Region:Middle East

Author(s):Shubham

Product Code:KRAA0979

Pages:84

Published On:August 2025

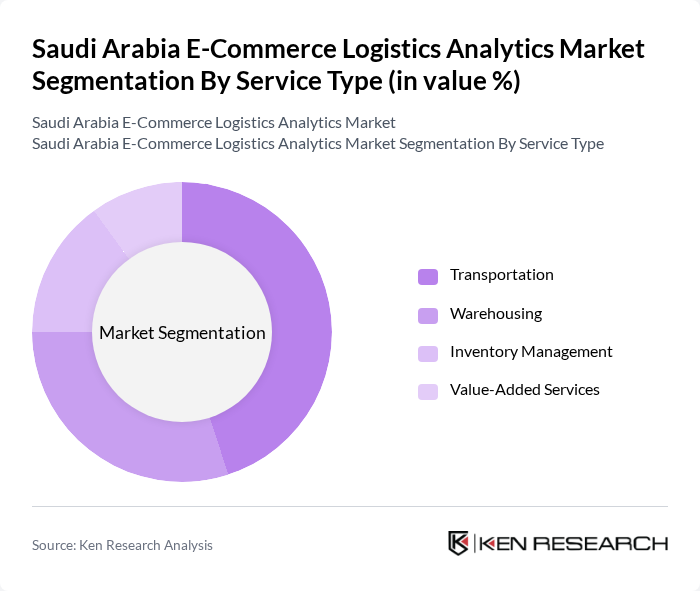

By Service Type:

The service type segmentation includes Transportation, Warehousing, Inventory Management, and Value-Added Services. Among these, Transportation is the leading subsegment, driven by the increasing demand for fast and reliable delivery services. The rise of e-commerce has led to a surge in last-mile delivery solutions, making transportation a critical component of logistics analytics. Warehousing also plays a significant role, as businesses seek to optimize storage and distribution processes to meet consumer expectations for quick fulfillment. Value-added services, such as packaging, labeling, and reverse logistics, are gaining traction as companies look to differentiate their offerings and improve customer satisfaction .

By Business Model:

This segmentation includes B2B and B2C models. The B2C model is currently dominating the market, driven by the increasing number of online shoppers and the growing trend of direct-to-consumer sales. As consumers increasingly prefer online shopping for convenience and variety, businesses are adapting their logistics strategies to cater to this demand. The B2B segment is also significant, particularly in sectors like wholesale and manufacturing, but it is the B2C model that is leading the charge in e-commerce logistics analytics. Domestic deliveries constitute the majority of transactions, while international shipping is seeing rapid growth as cross-border e-commerce expands .

The Saudi Arabia E-Commerce Logistics Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Post, SMSA Express, SAM Express, Aramex, DHL, Zajil Express, Naqel Express, ESNAD Express, FedEx, UPS, Bahri, Gulf Agency Company (GAC) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Saudi Arabia e-commerce logistics analytics market appears promising, driven by technological advancements and evolving consumer preferences. As businesses increasingly adopt data-driven strategies, the demand for real-time analytics and AI-driven solutions is expected to rise. Additionally, the integration of sustainable practices in logistics will become a focal point, aligning with global trends. This shift will not only enhance operational efficiency but also improve customer experiences, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Transportation Warehousing Inventory Management Value-Added Services |

| By Business Model | B2B B2C |

| By Destination | Domestic International |

| By Product Category | Fashion & Apparel Consumer Electronics Home Appliances Furniture Beauty & Personal Care Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-commerce Logistics Operations | 100 | Logistics Managers, Operations Directors |

| Last-Mile Delivery Services | 60 | Delivery Coordinators, Fleet Managers |

| Returns Management Strategies | 50 | Customer Service Managers, Returns Analysts |

| Warehouse Management Systems | 40 | Warehouse Managers, IT Systems Analysts |

| Cross-Border E-commerce Logistics | 40 | International Trade Managers, Compliance Officers |

The Saudi Arabia E-Commerce Logistics Analytics Market is valued at approximately USD 2 billion, reflecting significant growth driven by the rapid expansion of online retail and increasing consumer demand for efficient logistics solutions.