Region:Europe

Author(s):Geetanshi

Product Code:KRAB5834

Pages:91

Published On:October 2025

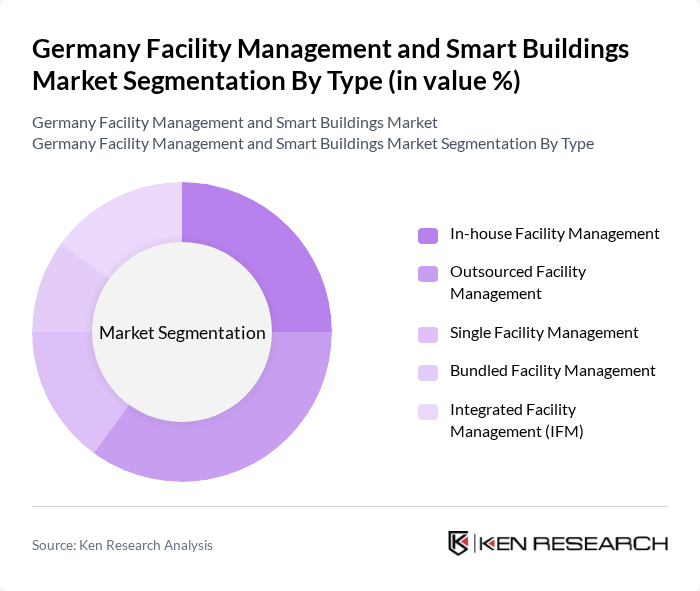

By Type:The market is segmented into various types of facility management services, including in-house, outsourced, single, bundled, and integrated facility management. Each type caters to different operational needs and preferences of organizations, influencing their choice based on cost, control, and service quality. Outsourced and integrated models are increasingly favored for their scalability and access to specialized expertise, while bundled services are gaining traction among large enterprises seeking unified solutions .

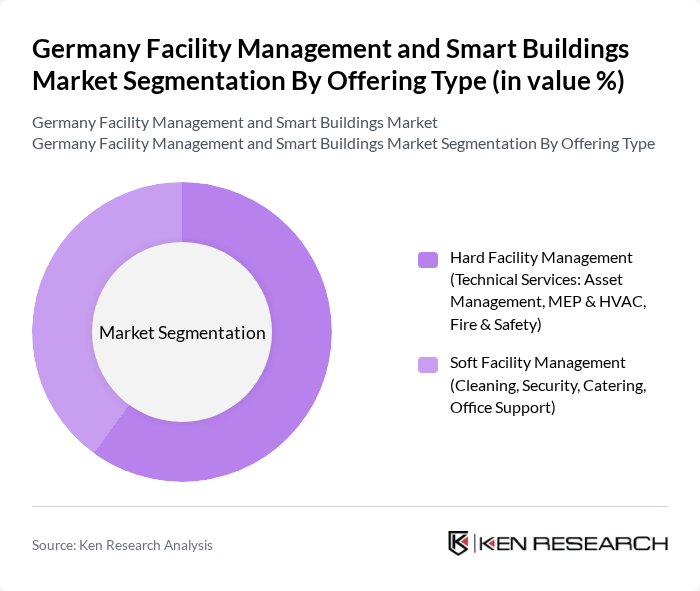

By Offering Type:The offering types in the market include hard facility management, which encompasses technical services such as asset management, MEP & HVAC, and fire & safety, and soft facility management, which includes services like cleaning, security, catering, and office support. The choice between these offerings often depends on the specific needs of the facility and the desired level of service. There is a growing trend toward integrated hard and soft services, especially in commercial and institutional buildings, to streamline operations and enhance user experience .

The Germany Facility Management and Smart Buildings Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS Facility Services GmbH, CBRE Group, Inc., JLL (Jones Lang LaSalle SE), Sodexo S.A., G4S Secure Solutions (Deutschland) GmbH, Bilfinger SE, Dussmann Group, Apleona GmbH, STRABAG Property and Facility Services GmbH, ENGIE Deutschland GmbH, WISAG Facility Service Holding GmbH & Co. KG, Siemens AG, Honeywell Building Solutions GmbH, Schneider Electric SE, Bosch Building Technologies, Caverion Deutschland GmbH, Vonovia SE, Gegenbauer Holding SE & Co. KG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Germany Facility Management and Smart Buildings market appears promising, driven by ongoing technological advancements and a strong governmental push for sustainability. As urbanization continues, the demand for smart, energy-efficient buildings will likely increase. Additionally, the integration of renewable energy sources and the adoption of cloud-based solutions are expected to enhance operational efficiencies. The focus on predictive maintenance and user experience will further shape the market landscape, fostering innovation and growth in facility management practices.

| Segment | Sub-Segments |

|---|---|

| By Type | In-house Facility Management Outsourced Facility Management Single Facility Management Bundled Facility Management Integrated Facility Management (IFM) |

| By Offering Type | Hard Facility Management (Technical Services: Asset Management, MEP & HVAC, Fire & Safety) Soft Facility Management (Cleaning, Security, Catering, Office Support) |

| By End-User | Commercial Buildings Institutional Buildings (Education, Government, Public Infrastructure) Healthcare Facilities Industrial & Process Facilities Residential Buildings Hospitality Others |

| By Application | Building Operations Maintenance Services Security Services Cleaning Services Energy Management Space Management Others |

| By Service Model | Outsourced Services In-House Services Hybrid Services Managed Services Others |

| By Region | Berlin Munich Frankfurt Hamburg Other Regions |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Performance-Based Pricing Others |

| By Technology Integration | IoT Integration AI and Machine Learning Building Management Systems (BMS) Smart Sensors & Automation Cloud-Based Facility Management Solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Building Management | 60 | Facility Managers, Building Owners |

| Residential Smart Building Solutions | 45 | Property Managers, Home Automation Specialists |

| Industrial Facility Operations | 40 | Operations Managers, Safety Officers |

| Smart Technology Providers | 40 | Product Development Managers, Sales Directors |

| Government and Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Managers |

The Germany Facility Management and Smart Buildings Market is valued at approximately USD 91 billion, driven by the demand for efficient building management solutions, digital transformation, and a focus on sustainability and energy efficiency.