Region:Europe

Author(s):Geetanshi

Product Code:KRAB5738

Pages:82

Published On:October 2025

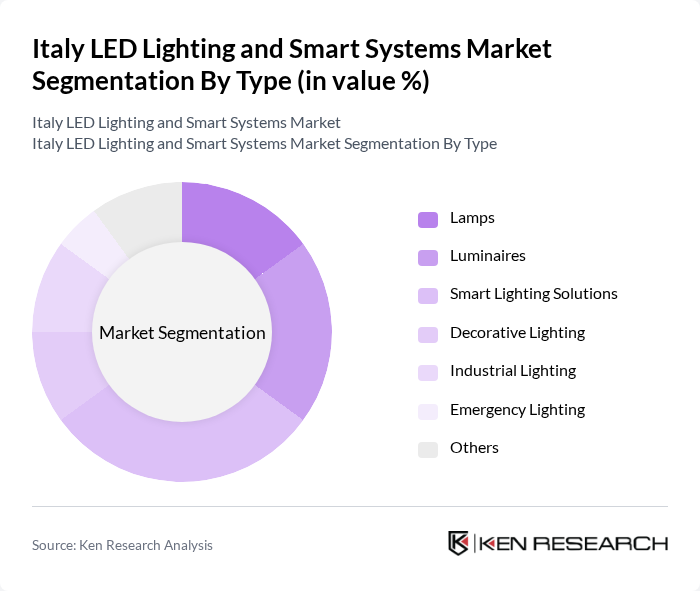

By Type:The market is segmented into various types, including lamps, luminaires, smart lighting solutions, decorative lighting, industrial lighting, emergency lighting, and others. Luminaires represent the largest product segment by revenue, while lamps are the fastest-growing category due to rapid consumer replacement of traditional bulbs. Smart lighting solutions are gaining traction due to their ability to enhance energy efficiency and provide users with control over their lighting environments. The increasing trend towards automation and IoT integration in residential and commercial spaces is driving the demand for smart lighting solutions, supported by the growing popularity of voice assistants, mobile apps, and home automation platforms.

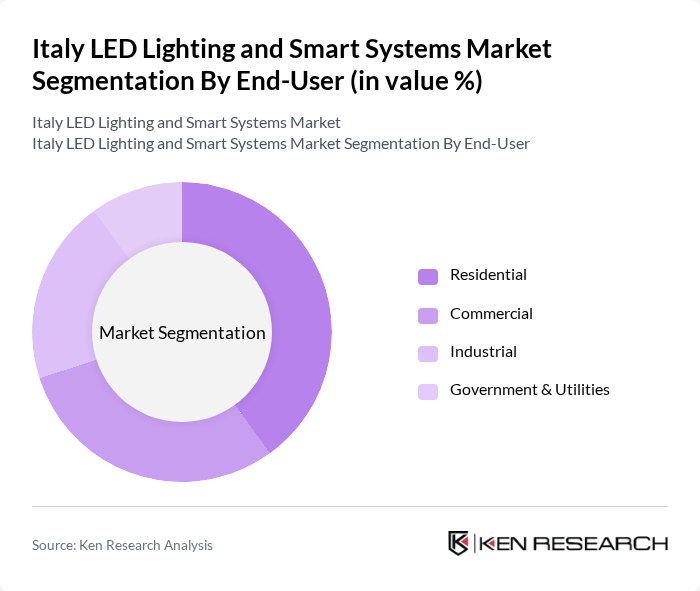

By End-User:The market is categorized into residential, commercial, industrial, and government & utilities segments. The residential segment is witnessing significant growth due to increasing consumer awareness regarding energy-efficient lighting solutions and the rising trend of smart homes. Homeowners are increasingly opting for LED lighting during renovations or new construction, particularly in combination with smart home systems, driven by rising energy prices and environmental awareness. The demand for smart lighting systems in residential applications is particularly strong, as consumers seek to enhance convenience and energy savings, making this segment a key driver in the market. The commercial and industrial sectors also show robust adoption, supported by collaborations between electricity suppliers and the government to distribute subsidized LED lights, especially in office buildings, retail spaces, and manufacturing facilities.

The Italy LED Lighting and Smart Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Signify N.V. (Philips Lighting), ams-OSRAM AG, Gewiss S.p.A., Disano Illuminazione S.p.A., iGuzzini illuminazione S.p.A., Artemide S.p.A., Beghelli S.p.A., Zumtobel Group AG, Trilux GmbH & Co. KG, Fagerhult Group, Cree Lighting, Acuity Brands, Inc., Panasonic Holdings Corporation, Legrand S.A., Lutron Electronics Co., Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italy LED lighting and smart systems market appears promising, driven by increasing consumer awareness and government support. As energy efficiency becomes a priority, the integration of smart technologies will likely enhance user experiences and operational efficiencies. Furthermore, the ongoing shift towards sustainable practices will encourage innovation in product development, paving the way for new solutions that meet evolving consumer demands while adhering to regulatory standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Lamps Luminaires Smart Lighting Solutions Decorative Lighting Industrial Lighting Emergency Lighting Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Indoor Lighting Outdoor Lighting Street Lighting Architectural Lighting Retail Lighting Office Lighting Hospitality Lighting Others |

| By Distribution Channel | Store-Based (Specialty Stores, Supermarkets/Hypermarkets) Non-Store Based (E-commerce, Direct Sales) |

| By Component | LED Chips Drivers Fixtures Sensors & Controls |

| By Installation Type | New Installation Retrofit |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial LED Lighting Solutions | 120 | Facility Managers, Energy Efficiency Consultants |

| Smart Home Lighting Systems | 100 | Homeowners, Smart Technology Enthusiasts |

| Industrial Smart Lighting Applications | 80 | Operations Managers, Plant Engineers |

| Public Infrastructure Lighting Projects | 70 | City Planners, Public Works Directors |

| Retail LED Lighting Strategies | 90 | Retail Managers, Merchandising Directors |

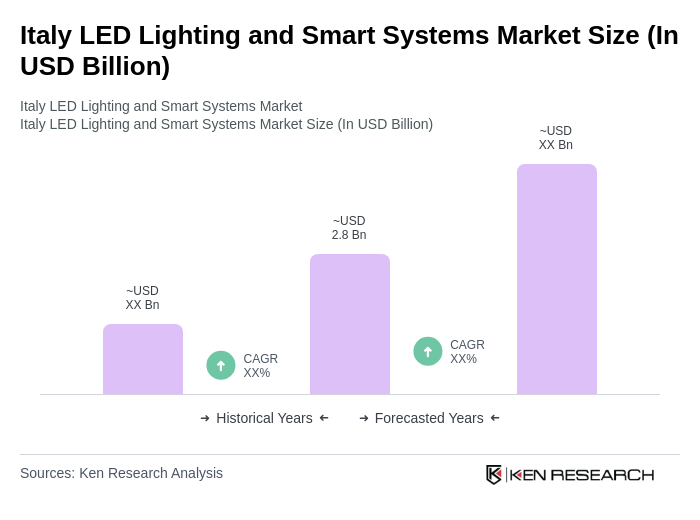

The Italy LED Lighting and Smart Systems Market is valued at approximately USD 2.8 billion, driven by increasing energy efficiency awareness, government initiatives, and the rapid adoption of smart technologies in urban infrastructure.