Region:Europe

Author(s):Rebecca

Product Code:KRAA6846

Pages:84

Published On:September 2025

By Type:

The major subsegments under this category include Real Estate, Automotive, Job Listings, Consumer Goods, Services, Electronics, and Others. Among these, the Real Estate segment is currently dominating the market due to the increasing demand for housing and commercial properties, driven by urbanization and population growth. The trend of remote work has also led to a surge in interest in suburban and rural properties, further boosting this segment's growth. The Automotive segment follows closely, fueled by the rising need for personal transportation and the growing popularity of online car sales platforms.

By End-User:

This segmentation includes Individual Consumers, Small Businesses, Corporations, and Government Entities. The Individual Consumers segment is the leading subsegment, driven by the increasing number of people seeking to buy and sell goods and services online. The convenience of accessing a wide range of products and services from home has made this segment particularly attractive. Small Businesses also represent a significant portion of the market, as they leverage digital platforms to reach a broader audience and enhance their sales channels.

The Russia Classifieds and Digital Market is characterized by a dynamic mix of regional and international players. Leading participants such as Avito, Yula, OLX Russia, Drom.ru, Cian, Tiu.ru, Youla, Auto.ru, Zoon, Rabota.ru, Domofond, Profi.ru, Kolesa.ru, Sberbank Marketplace, Wildberries contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Russia classifieds and digital market is poised for significant transformation, driven by technological advancements and changing consumer behaviors. As mobile commerce continues to grow, businesses will increasingly leverage AI and machine learning to enhance user experiences and streamline operations. Additionally, the integration of localized services will become essential for attracting diverse consumer segments, ensuring that platforms remain competitive in a rapidly evolving digital landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Real Estate Automotive Job Listings Consumer Goods Services Electronics Others |

| By End-User | Individual Consumers Small Businesses Corporations Government Entities |

| By Sales Channel | Online Platforms Mobile Applications Social Media Offline Listings |

| By Pricing Model | Free Listings Subscription-Based Pay-Per-Listing Commission-Based |

| By Geographic Coverage | Urban Areas Rural Areas Regional Markets National Coverage |

| By User Demographics | Age Groups Income Levels Education Levels Occupation Types |

| By Customer Loyalty | New Users Returning Users Loyal Customers Occasional Users |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Usage of Classifieds | 150 | General Consumers, Online Shoppers |

| Small Business Advertising Strategies | 100 | Small Business Owners, Marketing Managers |

| Real Estate Listings Engagement | 80 | Real Estate Agents, Property Managers |

| Automotive Classifieds Insights | 70 | Car Dealers, Automotive Enthusiasts |

| Consumer Electronics Market Trends | 90 | Electronics Retailers, Tech Consumers |

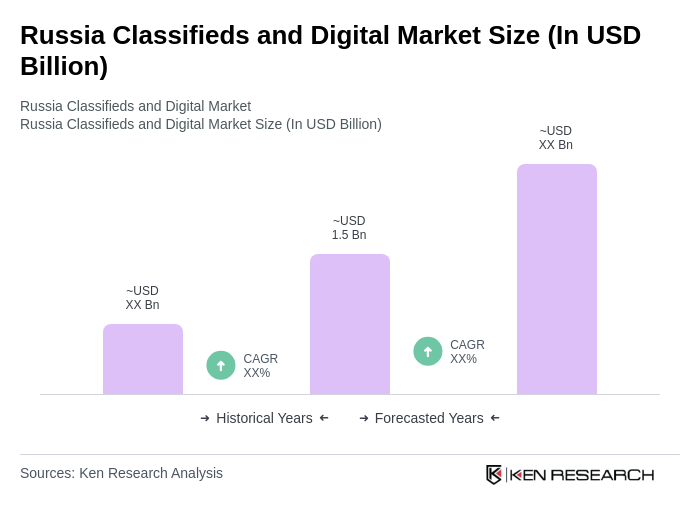

The Russia Classifieds and Digital Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increased internet penetration, mobile device usage, and a shift towards online shopping and services.