Region:Asia

Author(s):Geetanshi

Product Code:KRAB5739

Pages:89

Published On:October 2025

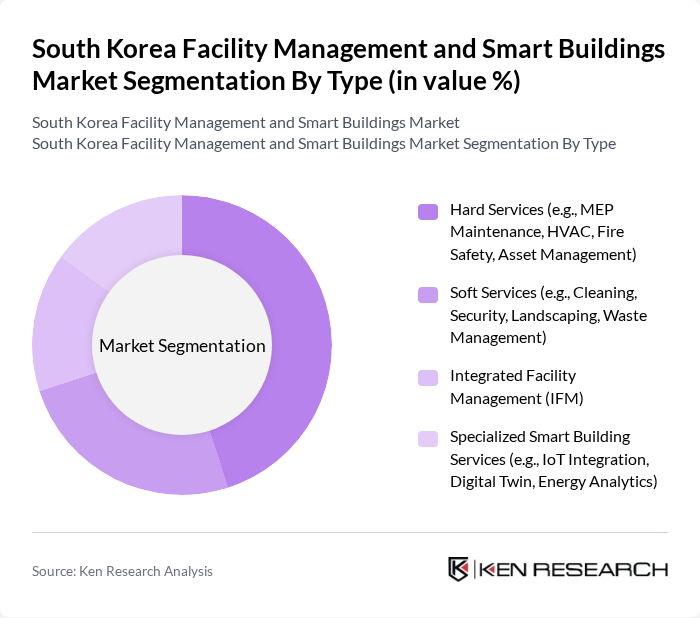

By Type:The market is segmented into various types, including Hard Services, Soft Services, Integrated Facility Management (IFM), and Specialized Smart Building Services. Hard Services encompass essential maintenance functions such as MEP Maintenance, HVAC, Fire Safety, and Asset Management. Soft Services include Cleaning, Security, Landscaping, and Waste Management. Integrated Facility Management (IFM) combines multiple services into a single contract, while Specialized Smart Building Services focus on advanced technologies like IoT Integration, Digital Twin, and Energy Analytics. Among these, Hard Services dominate the market due to their critical role in maintaining operational efficiency and safety in buildings. The demand for MEP maintenance and HVAC services is particularly strong, reflecting the need for compliance with safety regulations and efficient building performance .

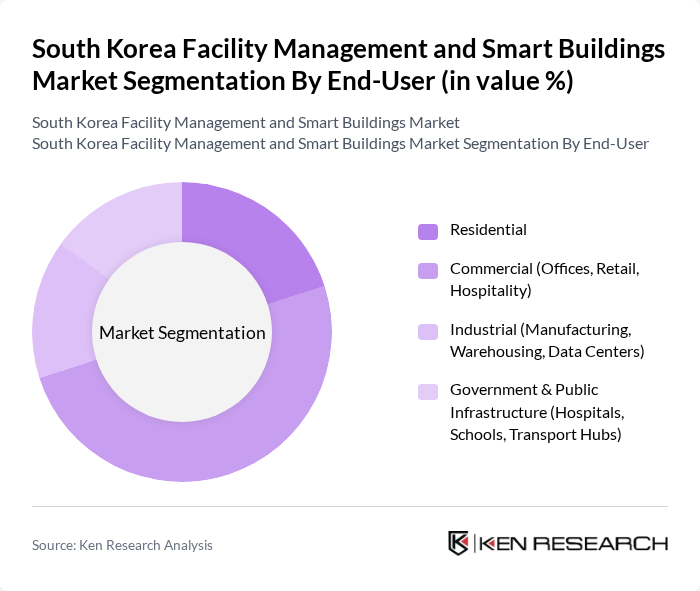

By End-User:The market is categorized into Residential, Commercial, Industrial, and Government & Public Infrastructure segments. The Residential sector includes apartment complexes and housing units, while the Commercial sector encompasses offices, retail spaces, and hospitality venues. The Industrial segment covers manufacturing facilities, warehouses, and data centers, and the Government & Public Infrastructure segment includes hospitals, schools, and transport hubs. The Commercial sector leads the market, driven by the increasing demand for efficient facility management solutions in urban business environments and the expansion of office and retail infrastructure .

The South Korea Facility Management and Smart Buildings Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung C&T Corporation, SK ecoplant (formerly SK E&C), LG CNS, POSCO E&C, Hanwha Engineering & Construction, Daewoo Engineering & Construction, Hyundai Engineering & Construction, GS Engineering & Construction, KT Corporation, S-1 Corporation, Samkoo Inc., CBRE Group, Inc., JLL (Jones Lang LaSalle), Savills Korea, ISS Facility Services Korea contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean facility management and smart buildings market is poised for significant transformation, driven by technological advancements and increasing sustainability initiatives. As urbanization continues, the integration of smart technologies will enhance operational efficiency and energy management. Furthermore, government policies promoting green building practices will likely stimulate investment in innovative solutions. The focus on sustainability and energy efficiency will shape the future landscape, encouraging collaboration between public and private sectors to develop smart infrastructure that meets evolving urban needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services (e.g., MEP Maintenance, HVAC, Fire Safety, Asset Management) Soft Services (e.g., Cleaning, Security, Landscaping, Waste Management) Integrated Facility Management (IFM) Specialized Smart Building Services (e.g., IoT Integration, Digital Twin, Energy Analytics) |

| By End-User | Residential Commercial (Offices, Retail, Hospitality) Industrial (Manufacturing, Warehousing, Data Centers) Government & Public Infrastructure (Hospitals, Schools, Transport Hubs) |

| By Application | Building Maintenance & Operations Energy & Sustainability Management Security & Surveillance Services Workspace & Occupant Experience Solutions |

| By Service Model | Outsourced Facility Management (Single, Bundled, Integrated) In-House Facility Management Hybrid Models |

| By Region | Seoul Gyeonggi Province Busan Incheon Ulsan & Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Regulatory Credits Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Real Estate Management | 120 | Property Managers, Facility Directors |

| Smart Building Technology Adoption | 80 | IT Managers, Building Automation Specialists |

| Energy Management Solutions | 60 | Energy Managers, Sustainability Officers |

| Residential Smart Home Integration | 50 | Homeowners, Real Estate Developers |

| Public Sector Facility Management | 40 | Government Facility Managers, Urban Planners |

The South Korea Facility Management and Smart Buildings Market is valued at approximately USD 15 billion, reflecting a significant growth driven by urbanization, technological advancements, and a focus on sustainability and energy efficiency in building operations.