Italy Digital Advertising and Programmatic Market Overview

- The Italy Digital Advertising and Programmatic Market is valued at USD 5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing penetration of the internet, the rise of mobile devices, and the growing importance of data analytics in advertising strategies. Advertisers are increasingly shifting their budgets from traditional media to digital platforms, reflecting a broader global trend towards digitalization.

- Key cities such as Milan, Rome, and Turin dominate the market due to their status as economic and cultural hubs. These cities host a large number of businesses and advertising agencies, facilitating a vibrant ecosystem for digital marketing. The concentration of tech-savvy consumers and high internet usage rates in these urban areas further enhance their dominance in the digital advertising landscape.

- In 2023, the Italian government implemented the Digital Services Act, aimed at regulating online platforms and ensuring fair competition in the digital advertising space. This regulation mandates transparency in advertising practices and requires platforms to disclose data usage policies, thereby enhancing consumer trust and promoting ethical advertising practices.

Italy Digital Advertising and Programmatic Market Segmentation

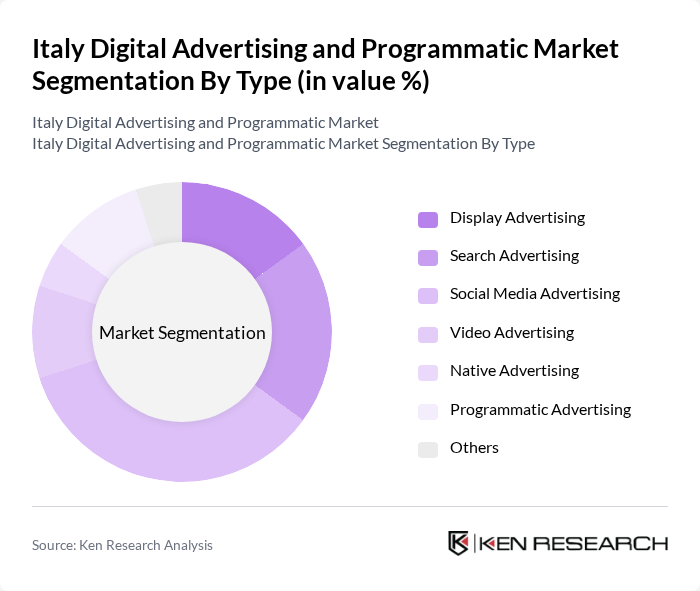

By Type:The market is segmented into various types of digital advertising, including Display Advertising, Search Advertising, Social Media Advertising, Video Advertising, Native Advertising, Programmatic Advertising, and Others. Among these, Social Media Advertising has emerged as a dominant force, driven by the increasing engagement of users on platforms like Facebook, Instagram, and TikTok. Advertisers are leveraging these platforms to reach targeted audiences effectively, resulting in a significant share of the overall market.

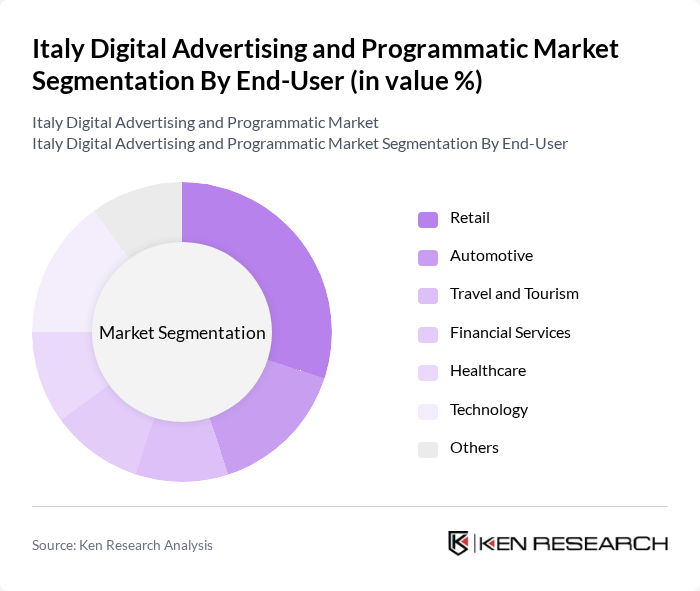

By End-User:The end-user segmentation includes Retail, Automotive, Travel and Tourism, Financial Services, Healthcare, Technology, and Others. The Retail sector is the leading end-user, as businesses increasingly adopt digital advertising strategies to enhance their online presence and drive sales. The shift towards e-commerce and the need for targeted marketing campaigns have made retail a significant contributor to the digital advertising market.

