Region:Middle East

Author(s):Dev

Product Code:KRAB7255

Pages:96

Published On:October 2025

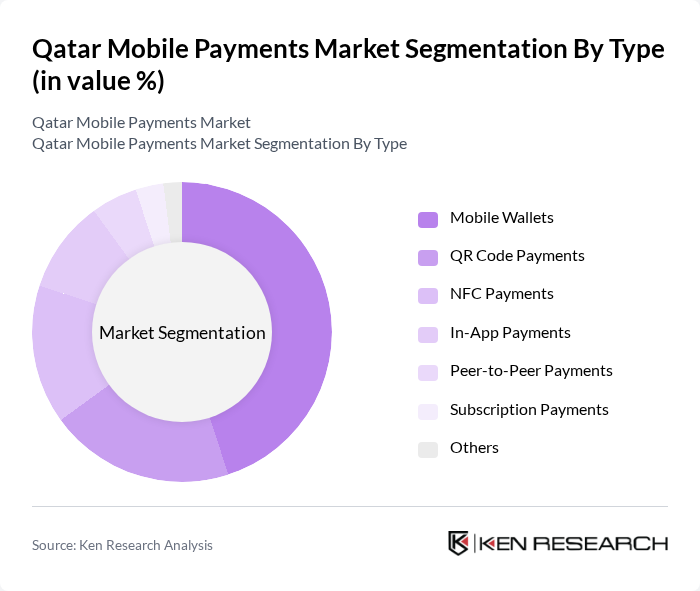

By Type:The mobile payments market can be segmented into various types, including Mobile Wallets, QR Code Payments, NFC Payments, In-App Payments, Peer-to-Peer Payments, Subscription Payments, and Others. Among these, Mobile Wallets have emerged as the leading sub-segment due to their convenience and widespread acceptance among consumers. The increasing integration of loyalty programs and promotional offers within mobile wallets has further enhanced their appeal, driving higher transaction volumes.

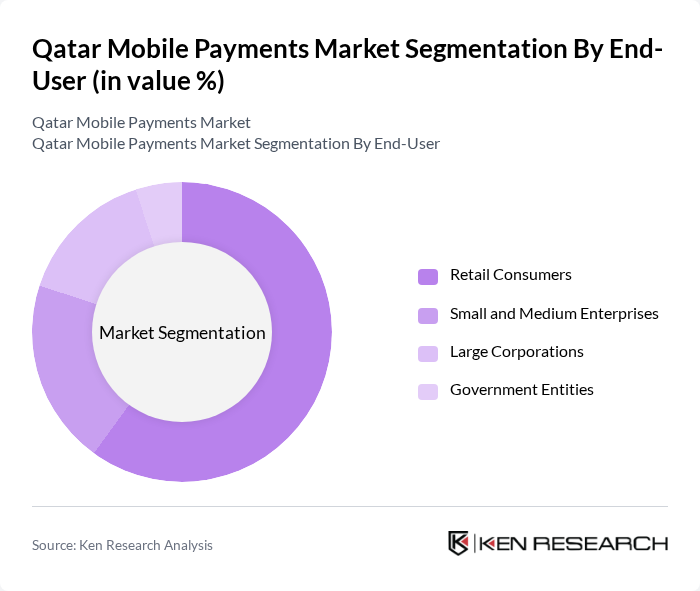

By End-User:The end-user segmentation includes Retail Consumers, Small and Medium Enterprises, Large Corporations, and Government Entities. Retail Consumers dominate this segment, driven by the increasing trend of online shopping and the convenience of mobile payments for everyday transactions. The growing number of mobile payment applications tailored for individual users has also contributed to the rise in adoption among retail consumers.

The Qatar Mobile Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar National Bank, Ooredoo, Vodafone Qatar, Doha Bank, QPay, DabaPay, Qatari Payment Solutions, Qatar Islamic Bank, Commercial Bank of Qatar, Al Khaliji Bank, Masraf Al Rayan, Qatar Central Bank, Fawry, PayFort, Stripe contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar mobile payments market appears promising, driven by technological advancements and evolving consumer behaviors. As digital literacy improves, particularly among older demographics, the adoption of mobile payment solutions is expected to rise. Additionally, the integration of advanced technologies such as AI and machine learning will enhance transaction security and user experience, making mobile payments more appealing. The ongoing support from the government and financial institutions will further facilitate this growth, creating a robust ecosystem for mobile transactions.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Wallets QR Code Payments NFC Payments In-App Payments Peer-to-Peer Payments Subscription Payments Others |

| By End-User | Retail Consumers Small and Medium Enterprises Large Corporations Government Entities |

| By Application | E-commerce Transactions Bill Payments Remittances Travel and Hospitality |

| By Sales Channel | Online Sales Offline Sales |

| By Distribution Mode | Direct Distribution Indirect Distribution |

| By Pricing Model | Subscription-Based Transaction Fee-Based |

| By Customer Segment | Individual Users Business Users Institutional Users |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Mobile Payment Usage | 150 | General Consumers, Tech-Savvy Users |

| Small Business Adoption of Mobile Payments | 100 | Small Business Owners, Retail Managers |

| Banking Sector Insights on Mobile Payments | 80 | Bank Executives, Payment Solution Managers |

| Regulatory Perspectives on Mobile Payments | 50 | Regulatory Officials, Financial Analysts |

| Technology Providers in Mobile Payment Solutions | 70 | Product Managers, Technology Developers |

The Qatar Mobile Payments Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by smartphone adoption, improved internet connectivity, and a shift towards cashless transactions among consumers.