Region:Africa

Author(s):Dev

Product Code:KRAB3033

Pages:80

Published On:October 2025

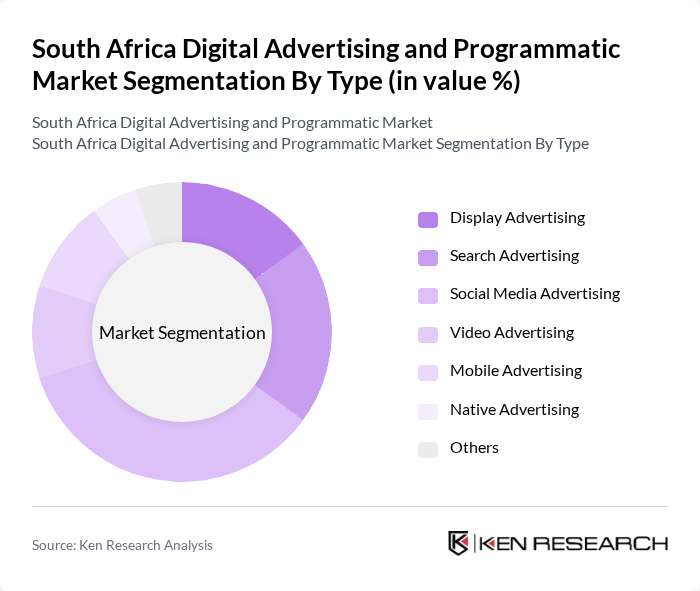

By Type:The digital advertising market in South Africa is segmented into various types, including Display Advertising, Search Advertising, Social Media Advertising, Video Advertising, Mobile Advertising, Native Advertising, and Others. Among these, Social Media Advertising has emerged as a dominant force, driven by the widespread use of platforms like Facebook, Instagram, and Twitter. Advertisers are increasingly leveraging these platforms to engage with consumers through targeted campaigns, making it a preferred choice for many brands.

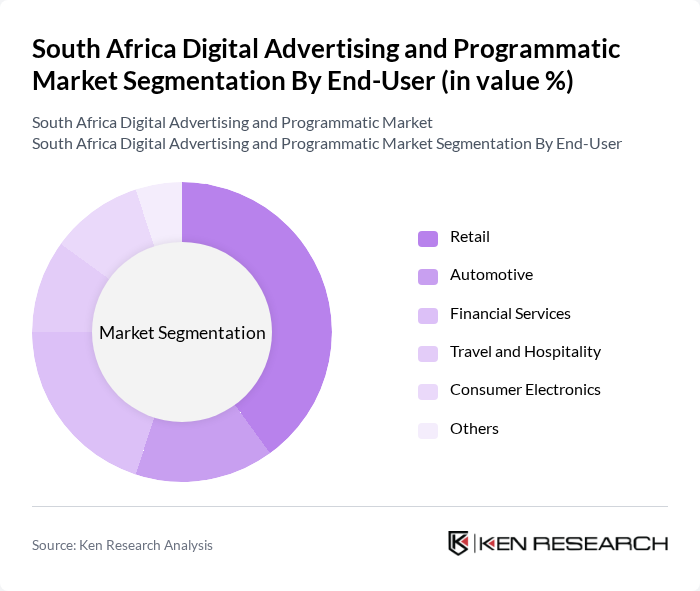

By End-User:The end-user segmentation of the digital advertising market includes Retail, Automotive, Financial Services, Travel and Hospitality, Consumer Electronics, and Others. The Retail sector is the leading end-user, as businesses increasingly utilize digital advertising to drive online sales and enhance customer engagement. The shift towards e-commerce has further accelerated the demand for targeted advertising strategies that cater to consumer preferences and behaviors.

The South Africa Digital Advertising and Programmatic Market is characterized by a dynamic mix of regional and international players. Leading participants such as Naspers Limited, Media24, Google South Africa, Facebook South Africa, AdColony, Clicks Group, The SpaceStation, Primedia, Dentsu Aegis Network, WPP South Africa, Ogilvy South Africa, Isobar South Africa, 24.com, iProspect South Africa, Yellow Pages South Africa contribute to innovation, geographic expansion, and service delivery in this space.

The South African digital advertising market is poised for significant evolution, driven by technological advancements and changing consumer behaviors. As brands increasingly prioritize personalized experiences, the integration of artificial intelligence and machine learning will enhance targeting capabilities. Furthermore, the rise of video content and influencer marketing will reshape advertising strategies, allowing brands to engage audiences more effectively. The focus on sustainability will also influence advertising practices, encouraging brands to adopt eco-friendly initiatives in their campaigns.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Advertising Social Media Advertising Video Advertising Mobile Advertising Native Advertising Others |

| By End-User | Retail Automotive Financial Services Travel and Hospitality Consumer Electronics Others |

| By Industry Vertical | E-commerce Telecommunications Healthcare Education Entertainment Others |

| By Advertising Format | Banner Ads Sponsored Content Affiliate Marketing Programmatic Buying Others |

| By Campaign Objective | Brand Awareness Lead Generation Customer Retention Sales Conversion Others |

| By Geographic Focus | Urban Areas Suburban Areas Rural Areas National Campaigns Others |

| By Budget Size | Low Budget Medium Budget High Budget Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Social Media Advertising | 150 | Social Media Managers, Digital Marketing Directors |

| Search Engine Marketing | 100 | PPC Specialists, SEO Managers |

| Display Advertising | 80 | Media Buyers, Brand Strategists |

| Programmatic Ad Buying | 70 | Programmatic Traders, Ad Operations Managers |

| Influencer Marketing | 60 | Influencer Marketing Coordinators, Brand Managers |

The South Africa Digital Advertising and Programmatic Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increased internet penetration, mobile device usage, and a shift from traditional media to digital platforms.