Italy Digital Advertising and Programmatic Market Competitive Landscape

The Italy Digital Advertising and Programmatic Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google LLC, Facebook, Inc., Amazon Advertising, Adform A/S, Criteo S.A., The Trade Desk, Inc., Verizon Media, MediaMath, Inc., Sizmek, Inc., Taboola.com, Outbrain Inc., AdRoll, Inc., Xandr, Inc., Quantcast Corporation, AppNexus, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Italy Digital Advertising and Programmatic Market Industry Analysis

Growth Drivers

- Increased Internet Penetration:Italy's internet penetration rate reached 82% in the future, with approximately 48 million users accessing online content. This growth is driven by improved infrastructure and increased smartphone usage, which is projected to reach 90% of the population in the future. The rise in internet accessibility has led to a surge in digital advertising investments, with the sector expected to attract over €4.5 billion in ad spend, reflecting a robust demand for online marketing solutions.

- Rise of Mobile Advertising:Mobile advertising in Italy is projected to account for €2.7 billion in the future, representing a significant portion of the overall digital ad spend. With over 36 million smartphone users, mobile platforms are becoming the primary channel for advertisers. The increasing consumption of mobile content, including social media and video, is driving brands to allocate more resources to mobile advertising, enhancing engagement and conversion rates across various demographics.

- Demand for Data-Driven Marketing:The Italian digital advertising landscape is increasingly influenced by data-driven marketing strategies, with 75% of marketers prioritizing data analytics in their campaigns. The investment in data management platforms is expected to exceed €1.2 billion in the future, as businesses seek to leverage consumer insights for targeted advertising. This trend is supported by the growing availability of big data and advanced analytics tools, enabling more effective audience segmentation and personalized marketing efforts.

Market Challenges

- Privacy Regulations:The implementation of GDPR has significantly impacted the digital advertising landscape in Italy, with companies facing fines of up to €22 million for non-compliance. As of the future, businesses must navigate complex privacy regulations while ensuring user consent for data collection. This challenge has led to increased operational costs and necessitated the development of transparent data practices, which can hinder the agility of marketing strategies in a competitive environment.

- Ad Fraud:Ad fraud remains a critical challenge in Italy's digital advertising market, with losses estimated at €1.3 billion in the future. The prevalence of bot traffic and fraudulent clicks undermines the effectiveness of advertising campaigns, leading to wasted budgets and diminished ROI. As advertisers become more aware of these issues, there is a growing demand for advanced fraud detection technologies, which adds complexity and cost to digital marketing efforts.

Italy Digital Advertising and Programmatic Market Future Outlook

The future of Italy's digital advertising market is poised for significant transformation, driven by technological advancements and evolving consumer behaviors. As brands increasingly adopt omnichannel marketing strategies, the integration of AI and machine learning will enhance targeting and personalization. Furthermore, the demand for sustainable advertising practices is expected to grow, prompting companies to innovate in their messaging and delivery methods. This dynamic environment will create new opportunities for growth and engagement in the digital space.

Market Opportunities

- Expansion of Programmatic Advertising:The programmatic advertising segment is anticipated to grow significantly, with investments projected to reach €2 billion in the future. This growth is fueled by the increasing automation of ad buying processes, allowing for real-time bidding and enhanced targeting capabilities. Advertisers are expected to leverage programmatic solutions to optimize their campaigns and improve overall efficiency in reaching their desired audiences.

- Growth of Video Advertising:Video advertising is set to become a dominant force in Italy's digital landscape, with spending expected to surpass €1.2 billion in the future. The rising popularity of video content across social media platforms and streaming services is driving this trend. Brands are increasingly investing in video ads to capture consumer attention and enhance engagement, making it a critical area for future marketing strategies.