Region:Europe

Author(s):Geetanshi

Product Code:KRAB5173

Pages:80

Published On:October 2025

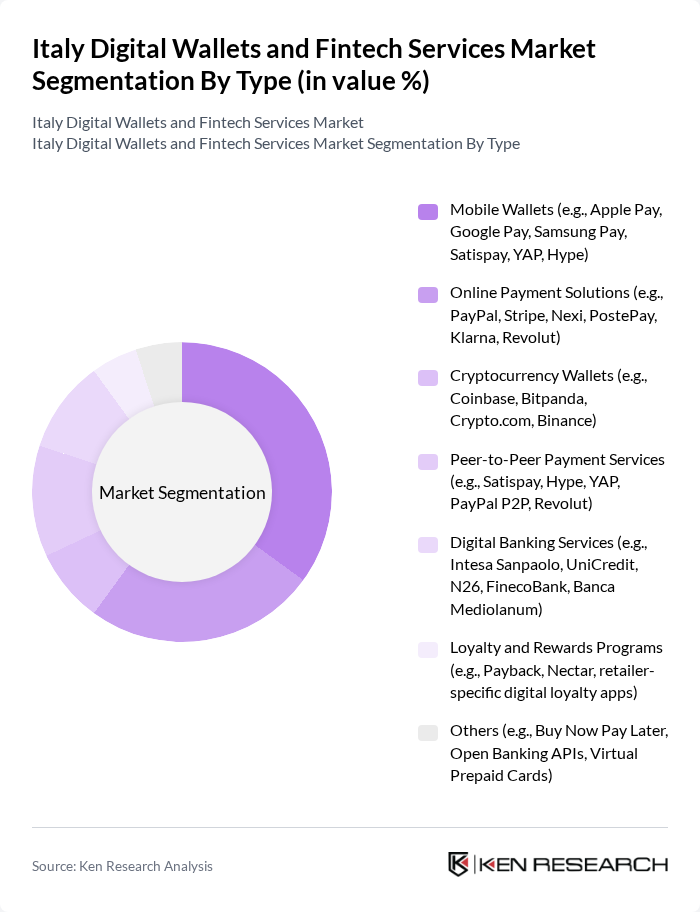

By Type:The market can be segmented into various types, including mobile wallets, online payment solutions, cryptocurrency wallets, peer-to-peer payment services, digital banking services, loyalty and rewards programs, and others. Each of these segments addresses distinct consumer needs and preferences, contributing to the overall growth of the digital wallet ecosystem. Mobile wallets and online payment solutions are particularly prominent, with digital wallets accounting for approximately 35% of online payments in Italy. Buy Now Pay Later services and open banking APIs are also rapidly gaining traction, especially among younger demographics and e-commerce platforms .

By End-User:The end-user segmentation includes individual consumers, small and medium enterprises (SMEs), large corporations, and government entities. Each group demonstrates distinct requirements and usage patterns, influencing the types of digital wallet services they prefer. Individual consumers are the largest segment, driven by convenience and integration with e-commerce, while SMEs and large corporations increasingly adopt digital solutions for efficiency and compliance .

The Italy Digital Wallets and Fintech Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as PayPal Holdings, Inc., Nexi S.p.A., Satispay S.p.A., Revolut Ltd., Hype S.p.A., PostePay S.p.A., Stripe, Inc., Samsung Pay, Google Pay, Apple Pay, Wise (formerly TransferWise), YAP S.p.A., Klarna AB, Mastercard Incorporated, Visa Inc., Intesa Sanpaolo S.p.A., UniCredit S.p.A., Banca Mediolanum S.p.A., N26 GmbH, FinecoBank S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital wallets and fintech services market in Italy appears promising, driven by technological advancements and evolving consumer preferences. As mobile-first payment solutions gain traction, the integration of artificial intelligence for fraud detection will enhance security and user experience. Additionally, the emergence of cryptocurrency wallets is expected to attract tech-savvy consumers, further diversifying the payment landscape. Overall, the market is poised for significant transformation, with innovative solutions catering to a broader audience.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Wallets (e.g., Apple Pay, Google Pay, Samsung Pay, Satispay, YAP, Hype) Online Payment Solutions (e.g., PayPal, Stripe, Nexi, PostePay, Klarna, Revolut) Cryptocurrency Wallets (e.g., Coinbase, Bitpanda, Crypto.com, Binance) Peer-to-Peer Payment Services (e.g., Satispay, Hype, YAP, PayPal P2P, Revolut) Digital Banking Services (e.g., Intesa Sanpaolo, UniCredit, N26, FinecoBank, Banca Mediolanum) Loyalty and Rewards Programs (e.g., Payback, Nectar, retailer-specific digital loyalty apps) Others (e.g., Buy Now Pay Later, Open Banking APIs, Virtual Prepaid Cards) |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Application | E-commerce Transactions In-store Payments Bill Payments Remittances |

| By Distribution Channel | Direct Sales Online Platforms Mobile Applications |

| By Payment Method | Credit/Debit Cards Bank Transfers (including A2A, SEPA, instant payments) Digital Currencies |

| By User Demographics | Age Groups Income Levels Geographic Distribution |

| By Security Features | Biometric Authentication Two-Factor Authentication Encryption Technologies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Digital Wallet Usage | 120 | Active Users, Age 18-45 |

| Fintech Service Providers | 60 | Product Managers, Business Development Executives |

| Regulatory Impact Assessment | 50 | Compliance Officers, Legal Advisors |

| Merchant Acceptance of Digital Payments | 70 | Retail Owners, Payment Processors |

| Consumer Attitudes Towards Fintech | 40 | General Public, Financially Active Individuals |

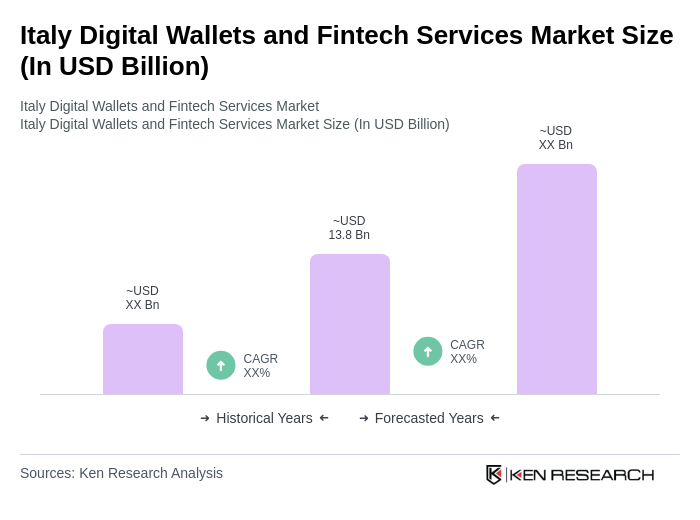

The Italy Digital Wallets and Fintech Services Market is valued at approximately USD 13.8 billion, driven by the growing adoption of digital payment solutions and the shift towards cashless transactions, particularly in urban centers like Milan, Rome, and Turin.