Region:Middle East

Author(s):Shubham

Product Code:KRAD3696

Pages:88

Published On:November 2025

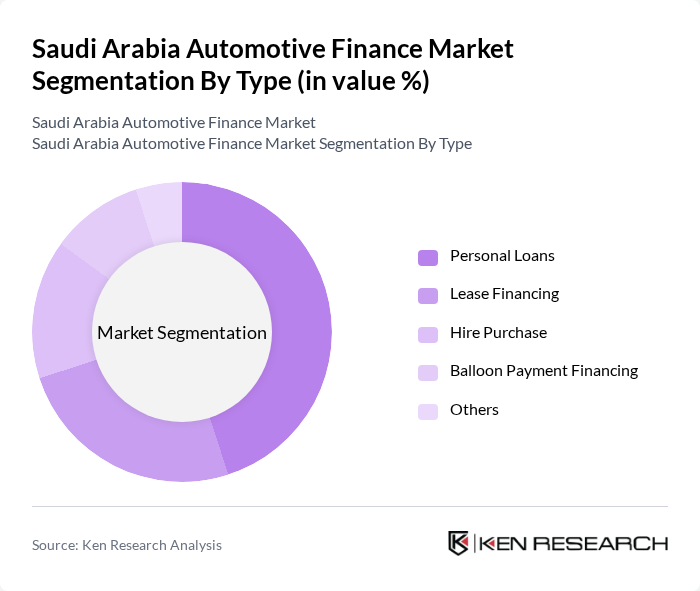

By Type:The automotive finance market can be segmented into various types, including Personal Loans, Lease Financing, Hire Purchase, Balloon Payment Financing, and Others. Among these, Personal Loans have emerged as the leading sub-segment due to their flexibility and the growing trend of individual ownership of vehicles. Consumers prefer personal loans for their straightforward application processes and competitive interest rates, making them a popular choice for financing vehicle purchases.

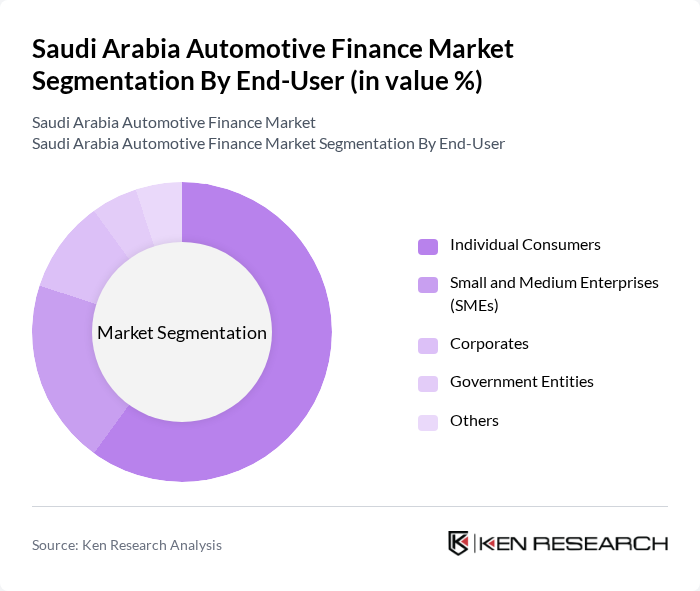

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Corporates, Government Entities, and Others. Individual Consumers dominate this segment, driven by the increasing trend of personal vehicle ownership and the availability of tailored financing solutions. The rise in disposable income and the growing preference for personal mobility have led to a surge in demand for automotive financing among individual buyers.

The Saudi Arabia Automotive Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Rajhi Bank, National Commercial Bank (NCB), Samba Financial Group, Riyad Bank, Arab National Bank, Banque Saudi Fransi, Gulf International Bank, Saudi Investment Bank, Alinma Bank, Bank AlBilad, Abu Dhabi Commercial Bank, Emirates NBD, Qatar National Bank, HSBC Saudi Arabia, Standard Chartered Bank contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi automotive finance market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. The increasing adoption of digital financing platforms is expected to streamline the loan application process, making it more accessible. Additionally, the rise of electric vehicles will create new financing opportunities, as consumers seek tailored solutions for sustainable mobility. As financial institutions adapt to these trends, the market is likely to witness enhanced competition and innovation, ultimately benefiting consumers and driving market expansion.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Lease Financing Hire Purchase Balloon Payment Financing Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Corporates Government Entities Others |

| By Vehicle Type | Passenger Cars Commercial Vehicles Electric Vehicles Luxury Vehicles Others |

| By Financing Source | Banks Non-Banking Financial Companies (NBFCs) Credit Unions Peer-to-Peer Lending Platforms Others |

| By Payment Structure | Fixed Installments Variable Installments Deferred Payments Others |

| By Customer Segment | First-Time Buyers Repeat Buyers Fleet Buyers Others |

| By Region | Central Region Eastern Region Western Region Southern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Dealership Financing Options | 150 | Finance Managers, Sales Directors |

| Consumer Financing Preferences | 200 | Potential Car Buyers, Financial Advisors |

| Banking Sector Automotive Loan Products | 100 | Loan Officers, Product Managers |

| Regulatory Impact on Automotive Financing | 80 | Policy Makers, Economic Analysts |

| Market Trends in Automotive Financing | 120 | Industry Experts, Market Researchers |

The Saudi Arabia Automotive Finance Market is valued at approximately USD 15 billion, reflecting a significant growth driven by increasing consumer demand for vehicles, favorable financing options, and government initiatives aimed at enhancing the automotive sector.