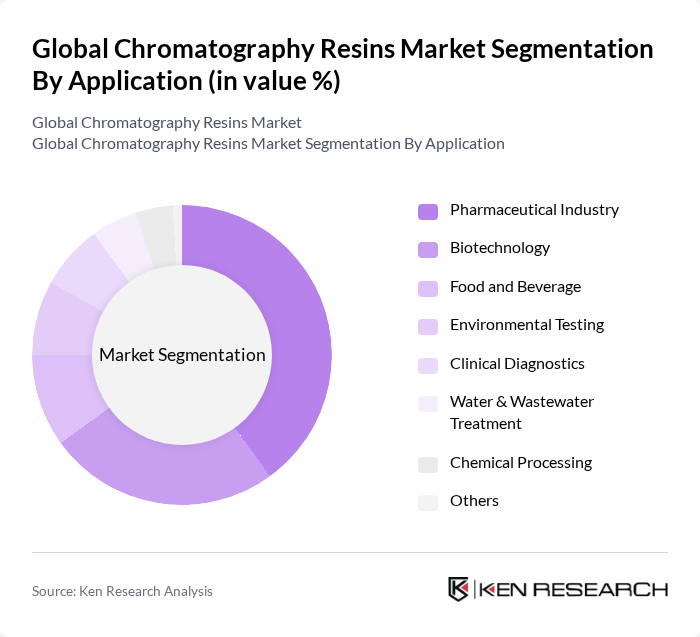

By Application:The chromatography resins market is also segmented by application, which includes the Pharmaceutical Industry, Biotechnology, Food and Beverage, Environmental Testing, Clinical Diagnostics, Water & Wastewater Treatment, Chemical Processing, and Others. The Pharmaceutical Industry is the leading application segment, driven by the increasing demand for biopharmaceuticals and the need for effective separation and purification processes. Biotechnology applications are also growing rapidly, as advancements in genetic engineering and molecular biology require high-quality chromatography resins for research and development .

The Global Chromatography Resins Market is characterized by a dynamic mix of regional and international players. Leading participants such as Merck KGaA, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., Cytiva (formerly GE Healthcare Life Sciences), Agilent Technologies, Inc., Pall Corporation, Repligen Corporation, Tosoh Corporation, Mitsubishi Chemical Corporation, Waters Corporation, Sigma-Aldrich Corporation (now part of Merck), Purolite Corporation, Sartorius AG, W.R. Grace & Co., Sepax Technologies Inc., SiliCycle Inc., Alfa Aesar (Thermo Fisher Scientific), Osaka Soda Co., Ltd., and Sorbead India contribute to innovation, geographic expansion, and service delivery in this space.

The future of the chromatography resins market appears promising, driven by technological advancements and increasing applications across various sectors. The integration of automation and artificial intelligence in chromatography processes is expected to enhance efficiency and accuracy, while the growing emphasis on sustainable practices will likely lead to the development of eco-friendly resins. As the demand for biopharmaceuticals continues to rise, the market is poised for significant growth, with innovative solutions addressing both efficiency and environmental concerns.

| Segment | Sub-Segments |

|---|---|

| By Type | Ion Exchange Resins Affinity Resins Size Exclusion Resins Reversed Phase Resins Normal Phase Resins Mixed-Mode Resins Hydrophobic Interaction Resins Chromatography Beads (Agarose, Polystyrene, Silica Gel) Others |

| By Application | Pharmaceutical Industry Biotechnology Food and Beverage Environmental Testing Clinical Diagnostics Water & Wastewater Treatment Chemical Processing Others |

| By End-User | Research Laboratories Academic Institutions Pharmaceutical Companies Contract Research Organizations Bioprocessing Facilities Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Brand | Established Brands Emerging Brands Private Labels |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 100 | R&D Managers, Quality Control Analysts |

| Food & Beverage Testing | 70 | Laboratory Technicians, Compliance Officers |

| Environmental Analysis | 60 | Environmental Scientists, Regulatory Affairs Specialists |

| Academic Research Institutions | 50 | Research Professors, Graduate Students |

| Industrial Applications | 80 | Production Managers, Process Engineers |

The Global Chromatography Resins Market is valued at approximately USD 2.76 billion, driven by the increasing demand for biopharmaceuticals, advancements in chromatography techniques, and the need for high-purity products across various industries.