Region:Europe

Author(s):Rebecca

Product Code:KRAA4615

Pages:99

Published On:September 2025

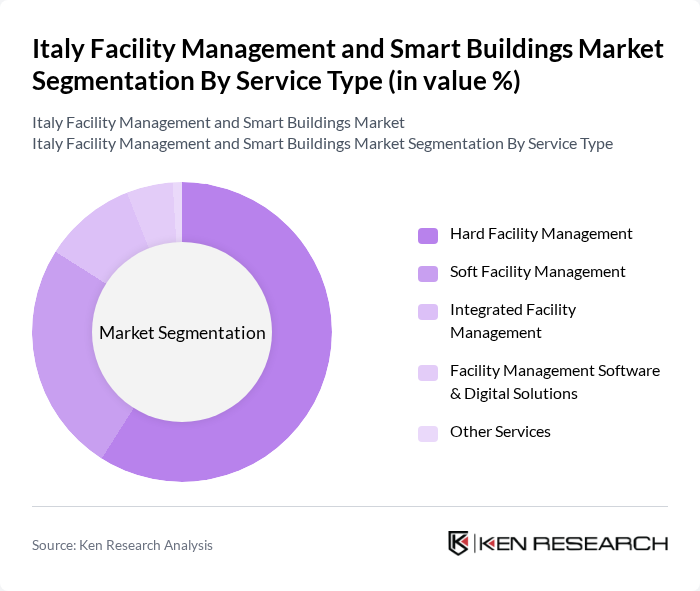

By Service Type:The service type segmentation includes various categories that cater to different aspects of facility management. The primary subsegments are Hard Facility Management, Soft Facility Management, Integrated Facility Management, Facility Management Software & Digital Solutions, and Other Services. Each of these subsegments plays a crucial role in ensuring the efficient operation and maintenance of buildings.

TheHard Facility Managementsubsegment is currently dominating the market, accounting for the majority of revenue due to essential services such as mechanical, electrical, and plumbing (MEP) maintenance, HVAC systems, and fire safety management. Regulatory requirements for fire-safety inspections, MEP upgrades, and HVAC retrofits, especially in healthcare and public buildings, underpin this dominance. As buildings become more complex and compliance standards rise, the demand for specialized hard facility management solutions continues to increase .

By Facility Management Model:This segmentation focuses on the different operational models used in facility management. The key subsegments include In-House Facility Management, Outsourced Facility Management, Single Service Contracts, Bundled Service Contracts, and Integrated Service Contracts. Each model offers distinct advantages depending on the organizational needs and resource availability.

TheOutsourced Facility Managementmodel leads the market, representing over half of all contracts. Organizations increasingly prefer outsourcing to focus on core business activities while leveraging the expertise of specialized service providers. This trend is especially prominent among large enterprises and public institutions, where the complexity of facility management requires dedicated resources and advanced technology solutions. Integrated and bundled contracts are gaining traction as companies seek unified service-level dashboards and predictive maintenance capabilities .

The Italy Facility Management and Smart Buildings Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS Facility Services S.r.l., Sodexo Italia S.p.A., CBRE Group, Inc., JLL (Jones Lang LaSalle S.p.A.), Manutencoop Facility Management S.p.A. (Rekeep S.p.A.), Engie Servizi S.p.A., Compass Group Italia S.p.A., Cofely Italia S.p.A. (ENGIE Group), Veolia Servizi Ambientali Tecnici S.r.l., Apleona HSG S.p.A., Bilfinger SE, SUEZ Italia S.p.A., Gabetti Facility Management S.p.A., Dussmann Service S.r.l., and G4S Secure Solutions S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italy facility management and smart buildings market appears promising, driven by technological advancements and a strong governmental push for sustainability. As urbanization continues, the demand for smart, energy-efficient buildings will likely increase. The integration of AI and IoT technologies will enhance operational efficiencies, while ongoing government incentives will further stimulate investments in green infrastructure. This evolving landscape presents opportunities for innovation and growth, positioning Italy as a leader in sustainable facility management practices.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Hard Facility Management (e.g., MEP, HVAC, fire safety, building maintenance) Soft Facility Management (e.g., cleaning, security, catering, landscaping) Integrated Facility Management (IFM) Facility Management Software & Digital Solutions Other Services (waste management, pest control, etc.) |

| By Facility Management Model | In-House Facility Management Outsourced Facility Management Single Service Contracts Bundled Service Contracts Integrated Service Contracts |

| By End-User Industry | Commercial & Retail Institutional (Education, Healthcare) Government, Infrastructure & Public Entities Manufacturing & Industrial Residential Others |

| By Technology Integration | IoT-enabled Facility Management AI and Machine Learning Applications Cloud-Based Solutions Digital Twin & Smart Building Platforms Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Service Delivery Model | Outsourced Services In-House Services Hybrid Services |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Real Estate Management | 60 | Facility Managers, Property Owners |

| Smart Building Technology Adoption | 50 | IT Managers, Building Automation Specialists |

| Energy Management Solutions | 40 | Energy Managers, Sustainability Officers |

| Integrated Facility Services | 40 | Operations Directors, Service Providers |

| Residential Facility Management | 40 | Homeowners, Community Managers |

The Italy Facility Management and Smart Buildings Market is valued at approximately USD 10 billion, reflecting the combined impact of facility management services and the growing adoption of smart building technologies, driven by efficiency demands and sustainability initiatives.