Region:Europe

Author(s):Geetanshi

Product Code:KRAA1282

Pages:94

Published On:August 2025

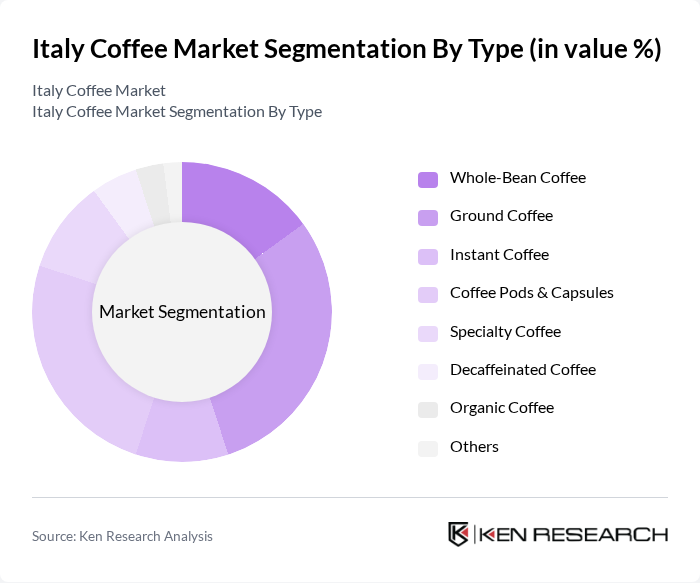

By Type:The coffee market in Italy is segmented into Whole-Bean Coffee, Ground Coffee, Instant Coffee, Coffee Pods & Capsules, Specialty Coffee, Decaffeinated Coffee, Organic Coffee, and Others. Ground Coffee and Coffee Pods & Capsules remain particularly popular due to their convenience and traditional appeal. The specialty coffee segment is expanding, driven by consumer interest in unique flavors, single-origin beans, and artisanal preparation methods .

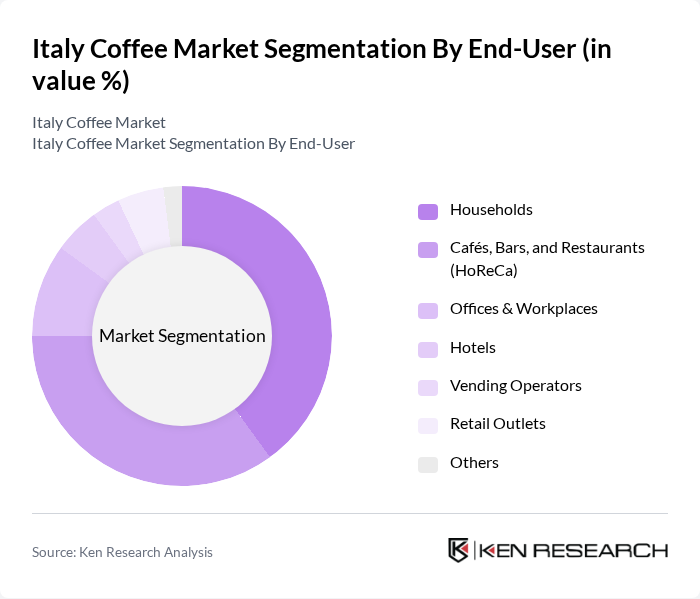

By End-User:The Italian coffee market is segmented by end-users into Households, Cafés, Bars, and Restaurants (HoReCa), Offices & Workplaces, Hotels, Vending Operators, Retail Outlets, and Others. The HoReCa segment is a major contributor, reflecting the importance of Italy’s café and restaurant culture. Households also represent a significant share, as consumers increasingly invest in premium coffee for home brewing. Offices and vending operators are notable segments due to the demand for convenience and on-the-go consumption .

The Italy Coffee Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lavazza S.p.A., Illycaffè S.p.A., Segafredo Zanetti S.p.A., Kimbo S.p.A., Caffè Vergnano S.p.A., Hausbrandt Trieste 1892 S.p.A., Caffè Borbone S.r.l., Caffè Pascucci Torrefazione S.p.A., Ditta Artigianale S.r.l., Caffè Molinari S.p.A., Caffè Carraro S.p.A., Starbucks Corporation, Nestlé Nespresso S.A., Caffè Kimbo S.p.A., Julius Meinl Italia S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italian coffee market appears promising, driven by evolving consumer preferences and innovative retail strategies. The increasing demand for sustainable and ethically sourced coffee is likely to shape market dynamics, as consumers become more conscious of their purchasing decisions. Additionally, the integration of technology in coffee retail, such as mobile ordering and personalized marketing, will enhance customer experiences and drive sales. As the market adapts to these trends, opportunities for growth and differentiation will emerge for both established and new players.

| Segment | Sub-Segments |

|---|---|

| By Type | Whole-Bean Coffee Ground Coffee Instant Coffee Coffee Pods & Capsules Specialty Coffee Decaffeinated Coffee Organic Coffee Others |

| By End-User | Households Cafés, Bars, and Restaurants (HoReCa) Offices & Workplaces Hotels Vending Operators Retail Outlets Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Specialty Coffee Shops Online Retail/E-commerce Direct Sales Vending Machines Others |

| By Price Range | Premium Mid-Range Economy Discounted |

| By Packaging Type | Bags Cans Pods & Capsules Bottles Others |

| By Flavor Profile | Dark Roast Medium Roast Light Roast Flavored Coffee Others |

| By Brand Loyalty | Established Brands Emerging Brands Private Labels |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Coffee Outlets | 150 | Café Owners, Baristas, Retail Managers |

| Wholesale Coffee Distributors | 100 | Distribution Managers, Sales Representatives |

| Consumer Coffee Preferences | 150 | Coffee Drinkers, Specialty Coffee Enthusiasts |

| Online Coffee Sales | 80 | E-commerce Managers, Digital Marketing Specialists |

| Coffee Importers | 70 | Import Managers, Supply Chain Analysts |

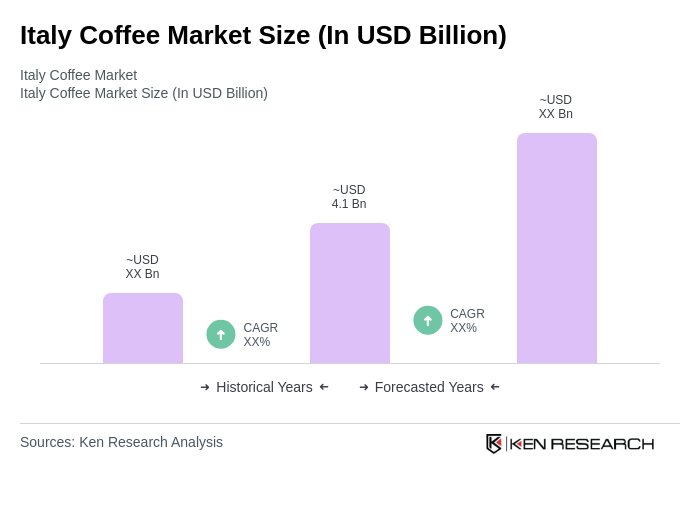

The Italy Coffee Market is valued at approximately USD 4.1 billion, reflecting a strong coffee culture and increasing consumer demand for specialty and premium coffee products, including coffee pods and capsules.