Region:Europe

Author(s):Shubham

Product Code:KRAB1270

Pages:92

Published On:October 2025

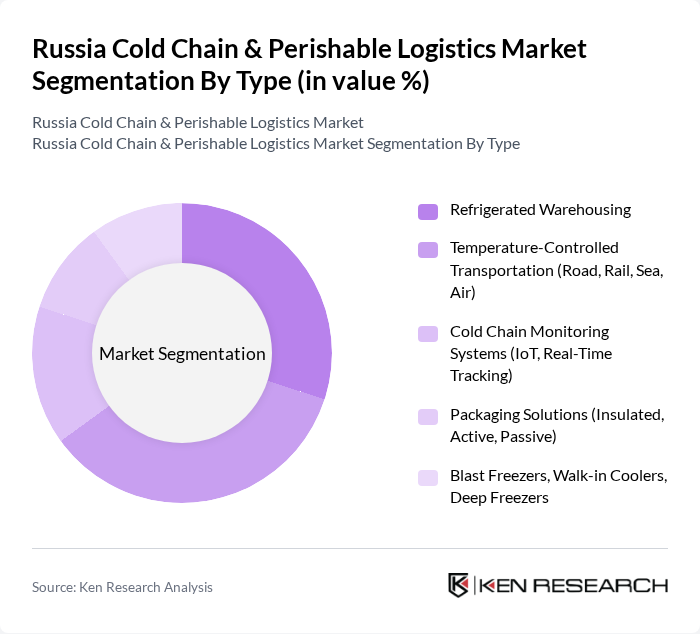

By Type:The market is segmented into various types, including Refrigerated Warehousing, Temperature-Controlled Transportation, Cold Chain Monitoring Systems, Packaging Solutions, and Blast Freezers. Each of these segments plays a crucial role in maintaining the integrity of perishable goods throughout the supply chain. Transportation is the largest revenue-generating segment, reflecting the significant need for reliable movement of temperature-sensitive goods over long distances in Russia’s vast geography .

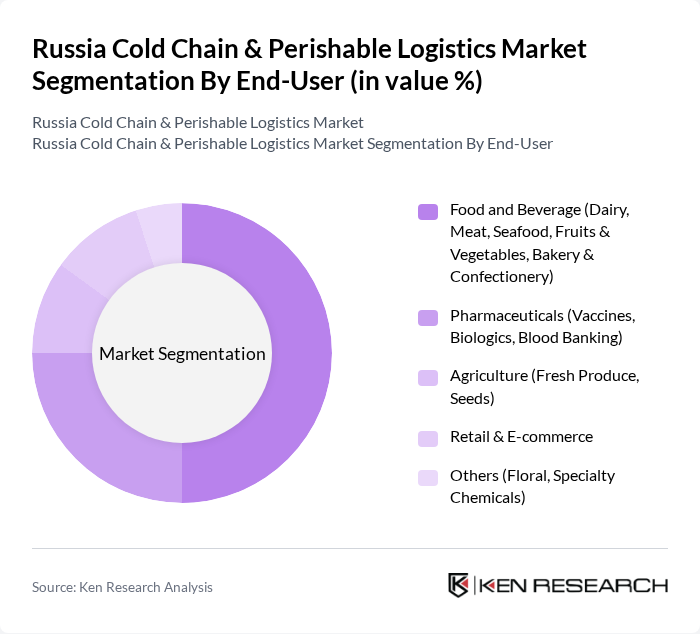

By End-User:The end-user segmentation includes Food and Beverage, Pharmaceuticals, Agriculture, Retail & E-commerce, and Others. Each segment has unique requirements and contributes to the overall demand for cold chain logistics services. The food and beverage segment holds the largest share, driven by the need for safe storage and transport of dairy, meat, seafood, fruits, vegetables, and bakery products. Pharmaceuticals are the second largest, reflecting increased vaccine and biologics distribution .

The Russia Cold Chain & Perishable Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as X5 Logistics, Magnit Logistics, Lineage Logistics Russia, RZD Logistics, Global Cold Chain, Aurora Cold Chain, Ruskhim Logistics, TransContainer, DPD Russia, Pochta Rossii, Ozon Logistics, DHL Supply Chain Russia, FM Logistic Russia, Itella Russia, Globaltruck Logistics contribute to innovation, geographic expansion, and service delivery in this space .

The future of the cold chain and perishable logistics market in Russia appears promising, driven by technological advancements and increasing consumer expectations for quality. The integration of IoT technologies for real-time monitoring is expected to enhance operational efficiency, while sustainable practices will gain traction as environmental concerns rise. Additionally, the government's commitment to improving food safety standards will likely foster a more robust regulatory environment, encouraging investments in cold chain infrastructure and technology.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Warehousing Temperature-Controlled Transportation (Road, Rail, Sea, Air) Cold Chain Monitoring Systems (IoT, Real-Time Tracking) Packaging Solutions (Insulated, Active, Passive) Blast Freezers, Walk-in Coolers, Deep Freezers |

| By End-User | Food and Beverage (Dairy, Meat, Seafood, Fruits & Vegetables, Bakery & Confectionery) Pharmaceuticals (Vaccines, Biologics, Blood Banking) Agriculture (Fresh Produce, Seeds) Retail & E-commerce Others (Floral, Specialty Chemicals) |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce Platforms Others |

| By Application | Food Storage Medical Supply Chain Floral and Horticultural Products Others |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment Others |

| By Policy Support | Tax Incentives Grants for Infrastructure Development Regulatory Support for New Technologies Others |

| By Temperature Range | Chilled (2–8°C) Frozen (-18°C and below) Deep Frozen (-30°C and below) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cold Storage Facilities | 60 | Facility Managers, Operations Directors |

| Perishable Goods Distributors | 50 | Supply Chain Managers, Logistics Coordinators |

| Retailers of Fresh Produce | 45 | Store Managers, Procurement Specialists |

| Refrigerated Transport Companies | 55 | Fleet Managers, Business Development Executives |

| Food Safety Regulators | 40 | Compliance Officers, Quality Assurance Managers |

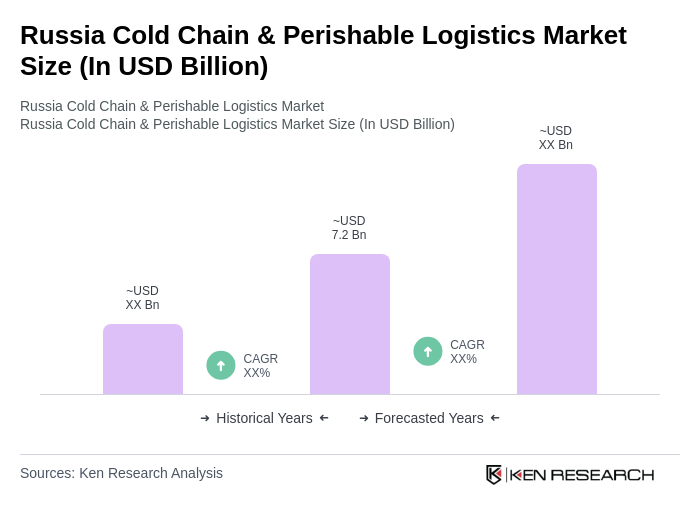

The Russia Cold Chain & Perishable Logistics Market is valued at approximately USD 7.2 billion, driven by the increasing demand for temperature-sensitive products in sectors like food and pharmaceuticals, as well as the growth of e-commerce and retail logistics.