Region:Europe

Author(s):Geetanshi

Product Code:KRAA0204

Pages:82

Published On:August 2025

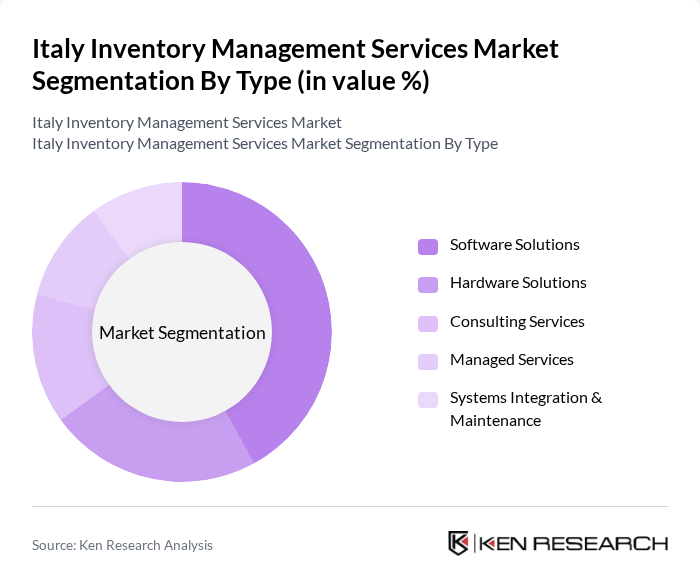

By Type:The market is segmented into Software Solutions, Hardware Solutions, Consulting Services, Managed Services, and Systems Integration & Maintenance. Each of these segments plays a crucial role in enhancing inventory management efficiency across different industries. Software Solutions are increasingly favored due to their ability to automate processes, provide real-time data, and integrate with other enterprise systems. Hardware Solutions, including RFID and barcode systems, support accurate tracking and monitoring. Consulting Services offer expertise in process optimization, while Managed Services provide end-to-end inventory oversight. Systems Integration & Maintenance ensures seamless operation and updates of inventory platforms .

The Software Solutions segment is dominating the market due to the increasing reliance on digital technology for inventory management. Businesses are adopting advanced software to streamline operations, enhance accuracy, and reduce costs. The growing trend of automation, real-time analytics, and cloud-based inventory management is driving the demand for software solutions, making it the leading sub-segment. Companies are investing in platforms that enable real-time inventory tracking, demand forecasting, and integration with logistics partners, further solidifying the dominance of this segment .

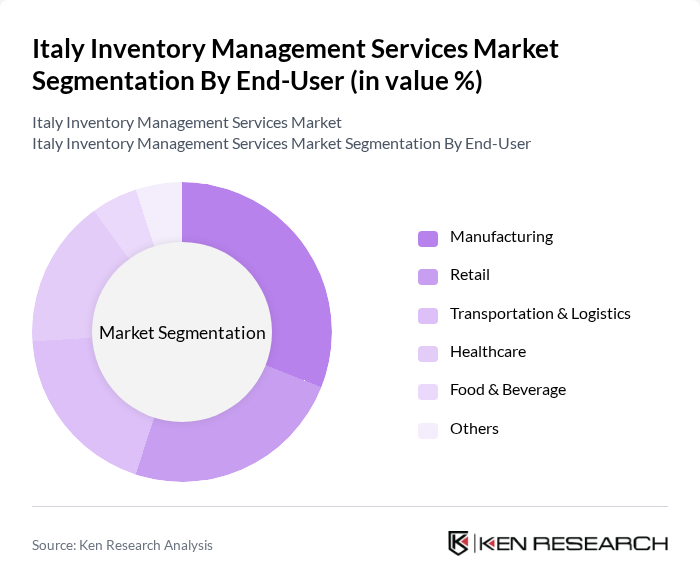

By End-User:The market is segmented by end-users, including Manufacturing, Retail, Transportation & Logistics, Healthcare, Food & Beverage, and Others. Each end-user segment has unique requirements and challenges that inventory management services address. Manufacturing relies on inventory solutions for raw material and finished goods tracking, Retail uses them for stock optimization and omnichannel fulfillment, Transportation & Logistics for real-time visibility and route planning, Healthcare for critical supply management, and Food & Beverage for perishable goods tracking .

The Manufacturing sector is the leading end-user of inventory management services, driven by the need for efficient production processes and supply chain optimization. Manufacturers are increasingly adopting inventory management solutions to minimize waste, enhance productivity, and ensure timely delivery of products. The complexity of managing raw materials, work-in-progress, and finished goods inventory in manufacturing environments necessitates sophisticated inventory management systems, making this segment a key driver of market growth .

The Italy Inventory Management Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Manhattan Associates, Infor, Blue Yonder (formerly JDA Software), Zebra Technologies, SSI SCHAEFER, Generix Group, Reply S.p.A., KFI S.r.l., TESISQUARE S.p.A., LCS Group S.p.A., Swisslog (KUKA Group), Savoye, and Oracle NetSuite contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italian inventory management services market appears promising, driven by technological advancements and evolving consumer expectations. As businesses increasingly prioritize efficiency and accuracy, the integration of AI and IoT technologies is expected to enhance inventory tracking and management capabilities. Furthermore, the growing emphasis on sustainability will likely lead to innovative practices that reduce waste and improve resource utilization, positioning companies to thrive in a competitive landscape while meeting regulatory demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Software Solutions Hardware Solutions Consulting Services Managed Services Systems Integration & Maintenance |

| By End-User | Manufacturing Retail Transportation & Logistics Healthcare Food & Beverage Others |

| By Industry Vertical | E-commerce Automotive Pharmaceuticals Electronics Energy & Utilities Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Region | Northern Italy Central Italy Southern Italy Islands |

| By Technology | RFID Technology Barcode Technology IoT Solutions AI and Machine Learning Mobile Inventory Management Others |

| By Service Type | Inventory Auditing Inventory Optimization Inventory Forecasting Inventory Tracking & Monitoring Stock Replenishment & Reporting Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 100 | Inventory Managers, Supply Chain Executives |

| Manufacturing Supply Chain Optimization | 80 | Operations Managers, Production Planners |

| E-commerce Fulfillment Strategies | 60 | Logistics Coordinators, eCommerce Directors |

| Warehouse Automation Solutions | 50 | IT Managers, Automation Specialists |

| Third-party Logistics (3PL) Services | 40 | Business Development Managers, Client Relationship Managers |

The Italy Inventory Management Services Market is valued at approximately USD 260 million, reflecting a significant growth driven by the demand for efficient supply chain management and the adoption of advanced inventory solutions, particularly in key economic hubs like Milan and Rome.