Region:Europe

Author(s):Shubham

Product Code:KRAB1118

Pages:98

Published On:October 2025

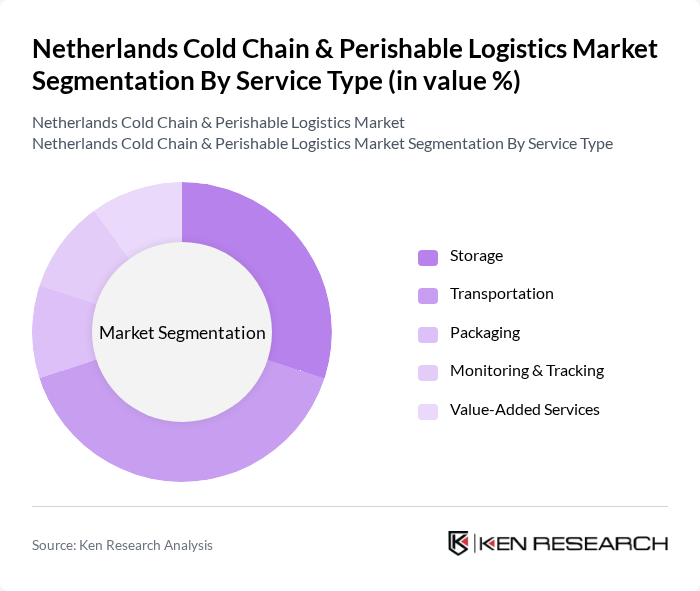

By Service Type:The service type segmentation includes various subsegments such as Storage, Transportation, Packaging, Monitoring & Tracking, and Value-Added Services. Each of these plays a crucial role in ensuring the efficiency and effectiveness of cold chain logistics. Storage remains the largest revenue-generating segment, while transportation is the fastest-growing due to the surge in e-commerce and rapid delivery expectations .

The Transportation subsegment is dominating the market due to the increasing demand for efficient delivery of perishable goods. With the rise of e-commerce and consumer expectations for fast delivery, logistics providers are investing in advanced refrigerated transport solutions. This trend is further supported by the growing emphasis on sustainability, prompting companies to adopt eco-friendly transportation methods. The need for reliable and timely transportation services is critical in maintaining the quality and safety of perishable products .

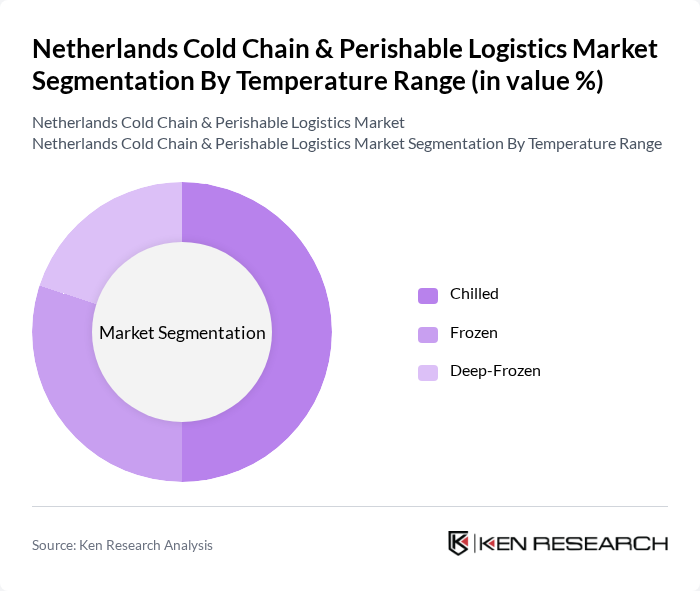

By Temperature Range:The temperature range segmentation includes Chilled, Frozen, and Deep-Frozen subsegments. Each of these categories is essential for maintaining the quality of various perishable goods during storage and transportation. The chilled and frozen segments are the most significant, reflecting the high demand for fresh produce, dairy, and processed foods .

The Chilled subsegment is leading the market, driven by the high demand for fresh produce, dairy products, and ready-to-eat meals. Consumers are increasingly seeking fresh and healthy food options, which necessitates efficient chilled storage and transportation solutions. The growth of the food service industry and the expansion of supermarkets and grocery stores further contribute to the demand for chilled logistics services. As a result, logistics providers are focusing on enhancing their chilled supply chain capabilities to meet consumer expectations .

The Netherlands Cold Chain & Perishable Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuehne + Nagel, DB Schenker, Lineage Logistics, NewCold, STEF Group, DHL Supply Chain, Americold Logistics, Rhenus Logistics, H Essers, Kloosterboer, Nichirei Logistics Group, Norish, Van den Bosch, Frigo Group, Samskip contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Netherlands cold chain and perishable logistics market appears promising, driven by increasing consumer demand for fresh and organic products. As e-commerce continues to expand, logistics providers will need to enhance their capabilities in temperature-controlled transportation and storage. Additionally, the integration of advanced technologies such as IoT and automation will streamline operations, improve efficiency, and reduce costs. These trends will likely lead to a more resilient and responsive supply chain, capable of meeting evolving consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Storage Transportation Packaging Monitoring & Tracking Value-Added Services |

| By Temperature Range | Chilled Frozen Deep-Frozen |

| By Transportation Mode | Road Sea Rail Air |

| By End-User | Food & Beverages Pharmaceuticals Retail Agriculture |

| By Application | Fruits & Vegetables Dairy Products Meat, Fish & Seafood Processed Foods Pharmaceuticals (Vaccines, Blood Banking, Others) |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Facility Type | Refrigerated Warehouse Cold Room Blast Freezer Walk-in Cooler/Freezer Deep Freezer |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Distribution Logistics | 120 | Logistics Coordinators, Supply Chain Managers |

| Pharmaceutical Cold Chain Management | 90 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Fresh Produce Supply Chain | 60 | Procurement Managers, Operations Directors |

| Temperature-Controlled Warehousing | 50 | Warehouse Managers, Facility Operations Heads |

| Logistics Technology Solutions | 70 | IT Managers, Technology Implementation Specialists |

The Netherlands Cold Chain & Perishable Logistics Market is valued at approximately USD 6.7 billion, driven by the increasing demand for fresh and frozen food products, e-commerce growth, and the expansion of the pharmaceutical sector.