Region:Central and South America

Author(s):Dev

Product Code:KRAA5902

Pages:92

Published On:September 2025

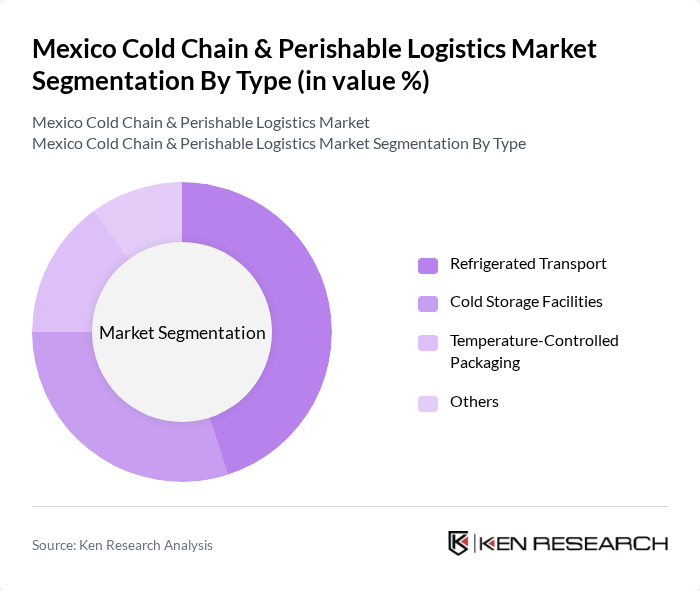

By Type:The cold chain logistics market can be segmented into various types, including refrigerated transport, cold storage facilities, temperature-controlled packaging, and others. Among these, refrigerated transport is the most significant segment, driven by the increasing demand for fresh produce and frozen goods. Cold storage facilities also play a crucial role in maintaining the quality of perishable items, while temperature-controlled packaging is gaining traction due to its ability to extend shelf life and reduce spoilage.

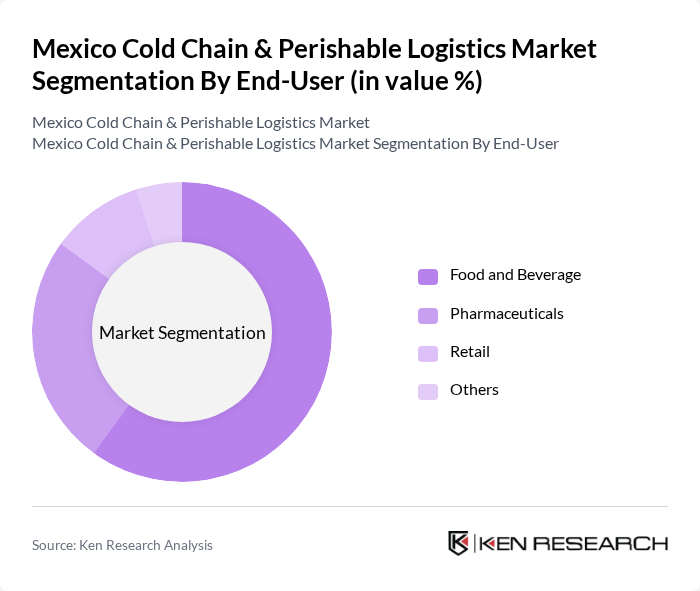

By End-User:The end-user segmentation includes food and beverage, pharmaceuticals, retail, and others. The food and beverage sector is the largest end-user, driven by the rising consumer demand for fresh and frozen products. Pharmaceuticals also represent a significant portion of the market, as temperature-sensitive medications require strict cold chain management. Retailers are increasingly adopting cold chain logistics to ensure product quality and safety, particularly in e-commerce.

The Mexico Cold Chain & Perishable Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo Bimbo, FEMSA, DHL Supply Chain, Kuehne + Nagel, Sysco Mexico, Grupo Lala, Cargill Mexico, JBS Foods, Nestlé Mexico, Walmart de Mexico, Alsea, Sigma Alimentos, Transportes Maza, Logística de Alimentos, Grupo TMM contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain and perishable logistics market in Mexico appears promising, driven by technological advancements and increasing consumer demand for fresh products. The integration of IoT and data analytics is expected to enhance operational efficiency and transparency in the supply chain. Additionally, as e-commerce continues to expand, companies will likely invest in innovative last-mile delivery solutions to meet consumer expectations for speed and quality, ensuring the market remains dynamic and competitive.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Facilities Temperature-Controlled Packaging Others |

| By End-User | Food and Beverage Pharmaceuticals Retail Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics E-commerce Platforms Others |

| By Application | Dairy Products Meat and Seafood Fruits and Vegetables Others |

| By Sales Channel | Wholesale Retail Online Sales Others |

| By Price Range | Budget Mid-Range Premium |

| By Policy Support | Subsidies Tax Exemptions Grants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Distribution Logistics | 150 | Logistics Managers, Supply Chain Coordinators |

| Pharmaceutical Cold Chain Management | 100 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Agricultural Export Logistics | 80 | Export Managers, Agricultural Producers |

| Retail Perishable Goods Supply Chain | 70 | Store Managers, Inventory Control Specialists |

| Refrigerated Transport Services | 90 | Fleet Managers, Operations Directors |

The Mexico Cold Chain & Perishable Logistics Market is valued at approximately USD 15 billion, driven by increasing demand for fresh and frozen food products, the rise of e-commerce, and the expansion of the food and beverage sector.