Region:Europe

Author(s):Shubham

Product Code:KRAA1158

Pages:97

Published On:August 2025

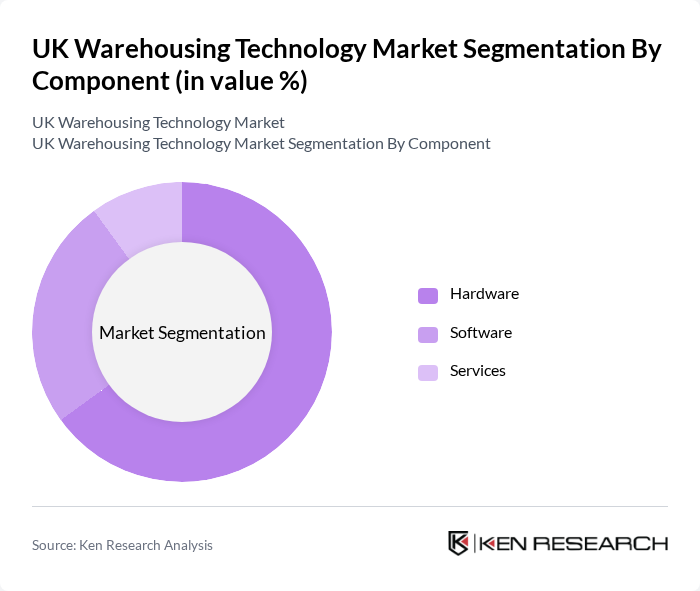

By Component:This segmentation includes Hardware, Software, and Services, which are critical for the operation and management of warehousing technologies. The Hardware segment encompasses Automated Storage and Retrieval Systems, Conveyor Systems, Robotic Arms, Automated Guided Vehicles, and Sensors. The Software segment includes Warehouse Management Systems, Warehouse Execution Systems, Control Software, and Inventory Management Software. The Services segment covers Consulting, Implementation, Maintenance & Support, and Training .

The Hardware segment is currently dominating the market, driven by the increasing adoption of automated systems that enhance efficiency and reduce operational costs. Automated Storage and Retrieval Systems and Robotic Arms are particularly popular due to their ability to streamline processes and minimize human error. As e-commerce continues to grow, the demand for advanced hardware solutions is expected to rise, making this segment a key focus for investment and innovation .

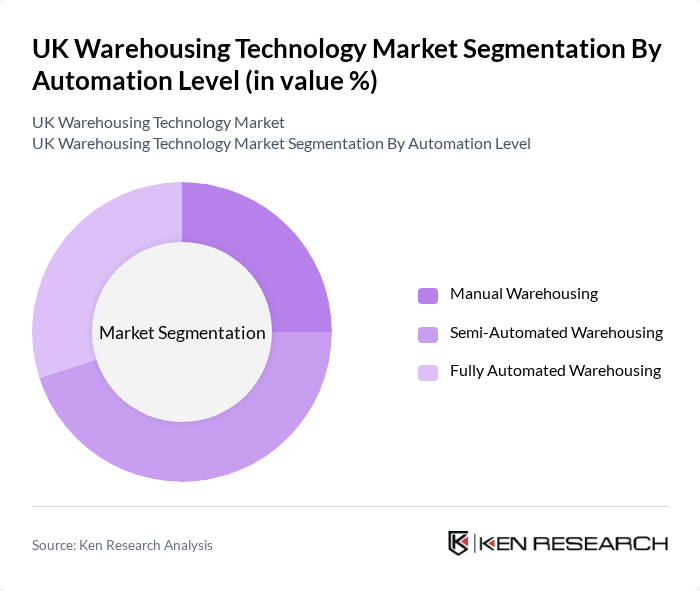

By Automation Level:This segmentation includes Manual Warehousing, Semi-Automated Warehousing, and Fully Automated Warehousing. Each level represents a different degree of technology integration and operational efficiency within warehousing operations .

Semi-Automated Warehousing is currently the leading segment, as many companies are transitioning from manual processes to semi-automated systems. This shift allows businesses to enhance productivity while managing costs effectively. The flexibility of semi-automated systems enables companies to gradually adopt more advanced technologies, making it a popular choice among various industries .

The UK Warehousing Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, XPO Logistics, Wincanton, Kuehne + Nagel, CEVA Logistics, DB Schenker, Geodis, Clipper Logistics, GXO Logistics, Stow Robotics, Swisslog (UK), SSI SCHAEFER (UK), Dematic (UK), Knapp UK, Ocado Group contribute to innovation, geographic expansion, and service delivery in this space.

The UK warehousing technology market is poised for transformative growth, driven by the increasing demand for efficiency and innovation. As e-commerce continues to expand, businesses will increasingly adopt smart warehousing solutions that leverage automation, IoT, and AI technologies. Furthermore, sustainability initiatives will play a crucial role in shaping operational strategies, as companies seek to reduce their environmental impact. The integration of these technologies will not only enhance productivity but also improve customer satisfaction through faster and more reliable service.

| Segment | Sub-Segments |

|---|---|

| By Component | Hardware (Automated Storage and Retrieval Systems, Conveyor Systems, Robotic Arms, Automated Guided Vehicles, Sensors) Software (Warehouse Management Systems, Warehouse Execution Systems, Control Software, Inventory Management Software) Services (Consulting, Implementation, Maintenance & Support, Training) |

| By Automation Level | Manual Warehousing Semi-Automated Warehousing Fully Automated Warehousing |

| By Application | Order Fulfillment Inventory Management Picking & Packing Shipping and Receiving Returns Management Cross-Docking Others |

| By End-User | Retail E-commerce Manufacturing Food and Beverage Pharmaceuticals/Healthcare Consumer Goods Automotive Others |

| By Region | South East Midlands North West Other Regions |

| By Technology Integration | IoT Integration AI and Machine Learning Blockchain Technology Augmented Reality Cloud-Based Solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automation Technology Adoption | 100 | Warehouse Operations Managers, IT Directors |

| Software Solutions for Inventory Management | 80 | Supply Chain Analysts, Software Implementation Leads |

| IoT Integration in Warehousing | 60 | Technology Managers, Logistics Coordinators |

| Robotics in Warehouse Operations | 50 | Automation Engineers, Facility Managers |

| Data Analytics for Supply Chain Optimization | 70 | Data Scientists, Business Intelligence Managers |

The UK Warehousing Technology Market is valued at approximately USD 3.9 billion, reflecting significant growth driven by the demand for efficient supply chain management, e-commerce expansion, and automation in warehousing operations.