Region:Europe

Author(s):Dev

Product Code:KRAB5520

Pages:98

Published On:October 2025

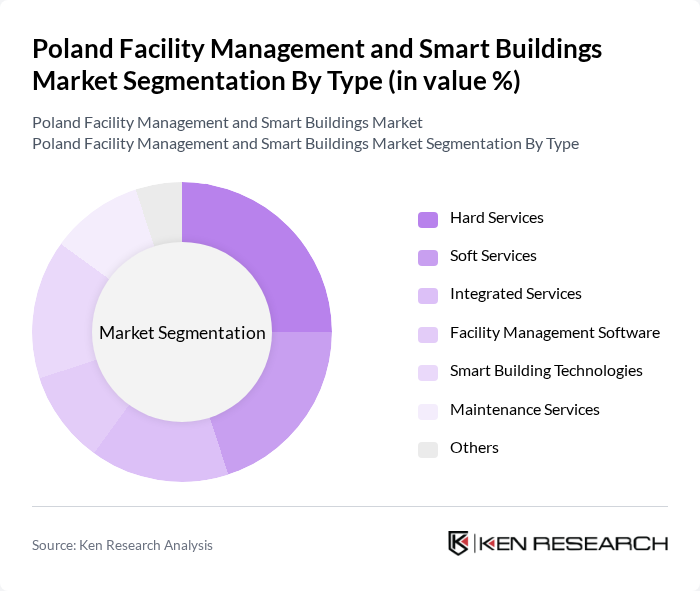

By Type:The market is segmented into various types, including Hard Services, Soft Services, Integrated Services, Facility Management Software, Smart Building Technologies, Maintenance Services, and Others. Each of these segments plays a crucial role in the overall market dynamics, catering to different aspects of facility management and smart building solutions.

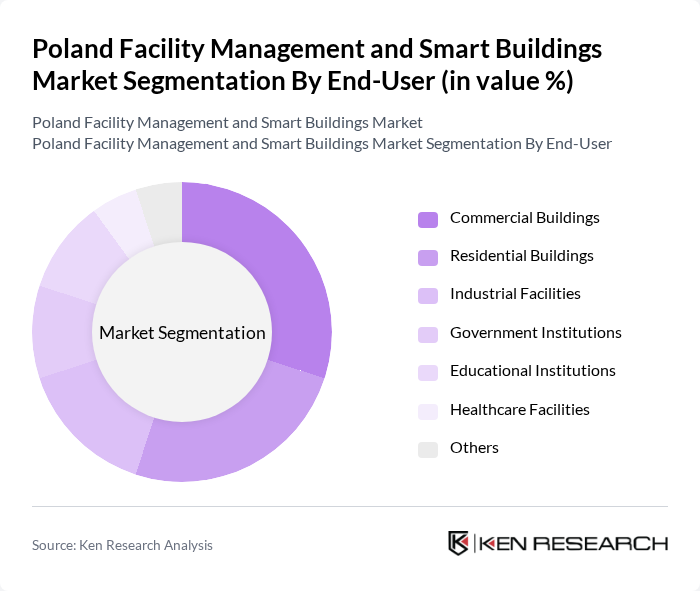

By End-User:The end-user segmentation includes Commercial Buildings, Residential Buildings, Industrial Facilities, Government Institutions, Educational Institutions, Healthcare Facilities, and Others. This segmentation highlights the diverse applications of facility management and smart building solutions across various sectors.

The Poland Facility Management and Smart Buildings Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS Facility Services, CBRE Group, Inc., Sodexo S.A., JLL (Jones Lang LaSalle), G4S plc, Cushman & Wakefield, Bilfinger SE, Seris Group, Apleona GmbH, SODEXO Polska, Colliers International, Veolia Environnement S.A., ENGIE Group, Atalian Global Services, Caverion Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Poland facility management and smart buildings market appears promising, driven by ongoing urbanization and technological advancements. As cities expand, the demand for integrated facility management solutions will likely increase, fostering innovation and investment. Additionally, the emphasis on sustainability and energy efficiency will propel the adoption of smart technologies. Companies that embrace these trends will be well-positioned to enhance operational efficiency, improve user experiences, and meet evolving regulatory requirements in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services Soft Services Integrated Services Facility Management Software Smart Building Technologies Maintenance Services Others |

| By End-User | Commercial Buildings Residential Buildings Industrial Facilities Government Institutions Educational Institutions Healthcare Facilities Others |

| By Application | Energy Management Security Management Space Management Maintenance Management Environmental Management Others |

| By Service Model | Outsourced Services In-House Services Hybrid Services |

| By Technology | Building Management Systems (BMS) Internet of Things (IoT) Artificial Intelligence (AI) Cloud Computing Others |

| By Investment Source | Private Investments Public Funding Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Policy Support | Government Subsidies Tax Incentives Grants for Energy Efficiency Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Building Management | 150 | Facility Managers, Building Owners |

| Residential Smart Building Solutions | 100 | Property Managers, Home Automation Specialists |

| Industrial Facility Operations | 80 | Operations Managers, Safety Officers |

| Smart Technology Providers | 70 | Product Development Managers, Sales Directors |

| Government Regulations Impact | 60 | Policy Makers, Regulatory Compliance Officers |

The Poland Facility Management and Smart Buildings Market is valued at approximately USD 5 billion, reflecting a five-year historical analysis. This growth is driven by the demand for efficient building management solutions and advancements in smart building technologies.