Region:Europe

Author(s):Shubham

Product Code:KRAB5579

Pages:100

Published On:October 2025

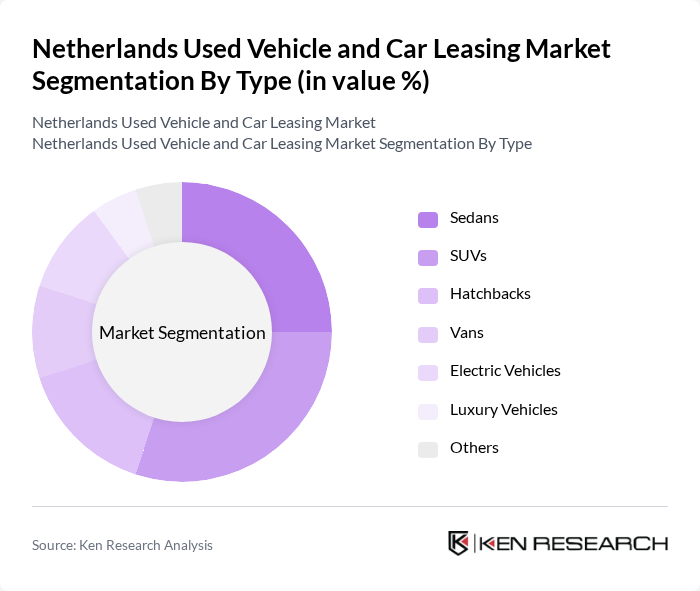

By Type:The market is segmented into various vehicle types, including Sedans, SUVs, Hatchbacks, Vans, Electric Vehicles, Luxury Vehicles, and Others. Among these, SUVs have gained significant popularity due to their versatility and spaciousness, appealing to families and individuals alike. Sedans also maintain a strong presence, favored for their fuel efficiency and affordability. The increasing interest in Electric Vehicles is notable, driven by environmental concerns and government incentives.

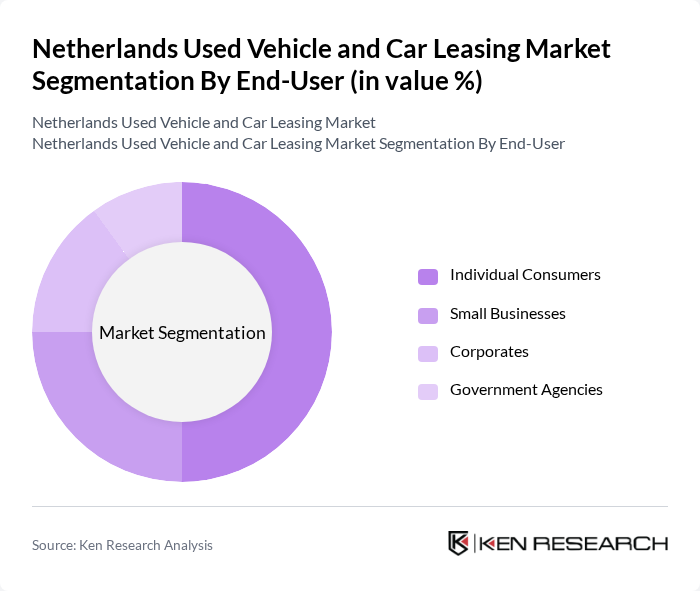

By End-User:The end-user segmentation includes Individual Consumers, Small Businesses, Corporates, and Government Agencies. Individual Consumers represent the largest segment, driven by the growing trend of personal vehicle ownership and leasing. Small businesses also contribute significantly, as they often prefer leasing to manage costs effectively. Corporates and Government Agencies are increasingly opting for leasing solutions to maintain a modern fleet while optimizing their budgets.

The Netherlands Used Vehicle and Car Leasing Market is characterized by a dynamic mix of regional and international players. Leading participants such as LeasePlan Corporation N.V., Arval Service Lease S.A., ALD Automotive, Athlon Car Lease, Volkswagen Financial Services, BMW Financial Services, Mercedes-Benz Financial Services, ING Car Lease, DirectLease, Sixt Leasing SE, TCR Group, LeasePlan Nederland B.V., Greenwheels, SnappCar, MyWheels contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Netherlands used vehicle and car leasing market appears promising, driven by increasing consumer interest in sustainable transportation options and digital transformation in leasing processes. As electric vehicle adoption rises, the market is likely to see a shift towards eco-friendly leasing solutions. Additionally, advancements in telematics and connected vehicle technologies will enhance customer experiences, making leasing more attractive. The integration of these trends will likely reshape the market landscape, fostering innovation and growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Sedans SUVs Hatchbacks Vans Electric Vehicles Luxury Vehicles Others |

| By End-User | Individual Consumers Small Businesses Corporates Government Agencies |

| By Sales Channel | Direct Sales Online Platforms Dealerships Auctions |

| By Lease Type | Operating Lease Finance Lease Closed-End Lease Open-End Lease |

| By Vehicle Age | New Vehicles 3 Years Old 6 Years Old + Years Old |

| By Geographic Distribution | Urban Areas Suburban Areas Rural Areas |

| By Price Range | Below €10,000 €10,000 - €20,000 €20,000 - €30,000 Above €30,000 |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Used Vehicle Dealerships | 150 | Dealership Owners, Sales Managers |

| Car Leasing Companies | 100 | Leasing Managers, Financial Analysts |

| Consumer Preferences in Vehicle Leasing | 200 | Potential Car Buyers, Current Lease Holders |

| Automotive Market Analysts | 50 | Market Researchers, Industry Consultants |

| Regulatory Bodies and Policy Makers | 30 | Government Officials, Policy Advisors |

The Netherlands Used Vehicle and Car Leasing Market is valued at approximately EUR 8.5 billion, reflecting a significant growth trend driven by increasing consumer demand for affordable and sustainable mobility solutions.