Region:Europe

Author(s):Geetanshi

Product Code:KRAA6657

Pages:99

Published On:September 2025

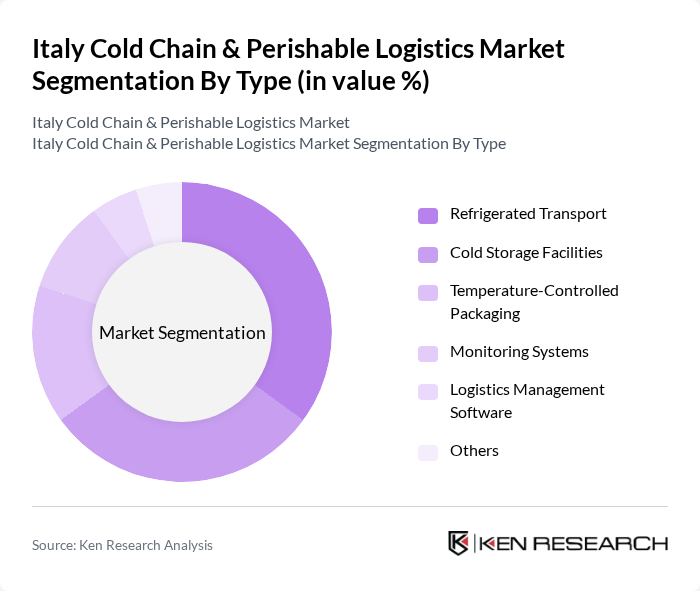

By Type:The market is segmented into various types, including Refrigerated Transport, Cold Storage Facilities, Temperature-Controlled Packaging, Monitoring Systems, Logistics Management Software, and Others. Each of these segments plays a crucial role in ensuring the integrity of perishable goods throughout the supply chain.

The Refrigerated Transport segment is currently the dominant player in the market, driven by the increasing demand for fresh produce and temperature-sensitive products. This segment benefits from advancements in transportation technology, which enhance the efficiency and reliability of cold chain logistics. The growing trend of online grocery shopping has also contributed to the rise in refrigerated transport needs, as consumers expect timely delivery of perishable goods.

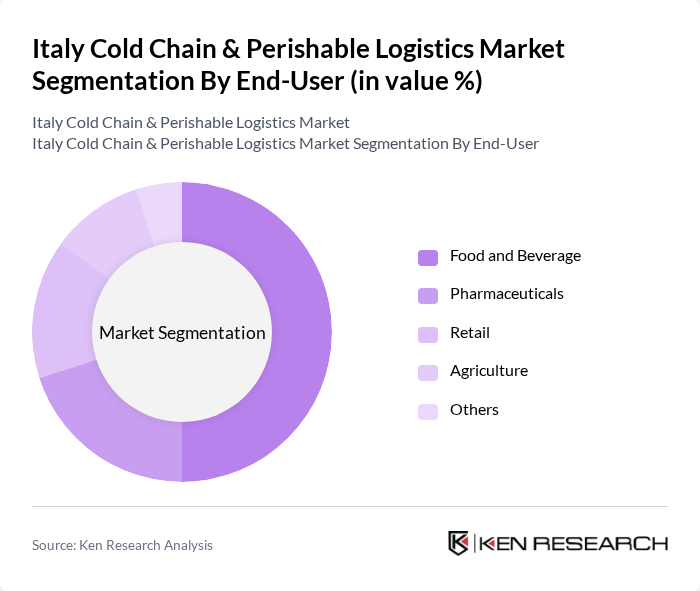

By End-User:The market is segmented by end-users, including Food and Beverage, Pharmaceuticals, Retail, Agriculture, and Others. Each segment has unique requirements and contributes differently to the overall market dynamics.

The Food and Beverage segment leads the market, accounting for a significant share due to the high demand for fresh and frozen products. The increasing consumer preference for organic and locally sourced food has further fueled this segment's growth. Additionally, the rise in health consciousness among consumers has led to a greater emphasis on the quality and safety of food products, driving the need for efficient cold chain logistics.

The Italy Cold Chain & Perishable Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, XPO Logistics, DB Schenker, Geodis, DSV Panalpina, CEVA Logistics, Lineage Logistics, Americold Logistics, Agility Logistics, Transplace, Nichirei Logistics Group, Kintetsu World Express, Rhenus Logistics, J.B. Hunt Transport Services contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain and perishable logistics market in Italy appears promising, driven by technological advancements and evolving consumer preferences. The integration of IoT technologies is expected to enhance supply chain efficiency, allowing for real-time monitoring of temperature-sensitive products. Additionally, the increasing focus on sustainability will likely lead to innovations in eco-friendly packaging solutions, further supporting the growth of this sector. As consumer demand for fresh and safe food continues to rise, the market is poised for significant transformation.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Facilities Temperature-Controlled Packaging Monitoring Systems Logistics Management Software Others |

| By End-User | Food and Beverage Pharmaceuticals Retail Agriculture Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics E-commerce Platforms Others |

| By Payload Capacity | Less than 1 ton 5 tons 10 tons More than 10 tons |

| By Temperature Range | Chilled (0°C to 5°C) Frozen (-18°C and below) Ambient (5°C to 25°C) Others |

| By Service Type | Transportation Services Warehousing Services Value-Added Services Others |

| By Market Channel | Wholesale Retail Online Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Retail Cold Chain Logistics | 150 | Supply Chain Managers, Logistics Coordinators |

| Pharmaceutical Temperature-Controlled Distribution | 100 | Pharmaceutical Logistics Directors, Quality Assurance Managers |

| Floral Supply Chain Management | 80 | Floral Operations Managers, Procurement Specialists |

| Perishable Goods Transportation | 120 | Transport Managers, Fleet Operations Supervisors |

| Cold Storage Facility Operations | 90 | Facility Managers, Inventory Control Analysts |

The Italy Cold Chain & Perishable Logistics Market is valued at approximately USD 10 billion, driven by the increasing demand for fresh and frozen food products, as well as the growth of e-commerce and online grocery shopping.